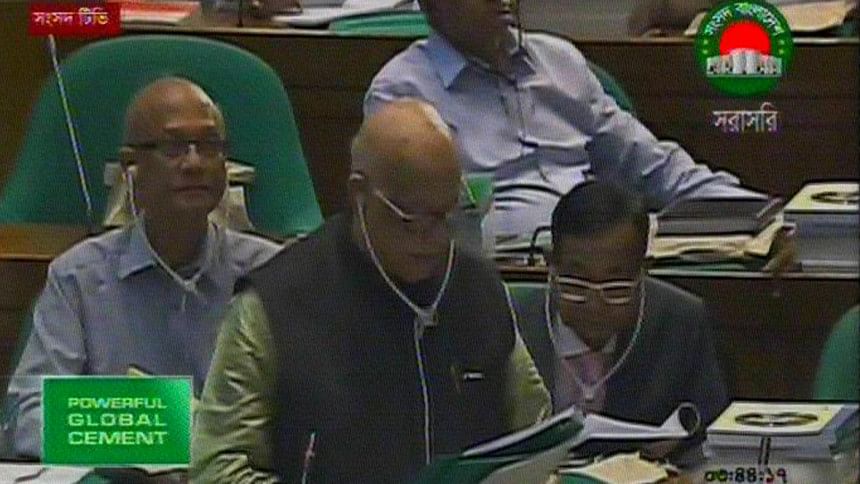

Muhith unveils national budget for FY 2016-17

Finance Minister AMA Muhith has been unveiling Tk 340,605 crore national budget for the fiscal year 2016-17.

Earlier around 3:00pm today, the cabinet has approved the national at a special meeting at the parliament complex with Prime Minister Sheikh Hasina in chair.

This will be the eighth consecutive budget placed by Muhith – what is believed to be around 29 percent bigger from the current fiscal year.

The planned Tk 340,605 crore budget for the next fiscal would be 17.4 percent of the gross domestic product. In terms of share in the GDP, the planned budget is almost the same as the budget of fiscal 2015-16.

The pattern of income and expenditure in the 2016-17 budget would be as usual. For example, as in the previous years, there would be big allocations for salaries and wages of public servants, subsidies and interest payments.

In the upcoming budget, the government is likely to set an ambitious revenue earning target. It was seen in the past that the government had to revise down the targets at the end of the year, and it still couldn't achieve the revised targets.

The overall budget deficit will be Tk. 97,853 crore which is 5.0 percent of GDP. Of the total, Tk 36,305 crore (1.9 percent of GDP) will be financed from the external sources and Tk 61,548 crore (3.1 percent of GDP) from the domestic sources.

Of domestic financing, Tk 38,938 crore (2.0 percent of GDP) will come from the banking system and Tk 22,610 crore (1.1 percent of GDP) from savings certificates and other non-banking sources.

READ MORE: Slowdown in investment: a headache for Muhith

The main focus of Muhith's eighth consecutive budget would be on speeding up implementation of some mega infrastructure projects and boosting private investment with the aim of creating more jobs.

He would project an economic growth of 7.5 percent in the coming fiscal year as the government seeks to inject life into stagnant private investment and create more jobs, say finance ministry officials.

For the last two fiscal years, the government closely monitored the progress of the fast-track projects.

This time, the finance minister would include them in a separate capital budget to demonstrate the government's emphasis on them, according to the officials.

The government's main target is to finish the construction of the Padma Bridge, the largest ever infrastructure project that would connect the country's south-western part with the capital. Once completed, it would boost economic output by up to 2 percentage points.

The Awami League-led government had pledged to complete the project in its previous term that ended in 2013.

But it was not possible as the project was delayed following the World Bank's withdrawal of financing over corruption allegation. The project was the source of a prolonged debate.

In FY 2015-16, the government allocated more than Tk 7,000 crore for the project but brought it down to Tk 3,592 crore in the revised outlay. Only Tk 892 crore was spent on the project as of March.

Of the Tk 28,000 crore estimated cost of the project, around 32 percent was spent till March this year.

Government high-ups are keen to open the much-talked-about bridge to vehicles by December 2018.

The government also wants to complete at least one unit of the Rooppur Nuclear Power project by 2018 though the deadline for its completion is 2023.

Of the total budgetary outlay, Tk 110,700 crore would be set aside for development expenditure and Tk 229,900 crore for non-development expenditure.

Salaries and allowances of government staffs, interest payment and subsidies would account for almost half of the non-development expenditure.

In the current fiscal year, the new pay scale has been partly implemented. An allocation of Tk 45,153 crore was made for salaries and allowances of public servants. The amount is 54 percent higher than that of the previous fiscal year.

In the next fiscal year, Tk 51,000 crore may be allocated for payment of salaries and allowances.

Over the last several years, the government had to spend a huge amount on subsidies.

However, the amount of subsidies has been declining after fuel prices started falling since mid-2014.

Subsides stood at Tk 25,000 crore in the original budget of FY 2015-16 but it came down to Tk 18,000 crore in the revised budget.

This time, there would be no subsidy on fuel.

However, Tk 5,500 crore would be set aside for gas subsidies. Besides, subsidies on food are going up. In total, subsidies are likely to surpass Tk 28,000 crore.

The government is going to set an ambitious revenue generation target to meet the expenditure though the country couldn't achieve its revenue targets in the last four fiscal years.

The revenue generation target may be set at Tk 242,750 crore. The National Board of Revenue would have to generate 84 percent of the targeted amount.

The NBR revenue target would be Tk 203,150 crore, 35.43 percent higher than that in the revised budget of the current fiscal year.

Of the revenue target, 36.47 percent would come from value added tax and 35.93 percent from income tax.

In FY 2015-16, the share of income tax in the revenue target was higher than that of VAT.

In the outgoing fiscal year, the government set 30 percent revenue generation growth. But it could manage a growth of only 15.91 percent as of March.

The new VAT Act is supposed to take effect from July 1 as per the government's commitment to the International Monetary Fund.

The banking sector is a major source of revenue income. In the current budget, the corporate tax on the sector was reduced by 2.5 percent. It might be withdrawn in the next budget.

Besides, the rate of tax at source for contractors -- another major source of income for the NBR -- may go up. Tax waiver given to government projects may also be withdrawn.

The government hopes tax collection would get a boost by higher economic growth.

Despite the ambitious revenue generation target, the budget deficit may be fixed at Tk 97,000 crore, which would be 5 percent of the GDP.

In case of deficit financing, the bank borrowing target would be set at Tk 38,900 crore, and another Tk 20,000 crore would be generated by selling savings instruments. The rest would come from external financing.

In the next fiscal year, the government would set aside more than Tk 40,000 crore for interest payments, up from Tk 35,000 crore in the current fiscal year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments