The Game Changer: How an injured athlete makes millions off the court

Athletes spend years honing their bodies and minds to compete at the highest echelons of the sport. However, it only takes a second for everything to change. From an irreparable injury to the inevitably ageing, athletes all face a moment when the game is over and they must come to terms with retirement and dwindling income.

Despite enjoying illustrious careers, and earning large incomes, there is still a recurring theme. Many athletes are not adequately prepared for retirement. Whether it be a lack of financial literacy or insufficient savings, there have been numerous accounts of sports figures falling on hard times and/or filing bankruptcy.

The struggle to survive

After earning $200 million in his professional career, basketball icon, Allen Iverson, reportedly spent a large portion of his earnings before he retired. An advisor, and friend, who witnessed Iverson's spending habits, negotiated a lifetime deal with Reebok to create a trust for Iverson worth $32 million. Iverson receives $800,000 annually, for the remainder of his life. One person's foresight and care allowed for the Hall of Fame legend to avoid a financial crisis. Unfortunately, adverse financial circumstances occur across all leagues. Sports Illustrated reported that after only two years of retirement, 78% of NFL players filed for bankruptcy and 60% of players ended up in a similar predicament after five years.

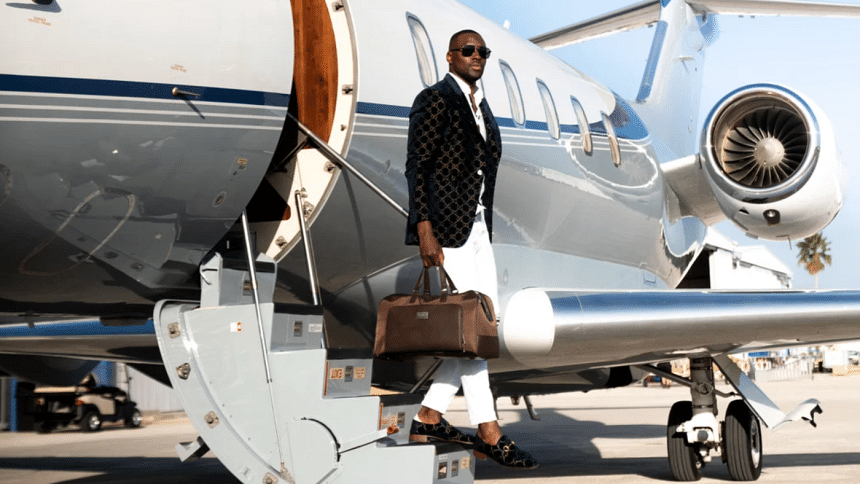

Thaddaeus Koroma, President of Limit Breakers, is a former athlete who is changing the game. After suffering a career-ending injury, he managed to pivot from his first love of basketball to establish a more profitable future as a business and investment adviser for top athletes. According to Koroma, "A sports injury ended my professional career but it became the foundation of my success today. If you've had to struggle your whole life just to survive, working hard and making the best of life is what is ingrained in you.''

When Koroma was forced to reassess his life and start over, he leveraged his network of professional athletes and A-listers to create a pathway for his peers and himself to no longer be vulnerable to losing their hard-earned wealth.

Why do sports stars get into financial trouble?

Why do athletes succumb to financial pitfalls? Athletes don't particularly follow a traditional working pattern and often have a short window of success. The average career span of an athlete ranges from 3 to 10 years. During this period, they need to manage their finances responsibly, invest for retirement, and plan for the future.

Athletes must acquire financial literacy over the course of their careers. Sports illustrated suggests that many stars don't do this. Unfortunately, most athletes either fail to plan entirely, or they leave the planning to someone else. Stories abound of stars who've been ripped off by unscrupulous 'advisors'.

Some athletes also struggle with something known as 'survivor's remorse'— a form of guilt that leads to them to overspend to support their low-income families— while others tend to live lavish and extravagant lifestyles. Regardless of the reason, if the spending patterns that are developed while playing the sport don't account for retirement, it's not long before they encounter problems.

Change the narrative

In recent years, sports stars have taken a vested interest in maintaining their wealth well into retirement. However, because of the demanding nature of professional sports, many require trusted partners in order to execute their business ventures. Before his untimely death, Kobe Bryant was well known for his numerous investments. Bryan Stibel, the investment firm that he co-founded, backed industry giants like Dell and Alibaba. Legendary tennis player, Serena Williams, also set up a venture capital firm that helps women and minorities start businesses. She diversified her portfolio by investing in areas such as fashion and health.

Whether you're a millionaire sports star or an average Joe, financial advisors preach the same message—live within your means and invest as much as you can—as early as you can. Diversify your portfolio to minimize the risk. Find a trusted professional: someone who can help you make the most of whatever you have. Then, sit back and enjoy.

Capitalize on your existing brand

Koroma's business model has based on the premise that most sports personalities have an existing brand. In many cases, that brand is their name. Their career achievements and history have brought them a level of fame and notoriety. Koroma uses this as leverage to create new business opportunities. Sometimes this involves identifying and inviting outside investors while other times, Koroma will invest himself and come alongside as a business partner.

Koroma specializes in creating a robust digital marketing strategy. He attributes success to a cohesive message that "attracts investors and creates demand for products". This is the path to creating multiple passive income streams.

Create new income streams

Koroma recognizes that there are a lot of people in the sports world who need support with wealth management. This can be done by scaling up existing businesses or by acquiring new ones and moving into different sectors. Overall, Koroma's aim is to enable his clients to earn passive income throughout their retirement.

He adds that "athletes are not the only professionals affected by the sudden loss of earnings and lack of retirement planning. Celebrities, musicians, actors, and others in the entertainment industry are equally vulnerable". Whatever the background, Koroma and his team are focused on maximizing business opportunities and generating passive income. Koroma says "At Limit Breakers, we leverage our client's current influence to facilitate business or investment opportunities; working with their team of agents, publicists and managers to secure residual income and build generational wealth for the clients."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments