Stocks continue to bleed as investment stagnates

The stock market in Bangladesh extended a losing streak for a third consecutive trading day yesterday as skittish investors were reluctant to pour fresh funds due to political and economic uncertainties.

As a result, both the Dhaka and Chattogram bourses witnessed thin participation of investors alongside massive sales requests as stagnation continued to plague the investment climate.

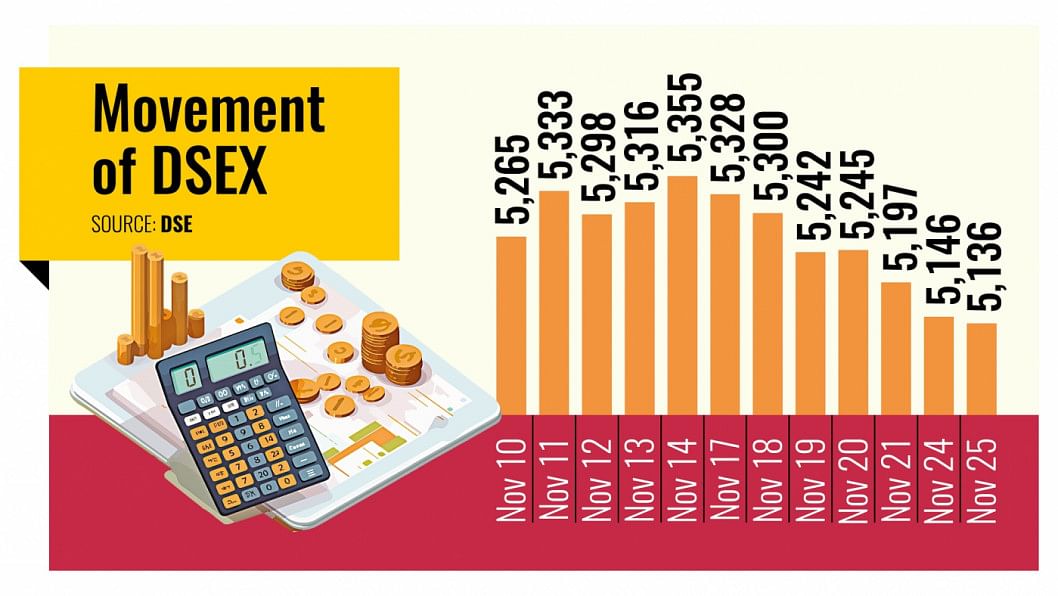

The broad index of Dhaka Stock Exchange (DSE), the DSEX, dropped by 10.37 points, or 0.20 percent from that on the previous day, before closing at 5,136.

The DSES index for the Shariah-compliant companies receded by 1.94 points, or 0.17 percent, to 1,147.

In the blue-chip segment, the DS30 index went down by 3.16 points, or 0.17 percent, to 1,896.

In Chattogram, the CAPSI, the premier index of Chittagong Stock Exchange (CSE), saw a similar trend, edging down by 23.09 points, or 0.16 percent, to settle the day at 14,396.

Of the issues that changed hands on the DSE, 148 advanced, 163 closed lower and the remaining 83 did not see any price movement.

Turnover, which indicates the total value of shares traded, increased by 5.88 percent to stand at Tk 319 crore.

The banking sector dominated the turnover chart, accounting for 17.85 percent of the total.

Block trades, which refers to high-volume securities transactions that are privately negotiated and executed outside the open market, contributed another 5.2 percent.

Bangladesh Shipping Corporation emerged as the most-traded share, with a turnover of Tk 14.9 crore.

Among the sectors, jute, ceramics and fuel and power became the top three to close in the positive, according to the day's market update by UCB Stock Brokerage.

However, life insurance, travel, and leisure and telecom were the top three sectors that closed in the negative.

BRAC EPL Stock Brokerage in a daily market update said sectors that account for large amounts in market capitalisation, which is the total value of their shares at present, posted a mixed performance.

Fuel and power booked the highest gain of 1.47 percent, followed by non-bank financial institutions (1.40 percent) and food and allied (0.50 percent).

Losses were incurred by engineering (0.22 percent), banking (0.39 percent), pharmaceuticals (0.53 percent) and telecommunication (0.71 percent).

The Power Grid Company of Bangladesh, Islami Bank Bangladesh, British American Tobacco Bangladesh, Olympic Industries, Jamuna Oil Company, Pubali Bank, Bangladesh Steel Re-rolling Mills, MJL Bangladesh, Asiatic Laboratories and IFIC Bank drew investors the most, as per LankaBangla Securities.

But none of the companies witnessed a double-digit growth in their share prices.

On the other hand, shares of Square Pharmaceuticals, BRAC Bank, Renata, Khan Brothers PP Woven Bag Industries, Midland Bank, Grameenphone, Eastern Bank, Pragati Life Insurance, Argon Denim and Orion Infusion suffered losses.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments