Islami Bank to realise Tk 10,000cr by selling S Alam Group’s stake

Islami Bank Bangladesh plans to sell the S Alam Group's stake in the bank to realise dues of around Tk 10,000 crore from the controversial conglomerate.

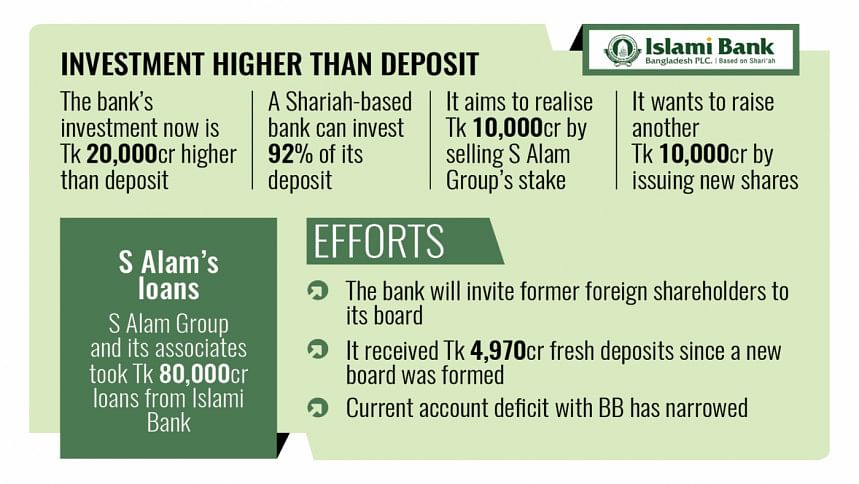

According to bank officials, the Chattogram-based group and companies associated with it took out around Tk 80,000 crore in loans through 17 branches of Islami Bank since 2015.

Selling the shares will require the bank to get approval from both the Bangladesh Bank (BB) and the Bangladesh Securities and Exchange Commission (BSEC), which barred any transfer or sales of the shares held in six banks by S Alam Group Chairman Mohammed Saiful Alam and his family members after the fall of the Sheikh Hasina-led government in early August.

"We will sell the shares owned by the S Alam Group and its concerns by filing a lawsuit to collect Tk 10,000 crore," Islami Bank's Chairman Md Obayed Ullah Al Masud said at a press conference at the Bangladesh Bank yesterday.

Central bank Governor Ahsan H Mansur as well as board members of Islami Bank were present at the press conference.

Masud said that Islami Bank had a Tk 20,000 crore gap between investments and deposits, which was created as the bank paid correspondent banks for letters of credit (LCs) opened by the S Alam Group.

"But S Alam group did not settle its liabilities to Islami Bank."

The remaining Tk 10,000cr will be raised by issuing new shares, Masud added.

At face value, the shares held by the S Alam Group are worth Tk 1,600 crore, he informed.

"However, taking into consideration that each share is trading for around Tk 60 at the Dhaka Stock Exchange, the market value is nearly Tk 10,000 crore."

At the press conference, BB governor Mansur said the central bank is taking action against individuals, not companies like S Alam Group and Beximco, which are considered national assets.

Mansur emphasised that the central bank would not shut down companies such as S Alam Group and Beximco.

"We are trying to prevent fund diversion," he added.

However, he said legal action would be taken against the S Alam Group's chairman and other officials for alleged crimes in the banking sector.

Islami Bank Chairman Masud added that the S Alam Group did not just take out money, but also destroyed the bank's relationships with international lenders.

The chairman added that they would invite former foreign shareholders like IFC and Alraji Saudi Group to invest in it again by January.

"In the three months since the board was reconstituted in August, deposits have increased by around Tk 5,000 crore and remittance is also increasing," he said, adding that they are now suspending new lending.

"We restarted the Real-Time Gross Settlement (RTGS), Bangladesh Electronic Funds Transfer Network (BFTN) and the National Payment Switch Bangladesh (NPSB), which reflects that all the services are now open at Islami Bank."

The bank is going to appoint three officials at each of its 2,700 agent points to increase the flow of deposits, he added.

By early September this year, S Alam Group, whose founder weaponised his close political ties to the ousted Awami League regime, accounted for more than half of the total loans disbursed by Islami Bank of Tk 174,000 crore.

S Alam, along with his family and associates, have at least a 30 percent stake in the Shariah-based lender, according to its annual reports.

However, allegations are rife that the group has a much higher stake by holding numerous shares under pseudonyms.

Once a profitable institution, Islami Bank's financial stability began to deteriorate after S Alam Group started exerting influence following a change to the top brass.

Until 2015, the S Alam Group had no stake in Islami Bank.

Afterwards, the conglomerate began buying the bank's shares through seven shadow companies, documents show.

After fully taking charge in 2017, S Alam Group appointed 7,240 employees and officials in violation of rules and regulations. Most of them hailed from S Alam's hometown of Patiya in Chattogram.

Founded in 1985 by Saiful Alam, a relative of former Awami League politician Akhtaruzzanan Chowdhury Babu and former Land Minister Saifuzzaman Chowdhury, S Alam Group grew into one of Bangladesh's largest conglomerates.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments