Interim govt to strengthen universal pension scheme

The interim government plans to strengthen the universal pension scheme (UPS) with the aim of bringing people from all walks of life under a sustainable social security framework.

As part of this move, the National Pension Authority (NPA) took a host of measures in the first meeting of its board of directors recently to boost confidence among subscribers.

To retain subscriber confidence, the authority decided to offer a profit of at least 8 percent on the money credited by October each year.

"The profit will not be less than 8 percent based on their initial year's deposit. Each account holder can see credited profit on their respective account by October," Md Golam Mostofa, a member of the NPA, said.

This calculation will be done by June each year and the profit will be credited to the beneficiary's account by October, he said.

The NPA board decided to examine the introduction of health insurance and one-time gratuity to make existing pension schemes more attractive, according to finance ministry officials.

To retain subscriber confidence, the authority decided to offer a profit of at least 8 percent on the money credited by October each year

In addition to treasury bonds, board members also suggested finding more profitable and low-risk sectors to invest in.

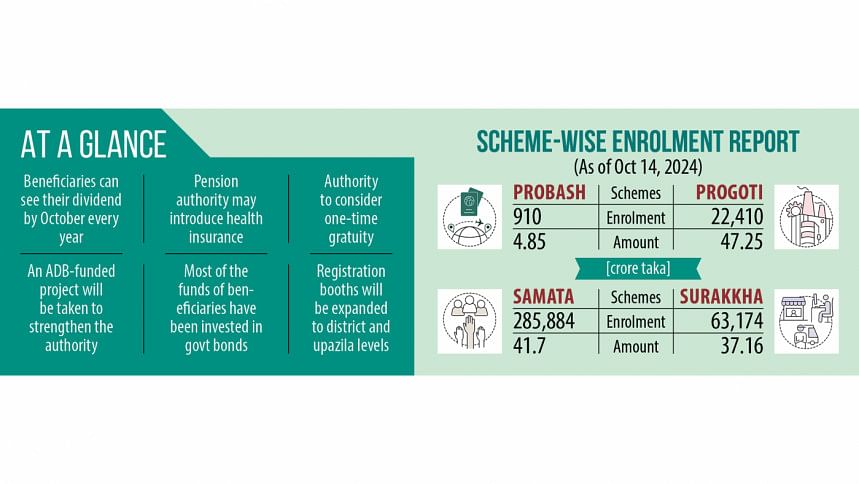

As of October 14, a total of 3.72 lakh beneficiaries had enrolled in the four pension schemes under the UPS, namely Probash, Progoti, Surakkha and Samata, and have deposited nearly Tk 131 crore.

The pension authority has already invested Tk 125 crore in government treasury bonds as a safe and lucrative option, according to NPA data.

The Samata scheme, which targets low-income citizens, has become the most popular choice, drawing 78 percent of total subscribers.

The monthly instalment fee under the Samata scheme is Tk 1,000. But half of the fee will be provided from government funds.

M Abu Eusuf, executive director of Research and Policy Integration for Development (RAPID), welcomed the move.

"After the uprising in July, there is a scope for the interim government to revive and expand the schemes publicly," he said.

"The NPA can hold public hearings with the four respective groups to encourage them," he suggested.

The NPA will have to work to remove "any doubt" and assure security of the beneficiaries' deposits, he said.

At the meeting, the board also gave a green signal to adopt a separate project financed by the Asian Development Bank (ADB) to further strengthen the pension authority.

The board also directed NPA officials to engage with the Economic Relations Division to send a proposal to the ADB in this regard.

A finance ministry official said they had already drafted a project worth $320 million or Tk 3,800 crore, adding that they would likely seek around $250 million from the ADB.

The project is likely to be completed by 2028, the official added.

Infrastructure, capacity-building, training facilities for officials, hiring public relations firms, establishing a permanent NPA office, and hiring consultants were all included in the project.

"We have already had primarily discussions with the ADB and the lender has shown an interest to invest in the project," an official of the finance ministry said.

The NPA board also directed officials of commercial banks to participate in the Progoti scheme, which is designed for employees of private companies.

The past government introduced the UPS on August 17 last year, bringing citizens aged between 18 and 50 years under coverage with the aim of ensuring a safety net for them and providing a monthly stipend to support their daily expenses.

Alongside the four schemes, the government also launched a pension scheme called Prottoy on July 1 this year for public universities and self-governed, autonomous and state entities.

However, the government scrapped the much-talked Prottoy scheme amidst opposition from university teachers in early August.

The interim government has no plans to revive this scheme.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments