Panic sales send stocks to four-year low

Stocks in Bangladesh plummeted to a four-year low yesterday, just a day after the stock market regulator formed an inquiry committee to investigate the reasons behind the market's sharp decline.

The fresh plunge prompted some investors to protest in front of the old Dhaka Stock Exchange (DSE) building in the Motijheel area of the capital.

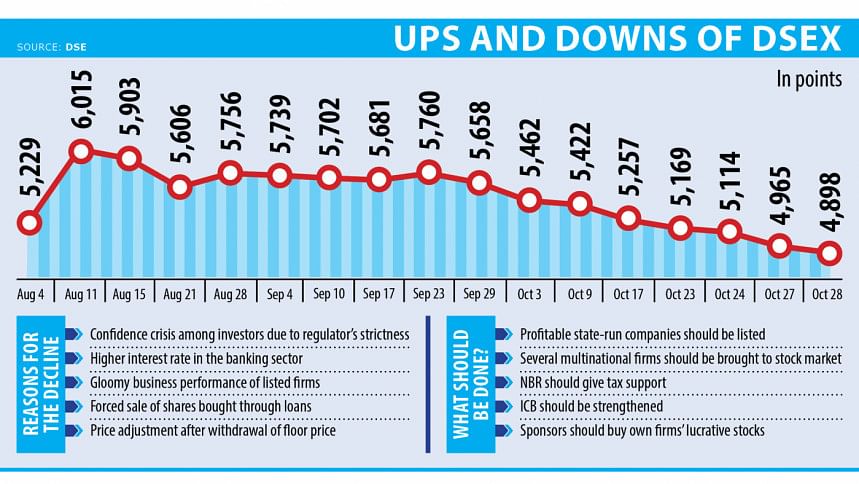

The DSEX, the benchmark index of the DSE, fell by 66 points, or 1.34 percent, to 4,898 yesterday, reaching its lowest level since November 2020.

On Sunday, the Bangladesh Securities and Exchange Commission (BSEC) formed a four-member committee to identify the causes of the recent downtrend in the primary index of the Dhaka bourse and to find out individuals involved in spreading market rumours.

The committee has also been tasked with recommending measures to improve investors confidence.

Meanwhile, stock market analysts blamed high interest rates in the banking sector, weak performance of listed companies, trigger selling and a confidence crisis among investors for the market fall.

Earlier, the finance ministry said the listing of weak companies, looting and manipulation over the past 15 years were not accurately reflected in the stock market index due to the floor price and circuit breaker mechanism.

With the removal of these measures, the real impact of the looting is now being reflected in the index, according to the government.

Regardless of the specific reasons, investors are witnessing an erosion of their funds almost every day.

In the first four days after the fall of Sheikh Hasina-led government in early August, the DSE's market capitalisation, meaning the total market value of all listed securities, soared Tk 67,908 crore, or 10.52 percent. After that, it dropped by Tk 69,739 crore, or 9.77 percent.

"While macroeconomic factors contribute to the decline in the share market index, investor fear and panic selling have accelerated the downtrend," said Kazi Monirul Islam, chief executive officer of Shanta Asset Management.

As interest rates are high and corporate earnings are depressed, the stock market has been impacted, said Islam. "As a result, many stocks have become undervalued."

So, selling shares at this time is not a rational decision, he said, adding that investors should consider investing now with a minimum one-year holding period.

"By holding onto their investments, they may be the market winner from a macroeconomic rebound in the coming months," he said. Islam hoped that large investors, who now have ample liquidity, would accumulate blue-chip stocks.

The DS30 Index, which tracks blue-chip stocks, declined by 25 points, or 1.37 percent, to 1,805 yesterday. Similarly, the DSES Index, the index of Shariah-compliant companies, plunged by 20 points, or 1.82 percent, to 1,087.

Emran Hasan, managing director and chief executive officer of Investit Asset Management Limited, also believes that panic selling and forced selling are causing the market to decline almost every day.

"Investors are panicked and fear that the market may fall further. So, they are actually overreacting to the situation," he said.

On the other hand, stockbrokers and merchant banks are compelled to execute forced selling due to a 40-50 percent decline in many marginable stocks over the past two months. These stocks are now facing margin calls and subsequent forced selling, he added.

As investors are not getting any new catalysts from the buyers' side and there is also no encouraging news on the economic or policy front, they remain in a state of panic, Hasan added.

Given that most stocks are now undervalued, institutional investors should seize the opportunity. But some of them are already heavily invested and do not have enough funds for further investment.

Others are adopting a wait-and-see approach, hoping for further price declines, according to Hasan.

Islami Bank's decline alone dragged 25 points from the DSEX, while Olympic Industries accounted for a 9-point drop, according to LankaBangla Securities data.

Stock investors, who staged a demonstration in Motijheel yesterday under the banner of Bangladesh Pujibazar Biniogkari Oikko Parishad, demanded the resignation of Bangladesh Securities and Exchange Commission (BSEC) Chairman Khondoker Rashed Maqsood.

Accusing him of failing to prevent the market's downturn, they said the BSEC chairman has not taken any effective measures to support a rebound in the stock market.

The recent market decline has caused severe financial hardship for many investors, they added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments