Listed firms’ profit drops 24% amid economic slowdown, political turmoil

Listed companies across all sectors saw their profits fall by around 24 percent on an average year-on-year during the last January-September period, due mainly to an economic slowdown and widespread political turmoil, according to an unofficial estimate.

Shanta Securities, a leading brokerage firm, calculated this figure based on data published by the listed companies.

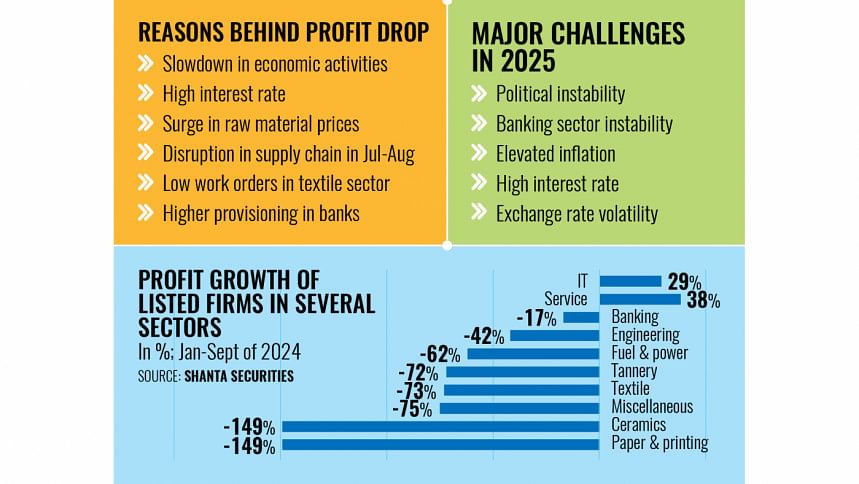

In its report titled "Bangladesh Finds its Lighthouse Amid Reform Hopes," Shanta Securities said the paper and printing, and ceramic sectors were the worst victims, with their earnings declining by over 149 percent in the first three quarters of 2024.

Profits in the textile and tannery sectors declined by over 70 percent, while the fuel and power sector saw a 62 percent profit erosion.

The engineering sector experienced a 42 percent profit decline, and the banking sector's profits fell by 17 percent.

Apart from the economic slowdown and political turmoil, the report cited higher interest rates on bank loans and a surge in raw material prices as key contributors to increased business costs.

Besides, low export orders in the textile sector and higher provisioning in the banking sector were identified as factors contributing to lower earnings.

After mid-July, overall business activities came to a grinding halt as the quota reform movement spread throughout the country, according to the report.

This situation further deteriorated with deadly crackdowns by law enforcement agencies and army deployment, curfews and the ouster of the government eventually through a mass uprising in the first week of August.

Subsequently, the interim government assumed office. Regarding the political changeover, the report said, "Things started to improve slowly after the new government took over."

However, the report cautioned that "business activities are yet to reach pre-July 2024 levels due to a cautious stance among businesspeople".

REGAINING ECONOMIC MOMENTUM MAIN CHALLENGE

Domestically, the report identified the containment of inflation, meeting government revenue target and maintaining banking sector stability as the key challenges.

It said the country has been facing high inflation, due mainly to the depreciation of the taka and the influence of business syndicates in the local supply chain for essential goods.

Despite five policy rate increases in 2024 by the Bangladesh Bank to 10 percent, inflation remained stubbornly high.

Concurrently, interest rates on bank loans surged, negatively impacting the business environment.

Moreover, the banking sector faces the looming threat of a surge in non-performing loans, which had already reached 16.9 percent by the end of September 2024.

Some banks have already defaulted on depositor payments.

The report said a failure to effectively resolve this issue could have severe consequences for overall economic activity.

Amid the uncertainty surrounding political stability, the report said regaining economic momentum and ensuring a stable business environment would be the main challenge in 2025.

The brokerage firm said the business environment would be greatly influenced by political and banking stability, price pressures, and interest and exchange rate fluctuations.

Geopolitical instability also posed a major concern, given the uncertain stance of the US regarding the Russia-Ukraine war, the Myanmar conflict and other global events.

The report said, "This political stability will be the most important factor for business in 2025."

MARKET TURNAROUND EXPECTED IN MID-2025

The report said the bearish market trend continued throughout 2024, with trading activity mainly concentrated on speculative small and medium-cap stocks amid a high-interest-rate environment.

After the political changeover in August 2024, large-cap stocks saw a brief one-month rally as investor expectations and confidence improved.

However, this rally proved unsustainable, losing momentum amid economic uncertainty and concerns regarding policy continuity.

Besides, regulatory and economic reforms in the final quarter of 2024 also impacted the overall stock market movement.

"We expect a turnaround in market momentum in 2025, especially during the second half of the year when inflation normalises, and interest rates begin to decline," predicted the report.

Mohammad Lutfor Rahman, a professor of economics department at Jahangirnagar University, said the profit drop due to political instability was not surprising as business was almost suspended for 40 days.

Apart from this, fluctuation of foreign exchange rates, higher finance costs for growing interest rates, and higher operating costs for costlier energy also impacted businesses, he said.

Due to the dearth of energy supply, many firms were not able to produce as per their capacity, especially the textile sector, which suffers the most from low gas pressure.

Rahman is optimistic about global economic turnaround through the de-escalation of the war between Ukraine and Russia, and timid oil prices.

However, frequent movement and political instability is a big challenge for the country to reap the benefits of world economic recovery, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments