Tanners may get slight tariff relief on chemicals

The government is considering reducing customs duty on seven imported tanning chemicals in the upcoming national budget, offering slight relief to the country's struggling tannery sector.

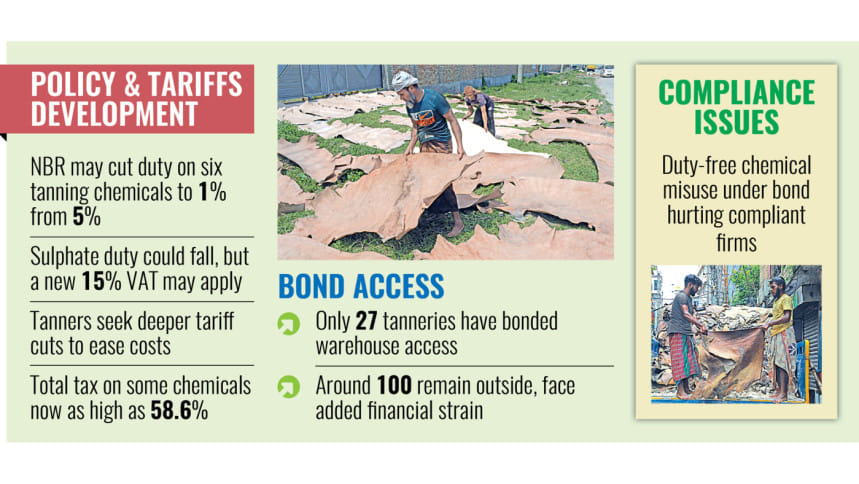

At present, only 27 tanners benefit from bond facilities designed to support the domestic leather industry. Around 100 others operate without such privileges and face higher and varied duties on chemical imports, according to finance ministry sources.

Industry leaders say this disparity creates an uneven playing field. The Bangladesh Tanners Association (BTA) has told the National Board of Revenue that the existing duty structure is hurting the competitiveness of the sector.

There are also reports that some traders are exploiting the bond system by importing chemicals duty-free and then selling them on the open market — an abuse made more profitable by the high duties faced by non-bonded tanners.

In response, the government is now weighing a reduction in customs duty on seven key chemicals used in tanning, including chromium sulphate, acid dyes, and wattle extract.

Under the proposal, duties on six of these items may be cut from 5 percent to 1 percent, while the duty on sulphate could drop from 10 percent to 5 percent. However, the NBR may also impose a 15 percent value added tax (VAT) on sulphate.

Even so, tanners say the planned changes are too little to make a real difference.

In a formal submission to the NBR in March this year, the BTA called for a sharp cut in the total tax incidence, which now reaches as high as 58.6 percent on some chemicals when advance taxes are included.

The association urged the government to bring that figure down to 7.5 percent.

"The current import tax structure, ranging from 35 to nearly 40 percent on essential chemicals, is simply unsustainable," said Shaheen Ahmed, chairman of the BTA.

"Chemical imports are the lifeline of the tannery sector. Except for basic inputs like salt and lime, we rely entirely on imported chemicals. Competing with countries that enjoy cheaper raw materials becomes nearly impossible under these tax conditions," said Ahmed.

He claimed that minor reductions in duty will not solve the bigger problem.

"Even if duties are cut by a few percentage points, it doesn't resolve the bigger issues," he said.

"Large commercial importers might absorb these costs, but small and mid-sized tanneries operating under strict compliance frameworks are disproportionately burdened," added the association chairman.

Mizanur Rahman, general secretary of the association and director of Samata Leather Complex Ltd, said that earlier reductions in duty, such as those on chromium sulphate, were eventually reversed, eroding industry confidence.

"Only seven products now receive marginal benefits, while duties on many essential chemicals remain unchanged," he told The Daily Star. "A 4 percentage-point concession is too little to offset the rising compliance and administrative costs we face."

According to Rahman, lowering chemical costs allows tanners to pay higher prices for raw hides, which in turn encourages internal competition and improves market dynamics.

He said that without meaningful reforms, many small and medium-sized tanneries could be forced to shut down.

"If current conditions persist, international buyers will increasingly turn to more cost-efficient suppliers elsewhere," he said.

"If the government genuinely intends to support the leather sector, the duty structure must be redesigned to reflect practical, on-the-ground needs," he added.

Speaking at a Dhaka Chamber of Commerce & Industry (DCCI) event on Sunday, Syed Nasim Manzur, president of the Leather Goods and Footwear Manufacturers & Exporters Association of Bangladesh, said the country produces around 350 million square feet of leather annually. Of this, nearly 40 percent is collected during the Eid-ul-Azha season.

Yet only 20 percent to 25 percent is processed locally, mainly for shoes and bags. The rest is exported, with 65 percent passing through Chinese middlemen who offer lower prices than direct international buyers, said Manzur.

For the industry, Manzur cited infrastructure and compliance issues as key setbacks.

"The Central Effluent Treatment Plant (CETP) at Savar is still non-functional, and we do not have critical global certifications like Leather Working Group (LWG) approval. Without these, we cannot enter premium international markets," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments