Islami Bank dethrones Sonali Bank to become largest lender by deposits

Islami Bank Bangladesh PLC has become the largest lender in the country by total deposits for the first time, surpassing Sonali Bank PLC, despite loan scams in recent years.

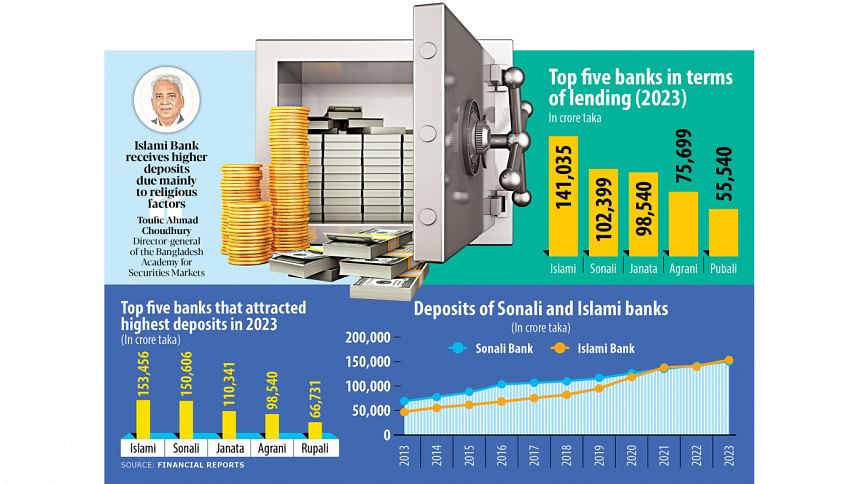

The Shariah-compliant bank attracted deposits of Tk 153,456 crore in 2023, an increase of around 9 percent year-on-year.

Sonali Bank, the largest state-run lender, mobilised deposits worth Tk 150,606 crore, up 6 percent, according to the financial reports.

This makes Islami Bank the largest bank in Bangladesh in terms of deposits and loans (investments). Its lending has been much higher than the state-run lender for several years.

"Islami Bank receives higher deposits due mainly to religious factors," said Toufic Ahmad Choudhury, director-general of the Bangladesh Academy for Securities Markets.

"Apart from this, people have limited investment opportunities to keep their funds safe. People can buy land and flats, but they are also cheated. Therefore, banks have managed to retain the trust of depositors."

Established in 1983, Islami Bank was the first Shariah-based bank in Southeast Asia. It has been facing crisis since 2017 when S Alam Group took it over. Since then, its financial health has been deteriorating and many sponsors have already pulled out.

It has recently come under scrutiny due to widespread financial scams. For example, the bank allegedly disbursed Tk 7,246 crore in loans to nine companies in 2022 violating banking norms.

Choudhury, also a former director-general of the Bangladesh Institute of Bank Management, said many depositors don't bother about whether banks are safe options or not, and they have little knowledge about how financial institutions use the funds to generate incomes.

Private banks are also expanding their footprint by setting up agent banking outlets and by launching mobile financial services and internet banking. On the back of new technologies, they are growing fast while state-run banks are lagging.

In terms of network, Sonali Bank is still the largest lender in Bangladesh and much ahead of Islami Bank.

Islami Bank had 394 branches at the end of 2023 whereas it was 1,232 for Sonali Bank. State-run Agrani Bank came second with 978 branches and Janata was third-placed with 928 branches.

Choudhury said Sonali Bank has to give many government services, and it can't focus on collecting deposits like its private-sector competitors. "However, this bank's financial performance is improving."

Historically, people have had more trust in state-run banks, and they expanded their footprint across the country through branches, which netted them comparatively higher deposits.

Janata Bank collected the third-highest volume of deposits of Tk 110,341 crore last year. It was Tk 98,540 crore for Agrani Bank, Tk 66,731 crore for Rupali Bank, and Tk 60,574 crore for Pubali Bank, their financial reports showed.

Among the foreign banks, Standard Chartered Bangladesh raised the highest deposit at Tk 41,940 crore, a year-on-year increase of around 15 percent.

Pubali Bank posted a 19 percent growth to Tk 60,574 crore, becoming the top deposit collector among local conventional banks.

A top banker said depositors of Shariah-based banks usually don't keep funds with conventional banks, and the number of depositors in Islamic banks is rising steadily.

"Besides, financially strong and sound banks get more deposits."

Islami Bank lent Tk 141,035 crore in 2023. Sonali Bank came second in the category by extending loans amounting to Tk 102,399 crore.

Janata, Agrani, and Pubali Bank were among the top lenders.

Although Islami Bank topped the chart in attracting deposits and providing loans, it ranked lowly in the list of top profit-makers.

Standard Chartered Bangladesh posted the highest profit among all banks, netting a record Tk 2,335 crore in 2023 followed by HSBC's Tk 999 crore, BRAC Bank's Tk 827 crore, Dutch-Bangla Bank's Tk 801 crore, Sonali Bank's Tk 747 crore, and Pubali Bank's Tk 697 crore.

Another top banker said many people keep their funds with Shariah-based banks even if they offer a lower return or their financial strength is weak.

"They keep funds with a view to avoiding interests in conventional banks. Even, some of my close relatives don't keep funds in my banks," he said. "So, this is a pure case of belief."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments