Remittance crosses $2b for sixth month

Bangladesh received over $2 billion in remittances in January for the sixth consecutive month, thanks to a disruption in the flow of money through informal channels following the fall of the Sheikh Hasina-led government last August amidst a student uprising.

In January, Bangladeshis working and living abroad sent $2.18 billion in remittances, a building block of Bangladesh's economy and a major enabler of reducing imbalances in the external accounts.

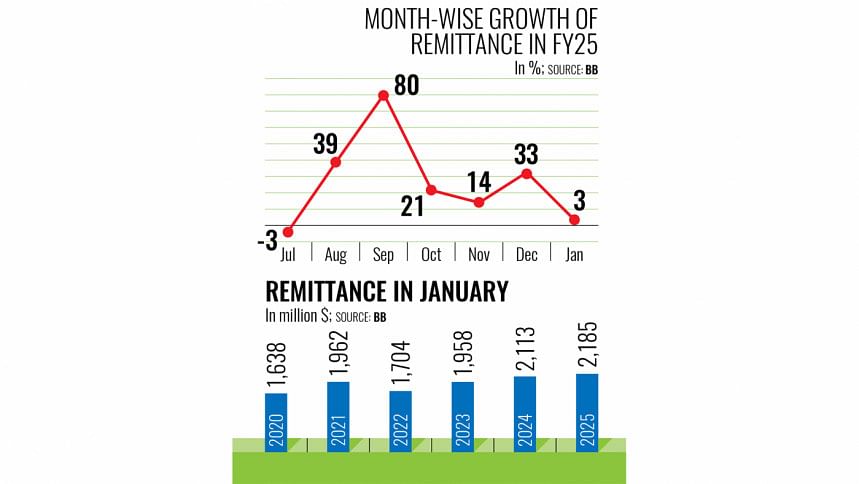

The amount was up 3.4 percent year-on-year.

However, the increase was lower than that in the previous month, as Bangladesh Bank had imposed restrictions on banks from offering high exchange rates to collect foreign currencies.

In December, remittance inflows surged 33 percent year-on-year, according to data from Bangladesh Bank (BB).

Banks were allowed to offer high rates to collect foreign exchange through remittances until December.

Since January, banks have been asked to offer a maximum of Tk 122 per dollar to collect remittances, said a treasury head of a private commercial bank.

For this reason, the growth of remittances slightly slowed, he said, adding that banks now have to maintain uniform rates to collect forex from remitters and exporters.

However, Mati Ul Hasan, managing director of Mercantile Bank PLC, said the remittance inflow in January had followed the usual trend.

Bangladeshi expatriates will send more remittances in the coming months ahead of the holy month of Ramadan and the Eid-ul-Fitr festival, he said.

The country's forex market is now liquid due to the growing trend of remittance inflows in recent months, he said.

Including the January inflow, a total of $15.96 billion had flowed in as remittances since July of fiscal year 2024–25, registering a 24 percent year-on-year growth, according to BB data.

Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue (CPD), said inflows usually fluctuate on a month-to-month basis.

The informal flow of remittances faced some setbacks after the political changeover in August. As a result, there was a surge in the flow. However, the robust remittance growth could prove to be a one-time phenomenon, he added.

"But we should not expect such high growth to continue. This phenomenon could be observed only in this fiscal year. To sustain the growth, we have to focus on sending skilled migrant workers and diversifying the market," he said.

Mustafiz said the authorities need to retain this trend and ensure that remittances are not channelled through the informal market. There should be strict monitoring of the kerb market, he added.

The economist said the increased flow of remittances has helped stabilise the country's foreign exchange reserves and support imports.

"We should also note that a large amount of subsidy is spent to attract remittances," he said, suggesting a gradual move towards a market-based exchange rate to reduce the subsidy pressure.

The government pays a 2.5 percent incentive on remittance sent from abroad.

Ashikur Rahman, senior economist at the Policy Research Institute (PRI) of Bangladesh, said remittance growth has shown real positive momentum in FY25 and helped stabilise the pressure on the country's balance of payments by boosting foreign reserves.

"Moreover, the depreciation of the taka against the US dollar has aided this development, as workers in international markets are finding official channels more attractive," he said.

As things stand, remittances should reach approximately $30 billion in FY25, which will support economic stabilisation by boosting local demand within the economy, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments