Heads Adani wins, tails Bangladesh loses

Gain is for Gautam Adani and loss for Bangladesh: that is how the electricity purchase deal with the Indian business tycoon may turn out to be.

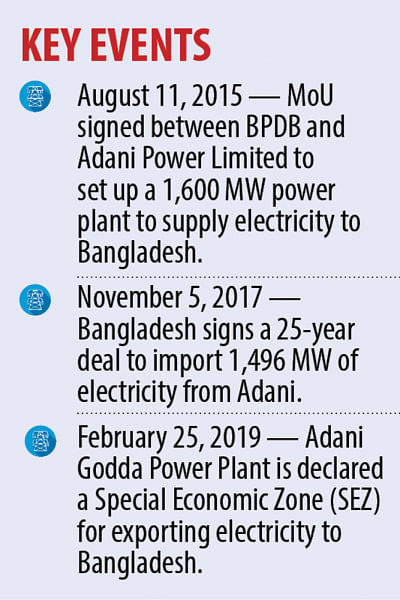

Now at the centre of a scandal over stock market manipulation and fraud that, within a few weeks, contributed to an epic fall from the position of Asia's richest person, Adani has literally taken Bangladesh for a fortune-ride through the controversial deal. Though officially still kept under tight wraps, the agreement has lately been published by a news portal and a number of whistleblowers in public interest.

"This appears to be the most expensive, lopsided contract to replenish the pockets of the ex-richest man in Asia, at the expense of the people in Bangladesh," Tim Buckley, a Sydney-based energy expert with 30 years of expertise in the field, told The Daily Star over the phone recently.

Knowingly or unknowingly, Bangladesh Power Development Board (BPDB) rushed to sign a deal that only allows Adani Power to mint money at every single phase, from coal purchase to electricity export. The document, in essence, lays bare how Bangladesh is forced to stay in the agreement even if Adani breaches the contract, according to the experts who analysed a copy of the deal obtained by The Daily Star.

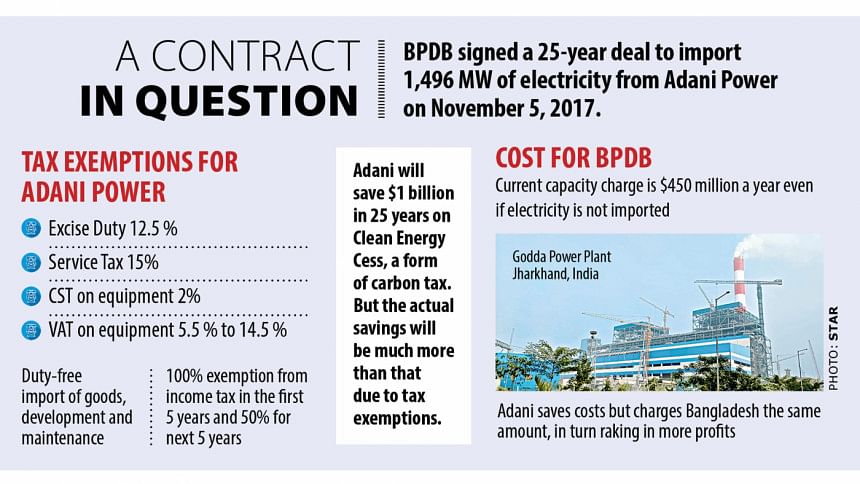

For the next 25 years, Bangladesh will partially bear what was initially thought to be Adani Power's tax burden even though the Indian conglomerate got a tax exemption based on the export deal it struck with Bangladesh.

And once the plant comes into commercial operation next month, Bangladesh will start paying Adani reference tariffs based on taxes it does not even pay. In other words, the agreement has a unique design: Adani saves costs but charges Bangladesh the same amount, in turn raking more profits.

It is estimated that Adani Power will save over $1 billion on the Clean Energy Cess (a form of carbon tax) alone over the 25 years of the contract by virtue of becoming a Special Economic Zone (SEZ), according to an investigation by the Washington Post.

That's just the reduction from one type of tax. Adani enjoys myriad other tax benefits and significant cost cuts for becoming an export-oriented plant through the deal with Bangladesh.

"So, the total savings for Adani will be way over $1 billion. For example, Adani also saves around $100 to $200 million on import duties of their equipment from China but it'll charge Bangladesh for the import duties. Its profits will be hefty — to put it lightly," Buckley said.

The Indian conglomerate, however, saw no evil. When contacted, a spokesperson from Adani on February 23 said, "The tax assumptions were uncertain when the deal was signed, and we took a risk fixing the costs. So, the SEZ tax exemption is our savings, in a lump sum contract -- it is business."

Requesting anonymity for fear of reprisal, the lawyer who reviewed the power purchase agreement for this paper begged to differ. "In a fair deal favouring both sides, Adani's cut in costs from tax benefits would mean Bangladesh also gets shares of them or at least, a portion of them."

However, in another interview on February 24, another spokesperson for Adani, said, "Since the Godda project is at a designated SEZ, power consumers of Bangladesh will not have to pay for the customs duty, taxes and cess, as applicable per current norms."

Taxes and tariffs apart, Bangladesh is liable to pay roughly $450 million a year in capacity charges, even if it doesn't buy electricity from Adani due to any reason, as stated in the original terms of the contract, Buckley said.

A strong voice for the protection of natural resources, Professor Anu Muhammad thinks that it is not a deal but a gift to Adani, who is seen as the closest ally of Indian Prime Minister Narendra Modi.

"As far as unfair deals go, the Adani contract is record-breaking," he told The Daily Star.

ADANI'S POSSIBLE BREACH OF CONTRACT

When signing the deal in 2017, Adani Power included a bevy of tax assumptions into the reference tariffs that Bangladesh will have to pay. These include 12 percent excise duties, 15 percent service tax, VAT, and income tax payable in India among others.

In February 2019, Adani's Godda Power Plant became a Special Economic Zone, following amendments to guidelines that previously did not allow a stand-alone power plant to receive such benefits.

Only on the grounds of exporting electricity to Bangladesh, Adani's Godda Power Plant was declared an SEZ, according to the official documents of the Indian Ministry of Commerce and Industry.

To interpret it simply, had it not been for Bangladesh, Adani would not have received the exemption from the corporate taxes. Most of Adani's expenditure in excise duties, state goods and services tax, have been nullified by the SEZ declaration, along with a 100 percent deduction in income tax for the first five years.

A clause in the agreement, 13.d (i) stipulates that Adani must officially inform the BPDB of the change in tax assumptions within 30 days. Another clause later in the document purports to allow the BPDB to recover the redundant tax charges, but that too has legal barriers.

Almost four years after the SEZ declaration, Adani has not officially (in writing) informed the BPDB of their exact savings, said a BPDB official, seeking anonymity for sharing what is seen as "sensitive information".

As per the Contract Act 1872 of Bangladesh, Adani's concealment of information constitutes a breach of contract and renders the agreement legally void.

A previous analysis by the AdaniWatch — a non-profit project of the Bob Brown Foundation that keeps an eye on the Adani Group's misdeeds across the planet — showed the violation and questioned whether the agreement is legally void. In standard agreements, the innocent party, which is the BPDB in this case, would have two options: ask for compensation or terminate the agreement altogether.

But the contract is not legally void; an unusual clause in the agreement prevents the BPDB from rescinding it.

Section 4.2 (L) states that the BPDB may give a notice of default, in the case of, "any material breach…by the company of this agreement [Adani], having a material and adverse effect on the company's ability to perform its obligations under the agreement, that is not remedied within sixty [60] days."

This clause was not used in the power purchase agreements with Payra and Rampal, according to the documents.

Put another way, only when a breach of contract "adversely affects" Adani, the BPDB has legal grounds to leave. Hiding the amount of money it is saving from taxes does not hinder Adani's ability to produce. As such, the BPDB has no grounds to opt out of the 25-year binding contract.

Adani did inform the BPDB of the change in taxes, the Adani spokesperson told this paper. The spokesperson was requested to provide proof with the written documentation sent to the BPDB.

Adani spokesperson declined, stating the document is "business confidential". The spokesperson said, "Ask the BPDB for the list of notifications we sent during the last 5 years. If they have compiled correctly, it should be there."

"When we place the invoice, it will be clear what the cost per unit is. In our calculation, it will be the lowest in Bangladesh," claimed the Adani spokesperson.

ADANI PROFITS BY NOT SHARING TAX BENEFITS

At each turn of the deal, page after page, Gautam Adani rakes in profits — on the Carmichael coalmine (Adani's Australian mine that produces high ash, low energy coal), coal port, railway line, the power plant in Godda, and part of the transmission line that he owns.

The agreement is "cost plus plus," said Buckley. It has been designed in a manner that ensures Adani profits more and more, and Bangladesh doesn't get a piece of that cake.

Each time Adani dangled a carrot in front of the BPDB, the very next instance, it took it away.

For example, a clause in the agreement purports to reduce the capacity price when the taxes change. Clause 13.(d) (iv) states, "Following the commercial operations date, a change in assumptions resulting in a one-time charge or expenditure (or a one-time increase or decrease in a charge or expenditure) shall cause an adjustment in the Reference Capacity Price." Sounds fair?

The very facade of fairness Adani shows in clause (iv) is quickly counteracted by clause (v) that follows. It states, "The parties expressly agree that no adjustment shall be applied or paid due to a change in assumption resulting from any change in taxes… until the plant has been commissioned." This provision further shows that the adjustment will not be done when it favours the BPDB, which is the perfect example of "discrimination," said the lawyer who reviewed the agreement.

Hasan Mehedi, member secretary of the Bangladesh Working Group on External Debt (BGWED), gives an idea about logical re-adjustment in pricing.

"Adani's tax cuts should've decreased the capacity price by 12-15 percent. If we take the current exchange rate, we will pay billions of dollars in 25 years when our foreign currency reserves are depleting."

Prof Anu Muhammad agrees: "There was clearly no negotiation here. Adani dictated these terms and Bangladesh went along with it for political gains."

The lawyer said, "The misrepresentation aspect of the agreement is that Adani has created a clause that will not allow the BPDB to get any tax holiday or rebate, so they can basically overcharge the capacity price."

Adani spokesperson said, "We have to factor in our savings in a business deal. We made the power plant in Jharkhand to reduce our total cost as the value of land price was lower."

"The design of the agreement is such that if there are additional taxes imposed by the Indian government, those will not be imposed on Bangladesh. The Indian government is now taking steps to ensure that every coal-fired power plant will need to use biomass, which will hamper our efficiency but those costs won't be borne by Bangladesh," added the spokesperson.

Tim Buckley said avoiding corporate taxes has long been an avenue for Adani to reduce its costs of production and increase the profit margins. Adani has also set up multiple ways to minimise the amount of tax it pays in Australia, where it has its coal mine.

Filings in Singapore by privately-owned Adani companies show that one of them, Atulya Resources, is registered in the British Virgin Islands, a tax haven, according to an investigation by ABC's Four Corners programme.

"There is also an ability for $2 per tonne royalty to be paid off to tax a haven from the Carmichael coalmine. So if Adani is buying 7 million tonnes [of coal], then there will be $14 million flying off to some tax haven ... ," said Buckley.

WHY DID BANGLADESH SIGN THIS DEAL?

Once US investment research firm Hindenburg blasted Adani Group's brazen stock manipulation and accounting schemes, the alarm bells started ringing in Bangladesh.

Experts in Bangladesh, who previously raised serious concerns regarding the deal, are now questioning why the nation, which has excess power generation capacity, got on board with Adani.

When Hasan Mehedi co-authored an article with India's advocacy institution Growthwatch, Bangladeshi officials hit back saying "the report was done to ruin the relationship between Bangladesh and India".

"But our point remains and it's coming out now. This deal will be disastrous for Bangladesh," Mehedi said.

"The same officials who signed previous agreements with foreign power plants, okayed Adani's agreement, knowing fully well that it does not favour Bangladesh."

A source in the BPDB, requesting anonymity, said, "We didn't get too much time to go through this agreement which was examined by the Power Division itself."

Contacted on many occasions, the Power Division declined to comment on the matter.

The BPDB chairman was contacted but he refused to comment.

Nasrul Hamid, the state minister for power, energy and mineral resources, responded to a phone call on February 25 but did not respond to specific questions.

As per his request, The Daily Star sent him further questions over WhatsApp but he was yet to respond to those when this report was published.

IS THERE A WAY OUT?

Regarding ways out, Section 19.4 of the power purchase agreement states that any dispute that is not resolved shall finally be settled in accordance with the Rules of Arbitration of the Singapore International Arbitration Centre, 2016, 6th Edition.

The BPDB could ideally take the agreement to arbitration in Singapore for termination, the lawyer told The Daily Star.

Anu Muhammad said, "The public will bear the cost of this expensive contract. We can argue against the deal for it being agreed upon without considering the public interest of Bangladesh."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments