S Alam Group took over half of Islami Bank’s total loans, says new IBBL chairman

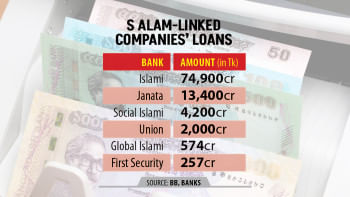

Chattogram-based conglomerate S Alam Group has taken more than half of the total loans disbursed by Islami Bank Bangladesh Ltd (IBBL), according to the bank's newly appointed Chairman Md Obayed Ullah Al Masud.

Masud shared this information with journalists today following a meeting with Bangladesh Bank Governor Ahsan H Mansur. Other members of the bank's board were also present.

Islami Bank's total loans amounted to over Tk 1.74 lakh crore at the end of June, according to the bank's records.

Masud said the group secured the loans by using overvalued assets, and a reassessment of the group's assets is currently underway.

"We need another week to gather exact figures of the total loans taken by S Alam Group," said Masud.

Masud added that the group's collateral is insufficient to cover the amount borrowed, hence a letter has been sent to the law ministry to identify any assets outside the collateral.

The central bank reconstituted Islami Bank's board on August 22 and appointed Masud, the former managing director of Rupali Bank, as chairman.

Four independent directors were also appointed to the board by the banking regulator, freeing the Shariah-based lender from the grip of S Alam Group who forcefully took over the bank in 2017.

"When the new board took charge, the bank faced a capital shortfall of Tk 2,300 crore," Masud mentioned.

"However, the shortfall is narrowing daily and has already reduced to Tk 2,000 crore as of Thursday. We expect the situation to improve by the end of this year," he said.

The new IBBL chairman assured that customers would no longer face difficulties in withdrawing funds, noting that deposits last week exceeded withdrawals, resulting in a net positive balance.

When asked about action against IBBL officials who assisted S Alam Group owner Mohammad Saiful Alam, Masud said, "We do not plan to take immediate action against junior officials, as it could destabilise the bank. However, senior officials who were involved are already being removed, and all responsible parties will be dealt with according to the law. No one will escape accountability, and no wrongful removals will occur either."

Masud presented a roadmap to address the bank's crisis in three phases.

The first phase, from now until December 31, will focus on recovery. The second phase, between 2026 and 2027, will mark a "turnaround", while the third phase, from 2027 to 2029, will focus on moving the bank forward.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments