One lakh stock accounts closed amid IPO drought in FY25

The stock market has almost closed the books on the fiscal year (FY) 2024-25 without a single company getting listed through an initial public offering (IPO), a rare event not seen in decades.

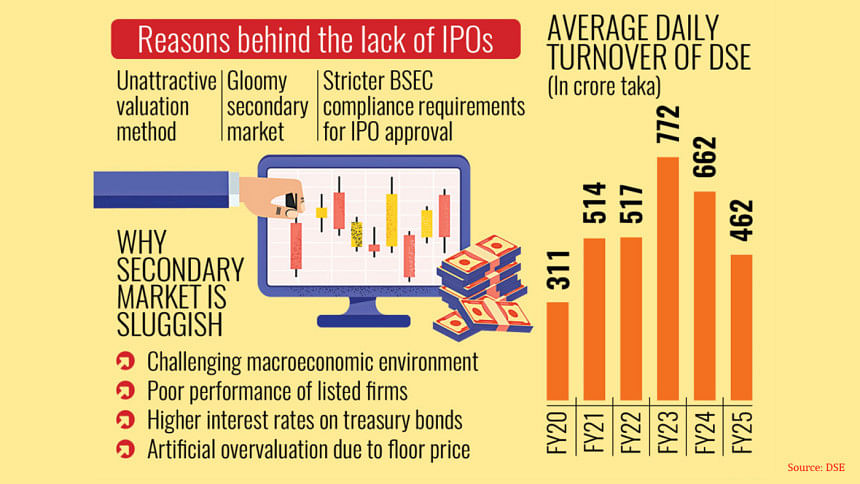

Market analysts have linked the absence of IPOs to the bleak secondary market and what they describe as an unappealing valuation policy under the current public issue rules.

The last company to launch an IPO was Techno Drugs, whose subscription closed in June 2024, during the tenure of the previous commission led by Prof Shibli Rubayat Ul Islam.

The new commission, appointed following the political changeover in August last year, has yet to approve any IPOs over the past year.

Officials at the Dhaka Stock Exchange (DSE) said FY25 was the first IPO-less fiscal year since the 1990s.

While records before that are incomplete and not available, some senior DSE officials said the last time the market saw such a dry spell may have been in the 1970s, when trading was suspended for several years after the country's independence in 1971.

In the absence of fresh listings and amid poor performance by many listed companies, investors have been leaving the market in large numbers. Around one lakh beneficiary owner (BO) accounts have been closed since June 2024, according to the Central Depository Bangladesh Ltd.

"The main reason for the lack of IPOs is the unattractive valuation method set out in the public issue rules," said Rubayet-E-Ferdous, chief executive of Shanta Equity.

He added that while the previous commission had initiated efforts to reform the rules, progress stalled due to the August political changeover and a shift in leadership at the regulator. As a result, strong companies saw little incentive to seek listings.

"When the secondary market is weak, issuers are usually reluctant to join as they worry about failing to secure a good price," he said. "But the shortage of IPOs has created a supply-side problem for the market."

Over the past year, the DSEX, the benchmark index of the DSE, has lost 516 points, or about 10 percent, to stand at 4,717.

For nearly a year, the index hovered around the 5,200 mark, propped up by a floor price mechanism introduced by the previous commission to artificially support prices.

The new commission scrapped the floor price shortly after assuming office, triggering a brief rally that pushed the index past 6,000 points. However, it soon began to slide again as the reality of weak corporate performance took hold.

The daily average turnover of the DSE has also suffered, falling by 30 percent year-on-year to Tk 462 crore, according to DSE data.

Saiful Islam, president of the DSE Brokers Association of Bangladesh (DBA), pointed to the long-standing irregularities plaguing the market.

"The current state of the market is the result of years of corruption and disorder," Islam said. "Protecting investors' money was a key responsibility that was neglected. It has been a fundamental failure on the part of all stakeholders, from regulators to brokers."

He added that the poor return on equities compared with other asset classes has further dented confidence.

"Treasury bonds and bills offer 11 to 12 percent, but stock market returns are much lower. In fact, many people have made losses. The low returns show a lack of governance, accountability, and an adverse macroeconomic backdrop."

The DBA president commented that many investors opened BO accounts solely to apply for IPOs, but with no new offers, their interest waned. "So, we are losing investors."

So far, 309 listed firms, including banks, have released their financial reports for the January–March quarter.

Of these, 177 reported lower profits compared with the same period last year, with combined earnings down 25 percent. Among them, 27 companies slid into losses despite having been profitable a year earlier, a sign of the tough business environment.

"Now the market is full of rotten apples," Islam said. "If we want to make it attractive again, we need to bring in a higher number of good apples."

Md Abul Kalam, spokesperson for the Bangladesh Securities and Exchange Commission (BSEC), acknowledged that the current valuation rules are the main reason for the lack of IPOs in FY25.

"The BSEC is working on amending the rules as part of its reform agenda," he said. "We hope that good companies will feel encouraged to come to the market once this is done."

The regulator has tightened its oversight of compliance, rejecting IPOs from companies that failed to meet standards, Kalam added. "Issue managers do not even dare submit questionable proposals now, as the commission takes compliance very seriously."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments