Trump’s remittance tax plan poses threat to Bangladesh

The US House Budget Committee voted late on Sunday to move forward with President Donald Trump's "One Big Beautiful Bill Act", a proposal that could make sending money back home more expensive for three lakh Bangladeshis currently living in the United States.

The bill proposes a 5 percent tax on all international money transfers made by non-US citizens, including holders of non-immigrant visas such as the H-1B and green card holders.

During the January-March quarter of this year, Bangladesh received the highest amount of remittances from the US -- which was more than 18 percent of the total inflow.

"This is a matter of concern for Bangladesh. It would deal a massive blow to our increasing remittance inflow," said Birupaksha Paul, a professor of economics at the State University of New York in Cortland.

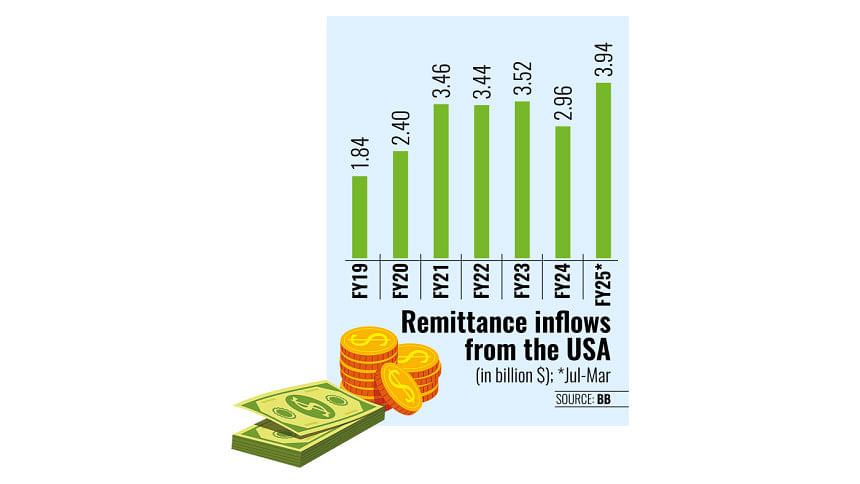

In the first nine months of the 2024–25 fiscal year, Bangladesh received $3.94 billion in remittances from the US, according to the Bangladesh Bank.

If enacted, the US law would deduct 5 percent from the transferred amount at the point of transfer. No minimum exemption has been proposed, meaning even small transfers would be taxed.

The measure could financially hurt around 300,000 Bangladeshis living in the US, according to 2023 estimates from the US Census Bureau.

Describing the proposed levy as "unfair", Paul said, "As people send remittance from their taxed income, it would be unfair to levy tax on remittance again."

He added that the bill might still pass due to the current political landscape in Washington.

"Most of the Congress members are fourth or fifth-generation migrants who no longer send remittances. And there is not much of a voice among economists here."

Paul said that the move comes at a time when the US is grappling with rising public debt and is looking for new revenue sources.

If the bill becomes law, India and several Latin American nations, which also receive large sums in remittances from the US, would feel a sharp impact.

For Bangladesh, Paul recommended allowing the exchange rate to be fully determined fully by the market, rather than offering remittance incentives.

"Better rates may attract remitters more effectively than cash incentives," he said.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, echoed similar concerns of Paul.

"If Bangladesh receives $1 billion in remittances from the US, a 5 percent tax would mean a $50 million loss," he said.

"As the US is our top remittance source, the impact would be significantly high," he added. "It would be a scary situation for the country's foreign exchange reserves."

Mohammad Abdur Razzaque, an economist and chairman of the Dhaka-based think tank Research and Policy Integration for Development (RAPID), said the proposed tax could push many back towards using illegal money transfer channels such as hundi, where rates are already more attractive.

"It will particularly affect small remitters," he said. "This is a policy challenge by a foreign country, but it will have serious domestic consequences."

"It is a matter of concern for us as the US is our largest remittance-contributing country."

Razzaque called for a united global response, pointing out that such a tax would undermine international efforts to reduce the cost of sending remittances.

"This is not just about Bangladesh. All affected countries should raise their voices collectively," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments