VAT rate may be cut to flat 12pc

The government is likely to set a flat 12 percent VAT rate by amending the new VAT law in the face of demands from various quarters, according to finance ministry officials.

Businesses have been reasoning that the proposal of a uniform 15 percent VAT would be too high for consumers.

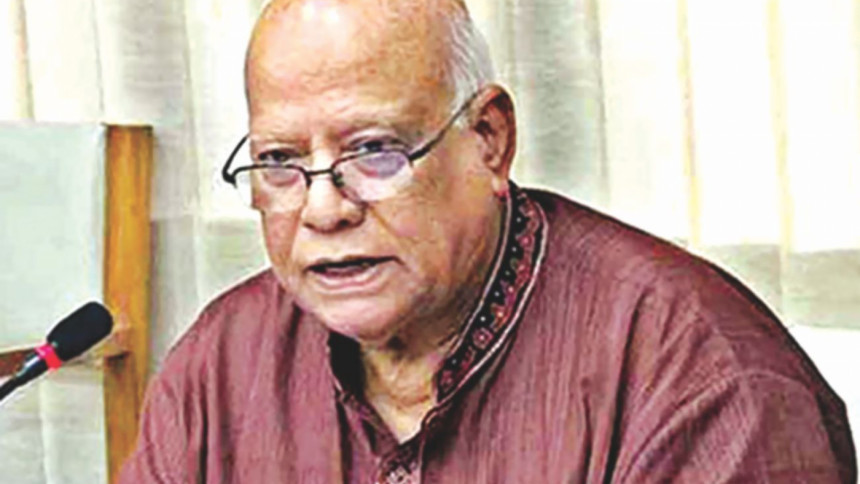

Finance Minister AMA Muhith is likely to unveil the rate when he proposes the budget for the fiscal 2017-18.

“You can say [it is a] revision in the law. Because I have already said that attempts will be made to give some relief,” he told journalists yesterday after inaugurating the VAT Online Mobile Help Desk in front of the National Board of Revenue headquarters.

However, the finance minister did not specify what the new VAT rate would be.

Muhith softened his stance on the new VAT rate after a heated debate between him and members of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) over the issue at a meeting last month.

Following the development, steps were taken to cut the 15 percent VAT rate. A proposal for amending the VAT law might be placed in the cabinet soon, said insiders.

At a discussion on May 2, Muhith said, “We will give you a more comfortable rate.”

There have been concerns among businesses over the uniform 15 percent VAT rate. They fear that if the VAT rate was implemented, living costs would rise.

Framed at the prescription of the International Monetary Fund, the new law envisages a flat 15 percent value-added tax, replacing the existing disparate VAT rates.

The government is going to frame the new legislation two and a half decades after the introduction of the VAT, which accounted for 35 percent of NBR's annual revenue collection of Tk 1,55,518 crore in the fiscal 2015-16.

The new law, which will be implemented through automation, is expected to bring transparency and accountability in VAT administration and raise revenue collection through increased compliance.

Businesses, particularly the FBCCI, however, said it would be tough for many small and medium enterprises to comply with the law and collect 15 percent VAT from consumers.

The apex trade body for the last two years has been demanding multiple VAT rates and increased protection for domestic industries and small and medium enterprises. Some economists also said the rate was high and recommended lowering it.

Muhith was unwilling to reduce the VAT rate from 15 percent under the new law. At a meeting of IMF in Washington last month, he said 15 percent VAT would be imposed, and a revision might be considered two years into the implementation of the law.

A finance ministry official said a decision on the changes in the VAT rate would be made in a couple of days when Muhith meets Prime Minister Sheikh Hasina.

Stringent measures would be taken to stop VAT evasion to recoup the revenue loss stemming from the probable amendment. The government would provide 10,000 Electronic Cash Registers (ECRs) to retailers at the purchase price to ensure that VAT paid by consumers goes to the exchequer, said finance ministry officials.

During his stay in Washington last month, Muhith told The Daily Star that relaxation would be given in three specific points.

Under the new law, the VAT-exempted annual turnover might be increased to Tk 35 lakh or more from the present Tk 30 lakh. Businesses, registering turnovers from Tk 30 lakh to Tk 80 lakh a year, now pay a 3 percent turnover tax. Here, the upper threshold of Tk 80 lakh might be increased to somewhere between Tk 1 crore and Tk 1.20 crore, said officials of the ministry and the NBR.

There would be a big change in supplementary duty. All supplementary duty would be withdrawn except the one for protecting local industries.

The number of products that will face supplementary duty in imports is likely to rise from 170 to nearly 500. The step would be taken to please entrepreneurs and protect domestic industries from stiff competition from imported products.

The government also plans to expand the list of VAT-exempted items to ease the burden on consumers.

A list of VAT exempted products and services are being prepared by the NBR. VAT might not be imposed on edible oil and iron rods, said a senior official.

Officials said the new law waives VAT on basic food, life-saving drugs, agricultural products, medical services and healthcare; newspaper printing, publication and distribution; and education.

The number of goods and services to remain free from VAT may rise to 1,200 in the new law, said officials.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments