Remittance hit $24b in FY24, highest in three years

After hovering around the $21-billion mark for the previous two fiscal years, total remittances sent home by Bangladesh's migrant workers reached nearly $24 billion in the just concluded fiscal year of 2023-24, providing some breathing space amid the forex crunch.

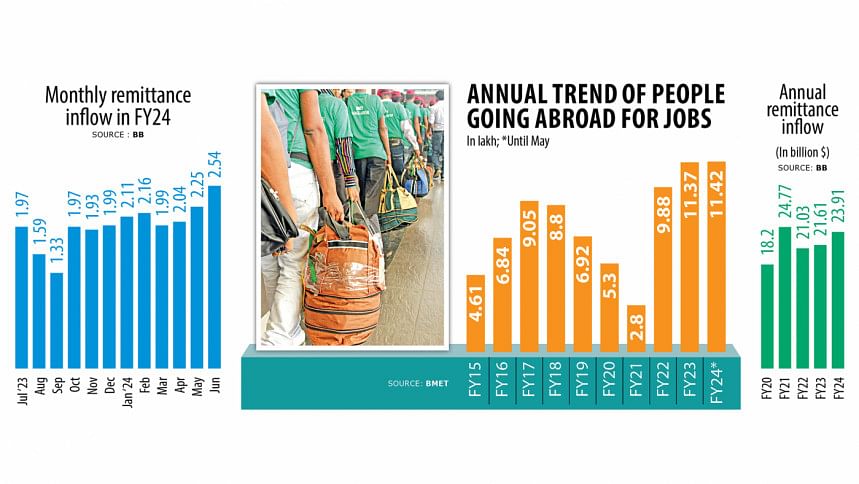

As per the latest data from the Bangladesh Bank, remittance inflow stood at $23.91 billion in FY24, rising by 10.66 percent compared to the year prior.

"We put all our efforts to collect remittance as banks were very thirsty for foreign currencies to pay import bills. This helped boost remittance earnings," said Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank.

Bangladesh's migrant workers sent home an increased amount of foreign currencies in the last two months of FY24 as the gap between the formal exchange rate and informal exchange rate narrowed due to the introduction of a flexible exchange rate, he added.

On May 8, the central bank introduced the crawling peg exchange rate system, allowing banks to buy and sell US dollars within a fixed band at around Tk 117.

The inter-bank exchange rate stood at Tk 118 per dollar yesterday.

In June, the last month of FY24, remittance inflow stood at $2.54 billion, up 15.59 percent year-on-year. Remittance inflow stood at $2.25 billion in May and $2.04 billion in April, BB data also showed.

Rahman, also a former chairman of the Association of Bankers Bangladesh (ABB), said remitters sent more money through banking channels in FY24 as the dollar rate was better than in previous years.

He added that some banks were providing incentives from their own fund, adding to the government incentives, which further boosted remittance inflow.

Rahman also attributed the increased remittance inflow to higher manpower exports.

Until May of FY24, around 11.42 lakh people left Bangladesh for work compared to 11.37 lakh in FY23, according to data from the Bureau of Manpower, Employment and Training (BMET).

In FY22, around 9.88 lakh individuals went abroad, the data also showed.

Rahman hoped the upward trend of remittance inflow would continue.

Bangladesh received a record $24.77 billion as remittance in FY21 because of the disruption of the hundi system -- an illegal channel that facilitates cross-border transactions -- due to the halt of international travel amid the Covid-19 pandemic.

The amount fell to around $21 billion in both FY22 and FY23 after the rules for travelling were relaxed.

At the same time, the gap between the formal and informal exchange rates adversely impacted remittance inflow through banking channels.

Mohammad Ali, managing director and CEO of Pubali Bank, told The Daily Star that remittance inflow increased in FY24 due to policy initiatives, including the introduction of a flexible exchange rate.

He said the use of hundi had come down in the final months of FY24, which positively impacted remittance earnings.

Ali added that over-invoicing and under-invoicing had also been curbed by strict monitoring.

He also said that the country's forex market is liquid now because of the increased remittance earnings.

Industry insiders alleged that some banks were providing a higher rate for dollars than the official rate in case of collecting remittance, which the banking regulator was not addressing.

In the first 21 days of June, Islami Bank Bangladesh received the highest remittance, amounting to around $441 million, BB data showed. Agrani Bank received $171 million and Janata Bank $127 million.

The growing trend of remittance will provide breathing space in the upcoming months as the country has been contending with a foreign exchange crisis for the past two and a half years.

Since August 2021, the forex reserves have fallen by $24 billion.

As per the calculation method used by the IMF, Bangladesh's gross forex reserves stood at around $22 billion on June 26 this year.

The foreign exchange market has been volatile because of higher US dollar outflow despite the government's austerity measures, including controlling import payments.

The $4.7 billion loan provided to Bangladesh by the International Monetary Fund (IMF) has also played a big role in tackling the ongoing crisis.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments