A cushy scheme for loan defaulters

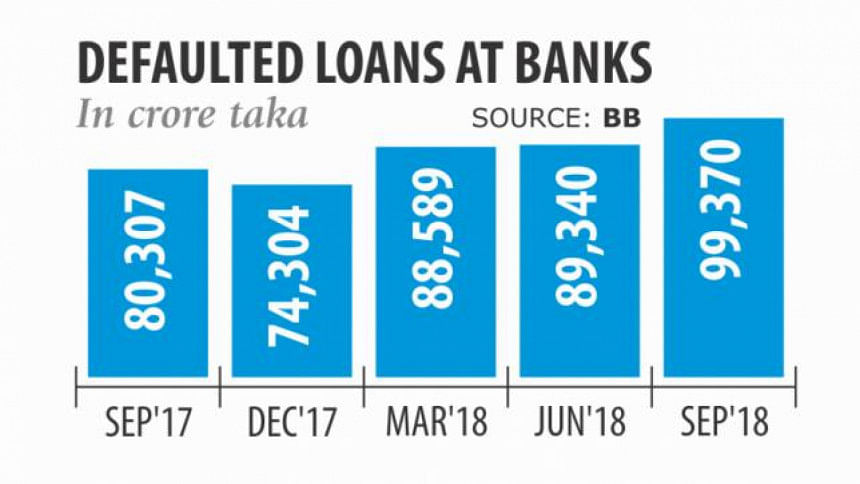

That the banking sector in this country is plagued by a culture of loan defaulting is not lost on anyone—as of last year, the total amount of defaulted loans stood at Tk 93,911 crore. The question is, what measures would be appropriate to curb this problem: bailout or stricter governance? We reported on March 18 that the Bangladesh Bank is considering a proposal for allowing easy rescheduling of defaulted loans on very generous terms. Experts have been of the opinion that rather than addressing the problem, this could further weaken the already ailing sector. And given past experience, we cannot but agree.

A similar scheme from four years ago yielded no results. So, we fail to see how allowing 13-15 years for repayment of defaulted loans—with a grace period of two years, and reducing down payment a significant amount—actually helps anything. We have seen recent reports of how the Basic Bank has been operating at a loss while, at the same time, restructuring large amounts of loans. There are of course valid grounds on which loans are defaulted, but allowing loan structuring on as vague a ground as being "adversely affected by internal and external economic factors" can only further make defaulting into a habit. It shows that the central bank is willing to go to great lengths to appease defaulters, even when similar schemes have failed in the past.

Economists and former officials are clear in their stance that what the sector needs is stricter governance and enforcement. Political clout has been alleged to influence decisions, and defaulters are almost certain of not having to pay back their loans. In this context, we would urge that this proposal be seriously reconsidered and stricter measures be taken to recover loans from chronic defaulters. Further weakening banking governance can in no way be the solution.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments