Inflation to hit double digits by end of FY25: ADB

Inflation is projected to hit double digits at the end of the current fiscal year owing to supply-side disruptions and higher import costs as a result of currency depreciation, according to the Asian Development Bank (ADB).

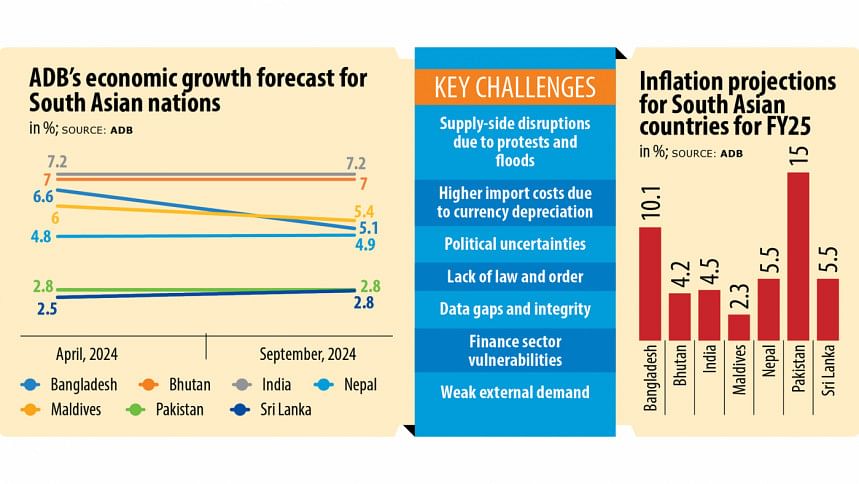

In its latest Asian Development Outlook released yesterday, the Manila-based lender projected that inflation would increase to 10.1 percent in fiscal year (FY) 2025, which is 3.1 percentage points higher than the estimate it made in April.

The immediate past government, which was ousted on August 5 by a mass uprising, had targeted to keep inflation to 6.5 percent this fiscal year after it had hit 9.7 percent in FY24.

"Elevated food and non-food prices in the first half of the fiscal year reflect supply-side disruption and higher import costs due to currency depreciation, pushing up inflation forecasts," the ADB said.

Consumers in Bangladesh have been fighting persistent inflationary pressures over the past two years, with inflation hovering above 9 percent since March 2023.

The interim government released the inflation data of July, which showed that the point-to-point inflation rate was 11.66 percent in July and 10.49 percent in August. However, the moving average was below 10 percent during the two months.

After the interim government released the data, economists said the sudden spike in inflation in July reflected that the data had not been manipulated.

The ADB said inflationary pressures were expected to moderate in the second half of the fiscal year as tight monetary and fiscal policies would lower domestic demand.

The central bank's monetary policy statement indicates that a tight monetary policy will continue in FY25.

In a statement presented before the political unrest, the central bank had committed to maintaining a contractionary monetary policy. It had also planned to streamline open market operations, cease currency swaps with and among banks, and refrain from lending to finance the budget deficit.

In line with that statement, the central bank on Tuesday increased its repo rate by 50 basis points to 9.0 percent, the standing deposit facility rate to 7.5 percent, and the standing lending facility rate to 10.5 percent.

It will likely raise the policy rate further as needed to manage inflationary expectations, the ADB added.

Although Bangladesh has been enduring persistent inflation for a long time, its South Asian peers appear to be in a comfort zone as they have managed inflationary pressures through policy support.

Meanwhile, the ADB lowered its forecast for Bangladesh's economic growth to 5.1 percent for the current fiscal year, primarily due to supply disruptions caused by political unrest in July and August as well as recent floods.

The Manila-based lender had earlier projected that the gross domestic product (GDP) would grow by 6.6 percent in FY25.

"Additionally, fiscal and monetary policies are expected to remain tight, further dampening consumption and investment demand. The forecast is highly uncertain as significant downside risks cloud the macroeconomic outlook," the ADB said.

"These risks primarily stem from ongoing political instability, a fragile law-and-order situation, and vulnerabilities within the financial sector."

The ADB's latest forecast is below the figure that the World Bank had projected in June, when the latter estimated that Bangladesh's economy would grow at 5.7 percent in FY25, driven by increased private consumption as inflation eased and investment rose due to large infrastructure projects.

The ADB observed that demand remained suppressed by elevated inflation, tight global monetary conditions and other macroeconomic challenges.

"Inflation has remained high due to elevated commodity and energy prices and currency depreciation. The current account deficit narrowed as both exports and imports declined," the ADB said.

The organisation further predicted that inflation could rise to double digits.

"Restoring and maintaining macroeconomic stability will depend on accelerated reforms to increase revenue for a better fiscal balance, stabilise the financial sector through improved interest and exchange rate policies, and diversify the economy," the ADB added.

Amid persistent inflation, continued pressure on external accounts, import contraction and sluggish private investment, Bangladesh recorded below 6 percent growth in the past two fiscal years: 5.78 percent in FY23 and 5.82 percent in FY24.

The previous government had targeted a GDP growth rate of 6.75 percent for FY25, a figure economists described as "ambitious" given the ongoing economic challenges.

"Significant downside risks muddy the macroeconomic outlook. These risks arise from evolving political uncertainties, the law-and-order situation, data gaps and integrity, the challenge to achieve fiscal objectives, finance sector vulnerabilities and weak external demand," the ADB said.

"In the face of these risks, the interim government has formed a committee to prepare a white paper that transparently lays out the state of the economy and recommends reforms for macroeconomic stability, achieving the Sustainable Development Goals, and mitigating challenges that will arise after Bangladesh graduates from the least developed country category in 2026."

The government also plans to form three task forces to lay out a roadmap for banking sector reforms, the ADB added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments