All set for mega oil refinery

Bashundhara Group is set to build the country's largest oil refinery plant in Chittagong, which is expected to meet about 80 percent of the national demand for refined oil.

Bashundhara Oil and Gas Company Limited, an affiliate of the local conglomerate, will construct the plant on 220 acres land near the seashore at Sitakunda in the port city. The land is owned by Bashundhara.

The construction is expected to start in July this year and complete by July 2022. The plant will produce liquefied petroleum gas (LPG), diesel, petrol, furnace oil and aviation fuel (Jet A-1).

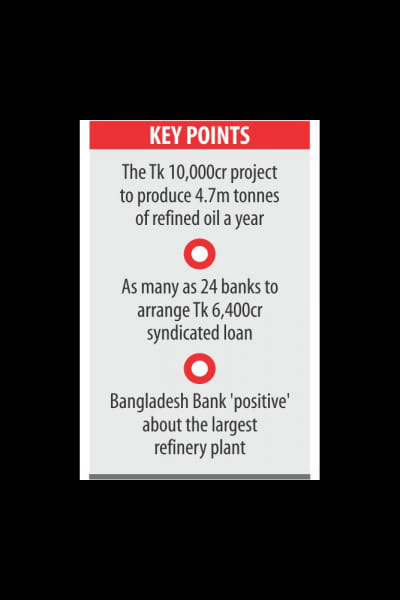

The project will require an investment of Tk 10,000 crore and create about 700 jobs.

Of the investment, 64 percent or Tk 6,400 crore will come from the banking sector. The rest will be arranged by the Group in the form of equity investment, according to project documents.

Led by Bank Asia, as many as 24 public and private banks are now working to arrange the funds through syndicated loan.

This is the largest syndicated loan arrangement in the banking sector. The loan will be repaid in 11 years, project documents show.

Before this, the highest syndicated loan was Tk 1,200 crore, given to GPH Ispat Ltd, a steel manufacturer.

Currently, Bashundhara has bank loans of Tk 4,000 crore and the syndicated loan will take its total loan to Tk 10,000 crore.

Of the expected bank financing, Tk 3,300 crore has already been approved by nine private banks. Bank Asia sanctioned Tk 500 crore.

Over the last few months, seven private banks have made policy decisions to finance the project. Another eight public and private banks are considering the proposal.

Three state banks -- Agrani, Sonali and Janata -- are expected to lend Tk 1,500 crore. Islami Bank, the largest private bank in the country, may sanction Tk 1,500 crore, according to project documents.

A number of banks have sought approval from Bangladesh Bank for financing beyond the limit set for a single borrower (15 percent of the bank's capital).

A senior official of the BB said they were positive about the project.

The BB also asked Bank Asia, the lead bank of the project, to send the proposal of all banks together for approval, the official told The Daily Star.

Mohammad Shams-Ul Islam, managing director of Agrani Bank, acknowledged that the project would lead to a loan concentration.

But the risk is not that high as the government will be one of its customers, he said.

Project documents show Bashundhara will sell its products to state-run Bangladesh Petroleum Corporation (BPC) as well as to other local buyers.

Once in operation, the plant will refine 1 lakh barrels of crude oil per day whereas Eastern Refinery Limited, the only refinery company in the public sector, refines 33,000 barrels, according to a feasibility study report prepared by Bank Asia.

The plant is expected to produce 4.7 million tonnes of petroleum oil every year against the existing local demand for 5.89 million tonnes.

Of the demand, only 1.2 to 1.3 million tonnes come from local sources and the rest is imported.

A 2016 estimate by the Japan International Cooperation Agency shows the demand for refined fuel in Bangladesh will rise by six times to above 30 million tonnes by 2041.

Bashundhara has been planning to set up the plant for the last two years and approached various banks for financing four months ago, said Mohammed Belayet Hossain, senior deputy managing director of the Group.

“Banks have responded positively about financing and the construction of the plant will start in due time,” he said.

Currently, the Group's asset is worth around Tk 50,000 crore, he said.

The business group has signed an Engineering, Procurement and Construction contract with PROKOP ENGINEERING Brno of Czech Republic. The company, founded in 1990, is an expert in the construction of industrial plants, especially in the fields of processing crude oil and oil products and gas processing.

In the South Asian region, India can meet its own demand and even exports its surplus production of refined oil.

In 2016, Pakistan and Sri Lanka produced 40 percent and 30 percent of their demand for refined oil, according to the project documents.

In the same year, Bangladesh produced only 20 percent of its demand and imported the rest.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments