Trade protection and job creation

The global debate over trade protection has gained momentum in the aftermath of the US national elections where populist candidate Donald Trump won the presidential elections promising the use of trade protection to create jobs. Although the case for free trade is contentious at both the theoretical and the empirical level, there is a broad agreement that large trade protection, unless offset by strong dynamic production gains from the protected industries, tends to lower national welfare by taxing consumers and reducing potential gains from production efficiency and expansion of export industries. In the case of Bangladesh, evidence shows that large trade protection from the early days of independence did not benefit industrial development and growth. Instead, trade liberalisation from 1980-2000 along with investment deregulation and better macroeconomic management boosted private investment, exports, manufacturing and GDP growth.

Trade policy reforms have taken a back seat since the early 2000s and nominal protection rate remains large. Even as customs duties have come down, the protection effects have been preserved by the introduction of a large range of supplementary duties (SD) and regulatory duties (RD). Indeed, these para-tariffs (SDs and RDs) now account for almost 50 percent of the nominal protection. The protection effects in many instances are unintended. The primary motive for the para tariff is revenue generation and these are imposed by the National Board of Revenue (NBR) without consultation with the commerce ministry who has the institutional responsibility for trade policy. The para tariffs are reviewed every year and changed as per the needs of revenue generation mainly without regards to the implications for trade protection and resource allocation, with few exceptions.

This randomness of the para-tariff regime is further illustrated by the examples of effective rates of protection (ERP) that were calculated based on a sample survey of 200 manufacturing enterprises in 2012. The ERP rates ranged from zero for export products to 483 percent for certain type of plastic products. There is wide dispersion in ERPs by sub-sectors and within sub-sectors. The large range of ERPs reflects the ad-hoc nature of the trade regime as far as incentives for production are concerned. What is clear, however, is that these ERPs provide a serious anti-export bias.

Despite the lack of evidence in support of trade protection, it continues to persist. What explains this persistence? Apart from the political economy aspects, the most used argument is that trade protection supports domestic workers by protecting their jobs from import competition. There are two problems with this argument. First, trade protection may support job creation in the protected sectors but it creates a serious anti-export bias that hurts job creation in the export industries. Second, on balance, what is the evidence that trade protection creates jobs faster than through a neutral trade regime that does not discriminate against export industries?

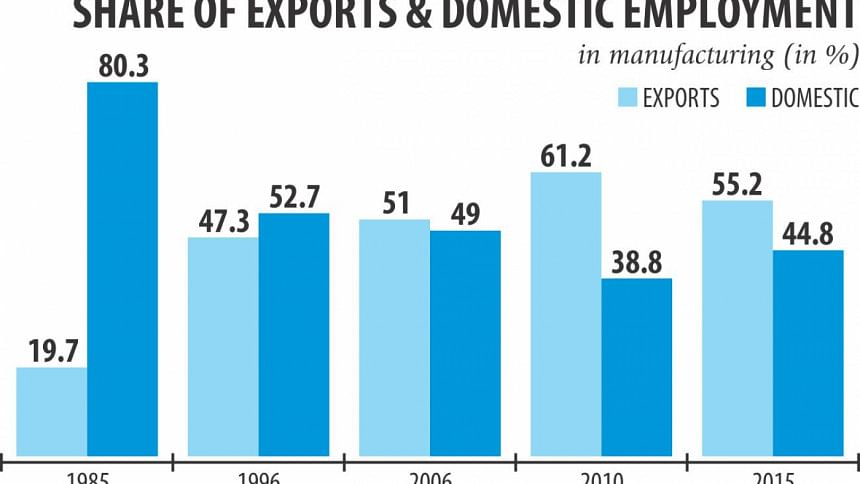

This article seeks to provide some insight into this debate by using available employment data from the various labour force surveys (1985 to 2015-16), the Survey of Manufacturing Industries 2012 and the BGMEA database on garment employment. The available data is grouped into three categories: total manufacturing employment; employment in manufactured export industries and employment in domestic-demand oriented manufacturing enterprises. The summary of the research is reported in the graph.

The results are very striking. In the mid-1980s, before the advent of the apparel revolution, the manufacturing sector was small, accounting for 11 percent of GDP and creating only 2.3 million jobs. The bulk of manufacturing employment (80 percent) was in domestic demand oriented manufacturing enterprises. Exports were negligible and created few jobs.

The trade and investment deregulation reforms of the 1980-2000 periods sharply changed the picture. Private investment and the apparel revolution took charge. By 2006 the GDP share of manufacturing had grown to 15 percent, boosted mainly by garment exports. Apparel was the dynamic source of employment, creating some 2.1 million new jobs between 1985 and 2006 as compared with 0.7 million additional jobs in the domestic demand oriented manufacturing enterprises. Combined with other export-oriented manufacturing enterprises, the share of manufactured export jobs increased dramatically from a mere 20 percent in 1985 to 51 percent in 2006.

This progress with contribution to value-added and job creation intensified further and by 2010, the export sectors accounted for an estimated 61 percent of total manufacturing jobs in Bangladesh. The share of domestic demand oriented manufacturing enterprises dwindled to 39 percent in 2010 as compared with 80 percent in 1985. The debacle it faced in job creation as compared with the export-oriented apparel sector is obvious.

More recently, the garment sector is facing some structural challenges as well as slowdown in global demand that has hurt its growth prospects. Compliance with employment and safety standards has caused greater capital intensity and closure of many garment enterprises. Together these have taken a toll on apparel employment that has remained unchanged at around 4 million since 2013. The anti-export bias of trade policy and the sharp appreciation of the taka in real terms against all major currencies including the US dollar, the euro and the Indian rupee have combined to hurt the export industries in general.

Some of the employment slack has been taken up by domestic-demand oriented enterprises. As a result, the employment share of domestic-demand oriented manufacturing enterprises has grown in the recent years, up from 39 percent to 45 percent. But this is more due to the stagnation of apparel employment growth rather than any evidence of growing dynamism of the domestic-demand oriented sector. Overall, even after allowing for the recent stagnation in apparel employment, the long-term employment growth in export-oriented manufacturing between 1991 and 2015 has been 7.1 percent per year as compared with only 2.2 percent in domestic-demand-oriented manufacturing.

The reason for this is pretty straight forward and in accordance with modern trade theory of comparative advantage as expounded by Nobel-prize winning economist Bertil Ohlin and his teacher Eli Heckscher (known as the Heckscher-Ohlin theorem). According to the Heckscher-Ohlin theorem, a country will export commodities that use relatively more intensely its abundant factor of production and import those commodities that use the relatively scarce factor. It is well known that Bangladesh has abundant labour supply but capital is scarce. Hence by concentrating on exports, it has succeeded in creating more jobs in export-oriented manufacturing (mainly apparel) than the import substitutes that are relatively more capital intensive.

The way forward for job creation strategy is obvious. Policy should focus much more on promoting export-oriented manufacturing by correcting the anti-export bias of trade policy and by eliminating the appreciation of the real exchange rate. Other policies concern the need to reduce the cost of production by reducing the cost of doing business, improving infrastructure and addressing the land constraint. But they apply equally to both export and domestic-oriented production.These reforms will help diversify the export base and boost other non-apparel exports such as leather, footwear, processed foods and electronics. Growth of these exports will create jobs at a much faster pace than domestic-demand oriented enterprises.

Sadiq Ahmed is vice chairman of the Policy Research Institute of Bangladesh. He can be reached at [email protected].

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments