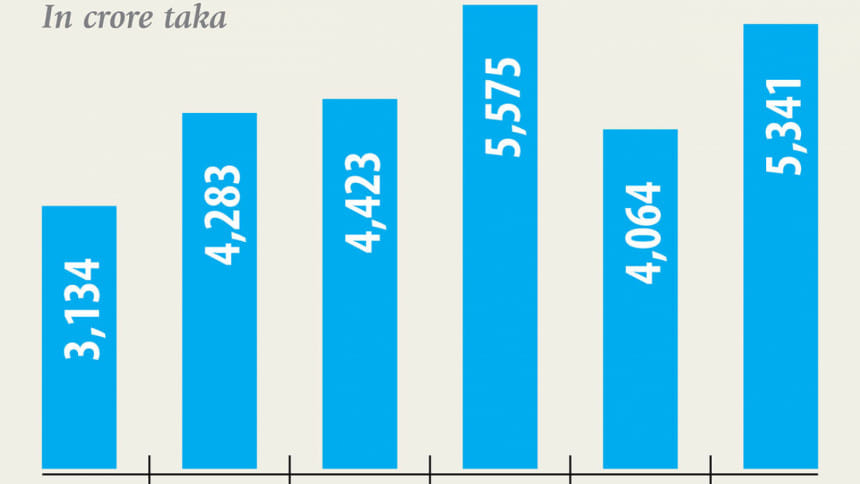

Swiss Banks: Bangladeshis’ deposits rise to Tk 5,341cr

Bangladeshis’ deposits in Swiss banks increased by 28.33 percent year-on-year in 2018 to 617.72 million Swiss francs or Tk 5,341 crore, according to the Swiss National Bank (SNB).

Experts said the deposit rate increased amid uncertainties over the general election held in December last year.

The SNB revealed the data in its annual report, titled “Banks in Switzerland 2018”, published yesterday. The report, however, did not shed any light on the alleged black money held by Bangladeshis.

Bangladeshi nationals’ deposits in the banks had dropped 27 percent year-on-year in 2017 to 481.32 million Swiss francs or Tk 4,064 crore. The amount was Tk 5,575 crore in 2016 and Tk 4,423 crore in 2015, according to the report.

Contacted over phone, Khondkar Ibrahim Khaled, a noted banker and a former deputy governor of Bangladesh Bank, told The Daily Star that deposits in Swiss banks usually increase mainly in two situations: when the rate of money laundering from Bangladesh goes up and when non-resident Bangladeshis, including businessmen, deposit money in those banks.

Khaled said many people may have transferred money from Bangladesh to Swiss banks fearing uncertainty centring the general election.

Ahsan H Mansur, executive director of the Policy Research Institute (PRI), echoed his views and said, “It is because of the election last year. A huge amount of money has been taken away from Bangladesh through over invoicing.”

The transfer of money is evident in the import trends of this year and last year.

Last year, import surged, while this year it collapsed, he said. Such kind of trend indicates that money has been taken away from the country, he said.

Usually, illegal earnings are deposited in the Swiss banks, although a few non-resident Bangladeshis could have also deposited money in the Swiss banks, he said.

The untaxed money is also kept in the banks, Mansur added.

Contacted, a Bangladesh Bank official said Bangladeshi nationals’ deposited money Swiss banks, but it did not mean the money was sent there from here or those were illegally earned or laundered.

Bangladeshis living abroad also keep their money in Swiss banks, said the official, wishing not to be named.

Bangladeshi businesspeople, who make transactions with firms or individuals in European countries for business purposes, may have also kept money in Swiss banks, added the official.

Over the last several decades, Switzerland has provided wealthy families around the globe with a convenient and safe place to stash their money.

The country’s political neutrality, stability and tradition of bank secrecy have kept their fortunes beyond the reach of national governments and even the most determined tax collectors.

Offshore accounts are not illegal, but many people use those to hide cash from the tax authorities, say experts.

Swiss banks have come under global pressure in recent times, as a number of countries, including India, are stepping up efforts to crack down on black money. A Europe-led clampdown has also been launched on tax evasion and corruption.

Experts, however, say data from the Global Financial Integrity (GFI), a Washington-based research organisation, gives a comprehensive picture about money laundered out of a country.

Bangladesh lost between $6 billion and $9 billion to illegal money outflows in 2014, according to a GFI report, published in 2017. The GFI also published its latest report in January this year which said some $5.9 billion was siphoned out of Bangladesh in 2015 through trade misinvoicing.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments