Who will actually have to pay 30 percent income tax?

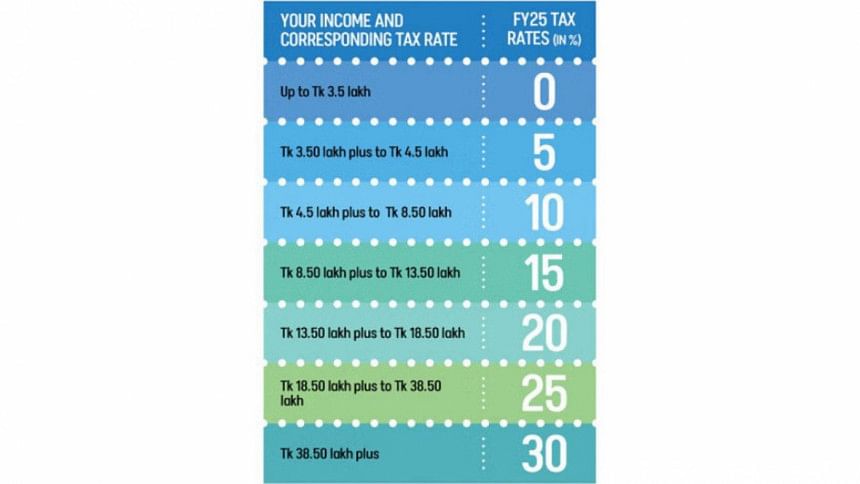

In the budget proposal on Thursday, finance minister Abul Hassan Mahmood Ali proposed that the marginal tax rate for the highest income slab would be 30 percent. While 30 percent income tax is a relatively high figure, as the tax rate for the highest income slab previously was 25 percent, it is important to consider the fact that Bangladesh has a progressive tax system, which means that in practice, most people will actually not be paying their income taxes at an effective rate of 30 percent.

What is a progressive tax system? Well, it means that the income tax rate climbs up as the income increases. But that still doesn't mean that the raised income tax rate will apply for the entirety of someone's income.

In this year's budget, it has been proposed that the first Tk 3,50,000 income any individual makes will be tax free. For the next Tk 1,00,000 that they make, the tax rate will be five percent. It will be 10 percent for the next Tk 4,00,000, 15 percent for the next Tk 5,00,000, 20 percent for the next Tk 5,00,000, 25 percent for the next Tk 20,00,000, and finally, 30 percent for whatever a person makes beyond this.

How does one make sense of all of this?

The best way to think about this is to think of one's entire income not as one whole, but as a collection of progressively more taxable chunks of money. The sizes of these chunks should follow the tax slabs given in the budget proposal. Let's consider an example.

It is clear that no tax has to be paid by a person who makes under Tk 3,50,000 in a year. But if a person makes Tk 4,00,000, then what?

From the budget proposal, we can see that the proposed tax rate is five percent for the next Tk 1,00,000 after Tk 3,50,000. But that doesn't mean that a person who makes Tk 4,00,000 will have to pay five percent tax on their whole income. In reality, the five percent tax will be applicable on the Tk 50,000 they make on top of the tax-free Tk 3,50,000.

This is why it's useful to think of one's income as chunks of money that are taxed at different rates. The first Tk 3,50,000 is tax-free, and the next Tk 50,000 (which is less than the second tax slab of Tk 1,00,000) is taxed at five percent, giving a total payable tax of Tk 2,500.

This means that a person making Tk 4,00,000 will pay a total of Tk 2,500 in income tax, which means the effective tax rate comes out at 0.625 percent.

What about someone who makes Tk 7,50,000? Let's break up this person's taxable income into chunks again. The first chunk is Tk 3,50,000, which is tax free. The next chunk is Tk 1,00,000, which is taxed at five percent. And the rest, Tk 3,00,000, will fall in the next tax slab, with an income tax rate of ten percent.

The first chunk of Tk 3,50,000 will be tax free. The next Tk 1,00,000 will be taxed at five percent, meaning the tax for this chunk of money is Tk 5,000. The remaining Tk 3,00,000, which falls under the next tax slab of Tk 4,00,000, is taxed at 10 percent, giving us Tk 30,000 tax on this last chunk. Our imaginary salary-man's total payable income tax will be a total of Tk 35,000, on his total income of Tk 7,50,000. This gives us an effective tax rate of 4.67 percent.

Hopefully, readers know by now how this works. To actually see if anyone is going to pay this 30 percent income tax, let's consider a successful professional who makes Tk 50,00,000 every year.

The first chunk of Tk 3,50,000 is tax-free once again. The next chunk of Tk 1,00,000 is taxed at five percent, giving a tax amount of Tk 5,000. The next Tk 4,00,000 is taxed at 10 percent, giving Tk 40,000 of tax. The Tk 5,00,000 after that gives 15 percent or Tk 75,000 of income tax. The next chunk, another Tk 5,00,000, gives 20 percent or Tk 1,00,000 as tax. The chunk after this is worth Tk 20,00,000, and this is taxed at 25 percent, for yet another tax amount Tk 5,00,000. The remaining Tk 11,50,000 is taxed at 30 percent, giving a tax amount of Tk 3,45,000.

So, a person making Tk 50,00,000 pays a total tax amount of Tk 10,65,000 (the sum of taxes for all the chunks calculated above). His effective tax rate comes out at 21.3 percent.

The progressive tax rate is designed to make people contribute more to the running of the country as they make more income, as a flat rate may discourage them from making more money. However, the concept can get a bit complicated, inducing panic in people who think all their hard-earned money is going away in taxes. Understanding it better can make the panic a tad bit more bearable.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments