Summit buys 2,000 towers from Banglalink for Tk 1,100cr

Summit Towers Ltd, a company of Summit Communications Group, is buying 2,000 towers of Banglalink for Tk 1,100 crore, a development that could intensify competition in the tower infrastructure businesses in Bangladesh.

The proceeds from the sale will primarily be used to service Banglalink's financial commitments and generate cost efficiencies while freeing up resources for the company's digital expansion, its parent company Veon said in a statement.

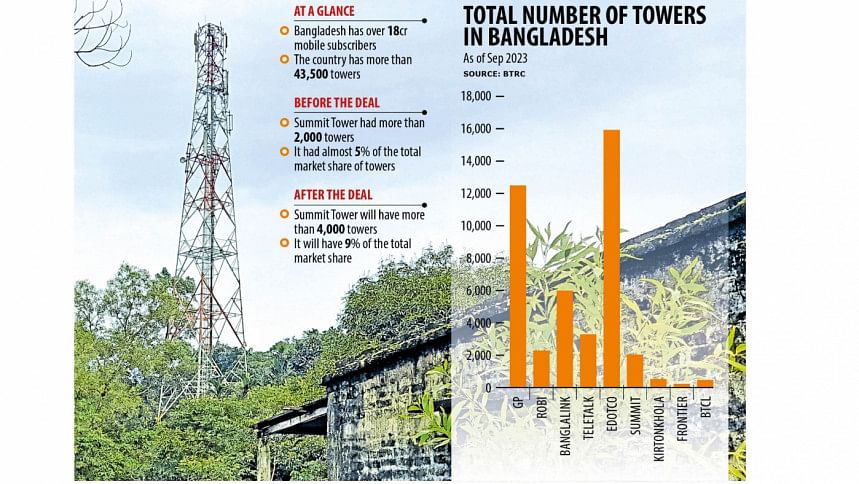

Banglalink, which has 6,034 towers currently, will transfer a third of them to Summit Towers, raising the number of sites under the management of the Bangladeshi company to above 4,000.

The acquisition of new towers by Summit will accelerate competition in the tower business in the country where edotco Bangladesh is a market leader.

Edotco will still remain a dominant player thanks to its 15,955 towers. It also manages more than 2,000 sites of other telecom players.

But Summit Communications, which has a robust fibre network and submarine cable licence, will emerge as a formidable player in the market.

It operates 53,000 kilometres of fibre optic network and serves 35 percent of Bangladesh's internet demand. It is building the country's first private submarine cable.

"With towers, fibres and submarine cable, we will build an integrated communication infrastructure and provide one-stop service," Md Arif Al Islam, managing director and CEO of Summit Communications, told The Daily Star.

"With the new towers, we will provide services to other operators alongside Banglalink."

In 2015, Robi sold 5,258 towers to edotco Bangladesh Co Ltd for $250 million. It was a wholly-owned subsidiary of the mobile phone operator at that time.

Edotco has been the leading operator since 2018 when the Bangladesh Telecommunication Regulatory Commission (BTRC) awarded the tower-sharing licence to four firms to build and operate tower infrastructures.

Summit received a boost last year as the telecom regulator designated edotco as a significant market power (SMP), barring it from rolling out more than 25 percent of new towers. At that time, edotco held more than 85 percent of the market share.

Since then, Summit has deployed most of the new towers.

Two other tower companies Kirtonkhola and Frontier have 564 and 275 towers, respectively.

Thanks to the deal, Banglalink, the third-largest operator, will be able to maintain its cash flow as it has to clear dues worth around Tk 823 crore following an audit into the operator for the period from 1996 to 2019.

The proceeds generated from the sale of the towers will also assist Banglalink in aligning its strategies with those of the parent company.

Since 2021, VEON has defined its value creation strategy around three pillars: asset-light business model and value crystallisation of tower assets, sustained growth in core business with the digital operator strategy, and growth in adjacent markets.

The agreement signed with Summit Towers aligns with the asset-light pillar of the value creation strategy and supports Bangladesh's goal of ensuring maximum efficiency in the utilisation of infrastructure resources, the press release said.

"Across our markets, VEON operators are transforming into asset-light digital operators," said Kaan Terzioglu, Group CEO of VEON, in the press release.

"Today's agreement marks a milestone, ensuring an efficient use of resources not only for Banglalink but also for Bangladesh as a whole."

"This deal will enable us to focus on our core business as the leading digital operator of the country and continue addressing the unmet demand in entertainment, education, healthcare and financial services."

Muhammad Farid Khan, chairman of Summit Communications and Summit Towers, said the strategic deal is a prelude to greater cooperation between Banglalink and Summit.

"The future is ours to grow together. With support from VEON, we believe that our collaboration will go beyond the boundaries of Bangladesh into the global arena, setting an example in the region."

Erik Aas, CEO of Banglalink, said: "Our partnership with Summit Towers enables us to focus our resources on our digital offerings, bridging the digital divide for all and providing an outstanding customer experience to the people of Bangladesh."

In the last one and a half years, the operator's performance has been impressive, with double-digit revenue and customer growth, taking the total number of customers to about 4.30 crore. Revenue rose 11 percent year-on-year to Tk 1,315 crore in the second quarter of 2022.

Telecom Minister Mustafa Jabbar welcomed the deal.

"It is a good move and we have introduced this licence so that tower resources can be shared and used properly."

"As we have limited land resources, telecom tower-sharing among operators fosters cost efficiency, enabling faster network expansion and improved service quality."

The closing of the transaction is subject to regulatory approvals.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments