Why dividend delay a double whammy for investors

Motaher Hossain Masum was frustrated last September when Confidence Cement announced a mere 10 percent dividend for the last fiscal year despite making a handsome profit.

His frustration turned to anger last month as the company delayed paying the dividend, exceeding the stipulated time.

On Tuesday last week, he was in shock after the Dhaka Stock Exchange (DSE) downgraded the company to 'Z' category for not paying dividends to investors on time.

It seems more shocks were still awaiting Masum.

The next day, the cement manufacturer's stock dropped over 5 percent, mostly because of the downgrade.

"Why should general investors be punished for the wrongdoing of the company?" Masum cried, lamenting the "double penalties" investors face. "This policy is completely against the interest of the investors."

Like Masum, many stock investors ultimately pay the price when listed companies fail to pay dividends within the stipulated time.

Market analysts say the regulator should punish the management and board if a company fails to pay dividends on time, not the general investors.

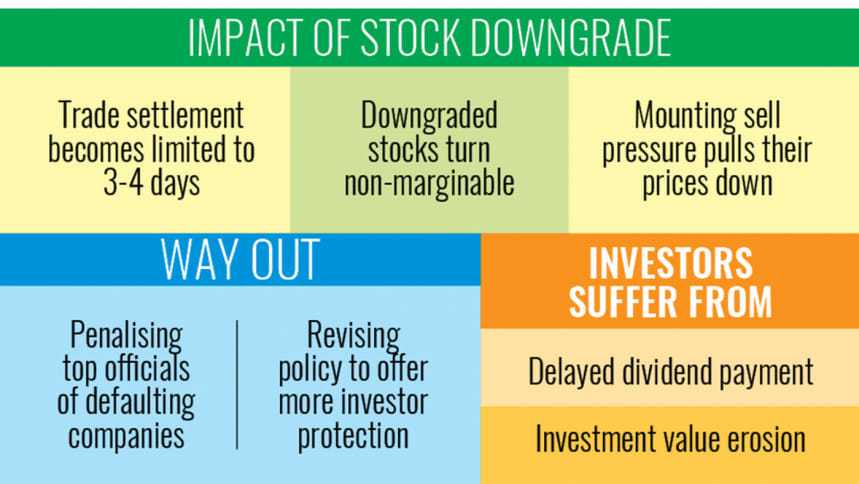

They argue that for late payment, investors not only miss out on their dividends but also face plummeting share prices after downgrades, further eroding their investment value.

A company is transferred to the 'Z' category if it fails to disburse at least 80 percent of its declared dividend within 30 days of its annual general meeting (AGM), according to the Bangladesh Securities and Exchange Commission (BSEC).

When a stock is downgraded, its trading settlement time is extended from two to three days, and it becomes non-marginable, meaning investors must pay the full purchase price without borrowing funds from their brokerage.

As a result, stock intermediaries often demand that investors return margin loans used to buy these shares.

If the investors fail to comply, intermediaries begin selling shares, triggering a steep fall in prices due to selling pressure.

In October this year, the DSE downgraded 14 companies to the 'Z' category for failing to pay dividends within the stipulated time.

The companies are SK Trims & Industries Limited, Shepherd Industries PLC, VFS Thread Dyeing Limited, Fortune Shoes Limited, Associated Oxygen Limited, Desh Garments Ltd, Indo-Bangla Pharmaceuticals Limited, Beach Hatchery Ltd, Advent Pharma Limited, Khulna Power Company Limited, Libra Infusions Limited, Pacific Denims Limited and Union Insurance Company Limited.

The latest addition to this list was Confidence Cement, which was downgraded to the 'Z' category last week.

After that, Confidence Cement's stocks fell by over 15 percent within a week.

On Monday, the DSE upgraded the cement-maker to the 'A' category after dividend payment.

Similarly, a number of companies downgraded in October returned to 'A' after implementing required measures.

"If a company fails to pay dividends within the specified period, the regulator should hold the management and board accountable and take punitive action against them," said Saiful Islam, president of the DSE Brokers Association (DBA).

"Stock investors are already victims of delayed dividends and downgrades further hurt them," he said, adding, "How can a regulator take steps that punish general investors instead of those responsible for the wrongdoing?"

Islam, also a director of BRAC EPL Stock Brokerage, called for revising the directive in the interest of stock investors.

Md Ashequr Rahman, managing director of Midway Securities, said the situation would not be as dire if margin loan restrictions were not tied to the downgrades.

"Investors usually sell shares to adjust margin loans, causing prices to drop further," he explained.

He also said that low financial literacy in the country complicates the whole scenario.

Rahman also suggested limiting margin loan offerings to protect investors.

Contacted, Md Delowar Hossain, company secretary of Confidence Cement, defended the company's track record.

"For 32 years, we paid dividends within the stipulated time. This year, we were in trouble due to stagnant business conditions."

The company announced a 10 percent cash dividend while reporting earnings per share of Tk 8.73, according to the DSE.

However, Hossain said unrealised profits tied up in associated companies constrained cash flow, preventing a higher dividend.

"We completed the dividend payment on Wednesday and informed the regulator," he added.

BSEC Spokesperson Mohammad Rezaul Karim said the commission avoids frequent policy changes but would consider recommendations from a task force currently consulting stakeholders.

"The task force will provide short-, medium- and long-term measures," he said.

The BSEC has already fined directors of 10 companies for failing to pay dividends within the deadlines set by the regulator.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments