Sonali to auction assets of Alltex Industries

Sonali Bank has decided to sell the assets of Alltex Industries through auction in a bid to recover unpaid loans of the listed textile producer.

The largest state-run bank in Bangladesh announced the auction yesterday, saying that Alltex Industries owed it about Tk 380.77 crore as of March 31, 2022.

To recover the funds, Sonali Bank will sell 14.7 acres of the Alltex's land, its manufacturing facilities and offices, raw materials, and spare parts, which were mortgaged for the loan.

Interested parties were asked to submit their auction letters to the bank before January 2.

However, despite the announcement, Alltex Industries' share price held steady at Tk 10 per unit yesterday.

Alltex Industries, which was listed with the stock market in 1996, provided cash dividends only twice, offering four percent in a year and one percent in another year.

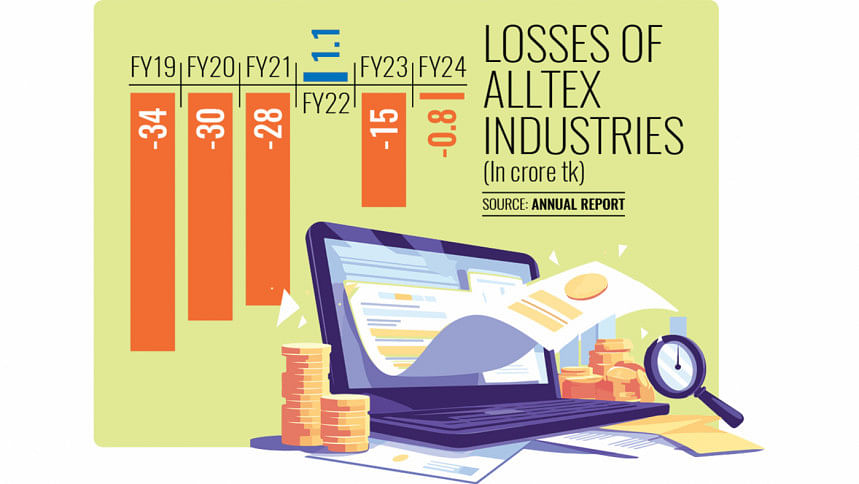

According to the company's financial statements for fiscal 2023-24, its net loss stood at Tk 8 lakh while its retained earnings reached Tk 113 crore in the negative as of June 31 this year.

In its report, the company's auditor also provided a qualified opinion, which is only issued when the auditor identifies material misstatements.

The auditor observed that the financial statements of Alltex Industries showed a loan balance of Tk 228 crore owed to Sonali Bank as of June 30 this year.

However, the loan balance shown on the company books was Tk 261 crore.

The bank did not charge interest on its loans from July 1, 2023 to June 30, 2024. The company also did not make provisions for interest on loans during this period, the auditor said.

In 2017, Sonali Bank decided to waive interest amounting to Tk 129 crore against loans worth more than Tk 360 crore worth to concerns of Alltex Group, which is owned by former Awami League lawmaker Afsar Uddin Ahmad.

But despite the interest waiver, the company still did not repay its loans. So, the bank has started the process of selling its mortgaged assets.

Md Ziaul Huque, company secretary of Alltex Industries, said they are in the process of negotiating with the bank.

He added that they had repaid Tk 1 crore last month.

"This loan was taken many years ago and the amount soared after adding interest year after year," he said, adding the principal amount is only one-third of the total dues.

He also said the company's factories have been suffering for many years due to the lack of adequate gas supply. Additionally, the business climate was unfavourable for the past several years due to the Covid-19 pandemic, Russia-Ukraine war, and political turmoil.

"But despite the dull business situation, the company is proceeding with negotiations," he added.

Huque acknowledged that the company had received an interest waiver of Tk 72 crore in 2017.

A mid-level official of Sonali Bank, preferring anonymity, said no bank wants to sell a company's mortgaged assets until and unless it sees that the company has a limited chance to repay the loans.

"The bank is trying to recover its defaulted loans," he added.

According to central bank data, Sonali Bank's overall bad loans stood at Tk 14,988 crore as of March this year.

Sonali Bank was asked to recoup Tk 300 crore from the top defaulters last year, shows data of the Bangladesh Bank, but the lender managed to recover only 12 percent of this amount.

The bank's bad loans amounted to Tk 13,340 crore in December last year.

Of the sum, more than Tk 4,000 crore was held by the top 20 defaulters.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments