VAT shock in the middle of the fiscal year

The National Board of Revenue went ahead with its plan to hike value-added tax and supplementary duty on goods and services despite widespread concerns that the move will stoke inflation and slow down economic activities.

Yesterday, it issued the notification for the new rates of VAT and SD on nearly 100 goods and services. The new rates will take effect today.

The hike in VAT and tax in the middle of the fiscal year is unprecedented, said SM Nazer Hossain, vice-president of the Consumers Association of Bangladesh.

Although Finance Adviser Salehuddin Ahmed on January 2 said the VAT and SD hike would not fuel inflation as the items account for an insignificant part of the basket for consumer price index, the NBR notification indicates a host of goods and services that are used widely in day-to-day life such as mobile phone and broadband internet use, LP gas, spectacles and clothes.

"People are already grappling with high inflation, and this move will only add to their burden," Hossain said.

The VAT and SD increase aligns with the recommendations of the International Monetary Fund as part of a $4.7 billion loan it approved for Bangladesh in January last year.

The IMF advised the government to rationalise tax exemptions, improve compliance with laws and bring about reforms in tax measures to bolster domestic revenue collection in Bangladesh, which has one of the lowest tax-to-GDP ratios in the world.

The hike in indirect taxes comes as overall revenue collection fell by 2.62 percent in the first five months of the fiscal year, increasing pressure on the government to borrow from domestic and foreign sources.

"If the government aims to increase revenue, it should prioritise curbing tax evasion. That would eliminate the need for such measures and prevent further public suffering," Hossain said.

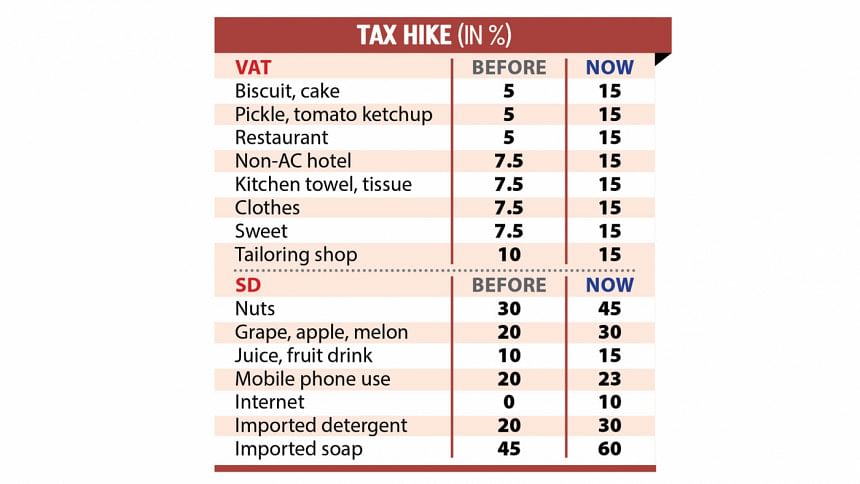

From today, consumers will be required to pay up to 15 percent VAT on restaurant bills, biscuits, cakes, pickles, tomato sauce, clothes, tailoring, toilet paper, napkin, towel, sweets, driving licence, non-AC hotel, spectacles, sunglasses, motor workshop and lubricant oil. Previously, the VAT was as low as 5 percent.

The VAT on certain industrial items such as electric transformer, electric pole and steel products such as cold rolled coil, limestone and dolomite, was also hiked to 15 percent from 5 percent.

People are also expected to pay more for medicine as the tax collector raised VAT at the trading stage to 7.5 percent from 5 percent.

The cost of printing, cinema ticket, repair and servicing and cleaning services will also rise because of a VAT hike to 15 percent from 10 percent.

The cost of mobile phone and internet services will rise as well. The NBR increased SD on mobile phone use to 23 percent from 20 percent. Now, mobile phone users will face over 42.45 percent in SD, VAT and surcharge, up from 39 percent.

Broadband internet users will face a 10 percent SD, which is likely to push up internet bills.

"This will have a detrimental impact. We are uncertain how we will survive with such extreme measures," said Emdadul Hoque, president of the Internet Service Provider Association of Bangladesh.

The quality of ISP services will deteriorate, he said.

"We urge the government to reconsider such actions as they will not only harm businesses but also undermine services and increase the costs for customers," he added.

The NBR increased excise duty on domestic flights from Tk 500 to Tk 700 per ticket. It raised the excise duty for travel to SAARC countries from Tk 500 to Tk 1,000.

For trips outside SAARC countries but within Asia, the excise duty has been hiked from Tk 2,000 to Tk 2,500.

The excise duty on tickets to Europe and America has been increased from Tk 3,000 to Tk 4,000.

The NBR hiked the SD on the import of certain dry and fresh fruits such as nuts and betel nuts to 45 percent from the previous 30 percent, and grapes, apples, melons, fresh fruits and juices to 30 percent from 20 percent.

Additionally, unmanufactured tobacco importers will have to pay 100 percent SD during import, up from the previous 60 percent. Imported paints, soap and detergent will also become costlier.

Consumers will also feel the pinch of increased SDs on juice, fruit drinks, and flavoured and electrolyte drinks as SD on the drinks went up by up to 30 percent.

Smoking will become costlier since the NBR hiked SD on all types of cigarettes and tobacco. Liquor served in bars will be more expensive due to an increase in SD to 30 percent from 20 percent.

At the same time, the revenue collector reduced the annual turnover limit for VAT registration for firms to Tk 50 lakh from the previous Tk 3 crore. It also cut the enlistment threshold for turnover tax limit for businesses from Tk 30 lakh to Tk 50 lakh.

The move means that a good number of businesses will come under the net of VAT, the main source of revenue, accounting for nearly 38 percent of total taxes collected by the NBR.

The indirect tax hike was necessary as the government's fiscal space has reached a critically low level, said MA Razzaque, chairman of Research and Policy Integration for Development.

"Without any improvement in revenue mobilisation, the government will have to rely on excessive borrowing, which will be difficult this year given the contractionary policy in place."

More importantly, since the interest rates are now high, the cost of borrowing for the government will be extremely high, he said.

Given the historically low revenue situation, more than one-third of the revenue was being spent on interest payments.

"And this year, the burden could be even higher. Therefore, given the tight fiscal space, the government might not be able to borrow to meet the fiscal deficit."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments