Investors suffer as SEC halts trading at deficit-hit brokerages

Aminur Rahman was excited after hearing that the company he had invested in had recently been upgraded to A-category. Anticipating price gains, he rushed to his brokerage house, only to be met with disappointing news: he was unable to trade.

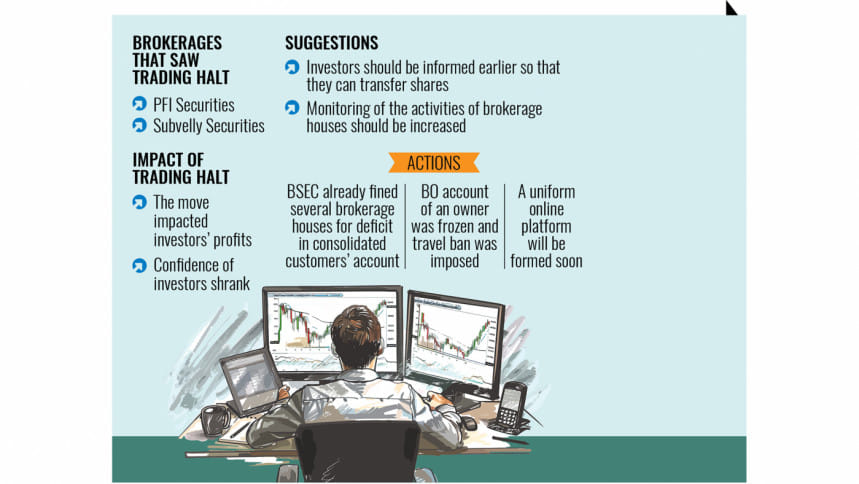

Rahman's broker, PFI Securities, had its trading halted by the stock market regulator due to mismanagement of client funds. But for it, investors like Rahman did not have a part to play.

"Who will bear the losses if my share prices decline before I can trade again?" questioned Rahman, which was not his real name as he requested anonymity.

The stock exchanges should follow the consolidated customers' account closely and publish the balance of the account on a weekly basis to see if any brokerage house has deficit in net capital.

The answer of Rahman's question is disappointing, as neither the regulator nor the stockbroker would shoulder the losses.

The Bangladesh Securities and Exchange Commission (BSEC) recently announced that it would not renew the licence of brokerage houses with deficits in their consolidated customer accounts (CCAs).

These fund gaps in the CCAs -- bank accounts used by brokers to hold and manage client funds -- indicate possible mismanagement, misappropriation or embezzlement of cash, prompting the BSEC to take the stringent measure.

PFI Securities, with a Tk 28 crore deficit in its CCA, was one such brokerage house that had its trading halted.

While Rahman supported the regulatory measure, he said the BSEC should have warned investors and allowed adequate time to transfer their shares to linked accounts before halting trading at the brokerage firms.

The regulator, however, says that the trading halt would not hurt investors as they could transfer their shares by opening linked accounts with other stock dealers.

Saiful Islam, president of the DSE Brokers Association (DBA), said investors should not suffer for the shortcomings of their brokerage, and this is a key concern for increasing investor confidence.

"So, the country's bourses should closely monitor and publish a weekly report if any brokerage has a deficit in net capital," he added. "If the dealers don't become transparent, then neither will the market."

Furthermore, Islam suggested forming a committee with officials from the stock exchanges and BSEC that they can take immediate steps whenever the bourses detect a deficit in a brokerage's CCA.

"If immediate steps were taken, we would not have seen the case of Mashiur Securities," he said.

The DSE recently found that Mashiur Securities had misused a total of Tk 161 crore of investors' funds, prompting the BSEC to suspend its activities.

However, Islam informed that the CCA deficit at Mashiur Securities has existed for around 10 years now.

"So, then what role did the regulator really play in protecting the investors?" he said.

Citing how several brokerage houses embezzled investors' funds over the past 15 years, the new BSEC commission recently announced that it will go tougher on those that have a CCA deficit to protect investors' interests.

As such, the BSEC sought travel bans on the top brass of Dhanmondi Securities and PFI Securities for having CCA deficits worth Tk 35 crore.

Additionally, the BSEC has asked the Central Depository of Bangladesh to freeze the beneficiary owner accounts of these firms.

Previously, the stock exchanges ran an investigation on all stock dealers and found that 108 of them had a combined CCA deficit of more than Tk 500 crore.

Later, 102 of the brokerage houses covered the deficit as instructed by the regulator. The remaining six failed to do the same, with trade being halted at Subvalley Securities for this reason.

Kazi Fariduddin Ahmed, managing director and CEO of PFI Securities, did not take phone calls or reply to messages seeking a comment by the time this report was filed.

Likewise, the phone of Md Mizanur Rahman Khan, managing director and CEO of Dhanmondi Securities, was found switched off.

Mahbub-E-Elahi, managing director of Subvalley Securities, could also not be reached.

BSEC Spokesperson Mohammad Rezaul Karim informed that the regulator is taking steps with the recommendation of the stock exchanges in order to protect investors' rights.

"Investors should not face any problem despite the trading halt at certain brokerages as they can transfer their shares to linked accounts at other dealers," he said.

With the trading halt, their investors will not face problems trading as they can transfer their shares through opening linked accounts in other stock dealers.

"If any brokerage house does not facilitate the share transfers, then let us know and we will take steps against them," he added.

He also said the BSEC has already taken steps to form the "Union Online Platform", which will require brokerages to upload their CCA balance on a daily basis.

With that, the CCA will be under full monitoring, Karim added.

Sattique Ahmed Shah, chief financial officer and acting managing director of the DSE, said publishing the net capital of stock brokerages on a weekly basis is a good suggestion. So, they will discuss it with all stakeholders immediately.

"We will also learn the world's practices in this regard to address the problem," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments