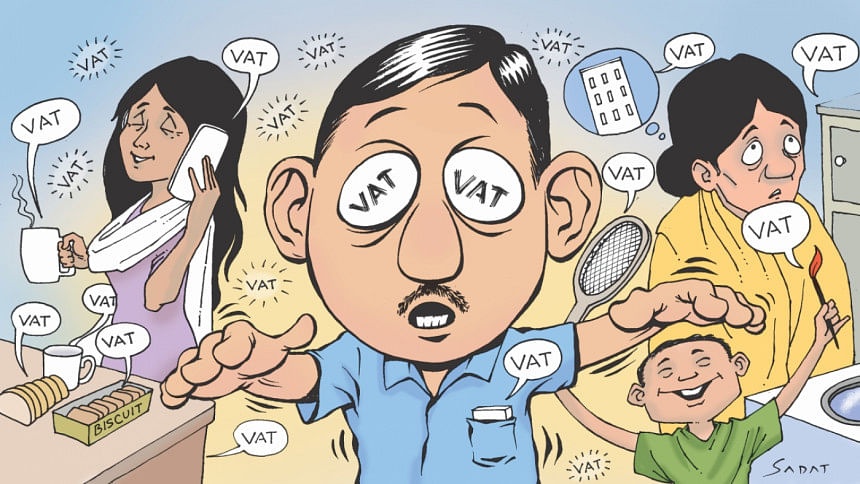

VAT to push up cost of living

The government has backtracked from its decision to roll out the new VAT law from July due to resistance from businesses and a section of revenue officials and inadequate preparation from the National Board of Revenue.

The VAT and Supplementary Duty Act 2012, which envisages a universal 15 percent VAT rate, will now take effect from July 1, 2017.

Instead of going for the new law, Muhith sought to continue collecting the indirect tax under the existing VAT law of 1991 but proposed tight measures for various sectors.

Small businesses in Dhaka and Chittagong city corporations will have to pay package VAT of Tk 28,000, instead of Tk 14,000. The rate has also been increased for shops in other city corporations and towns.

However, the existing trade VAT of 4 percent at all levels of wholesale and retail sales will remain unchanged.

The VAT rate will be 15 percent for the traders, who are willing to pay VAT on actual value addition. For them, input tax credit and adjustment facility on easy terms would be available.

Abdul Matlub Ahmad, president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), welcomed the continuation of existing VAT law and package VAT.

VAT determined by tariff value on nearly 30 products will go up, depending on the type of item. The items include corrugated iron sheet, rod, paper and tissue, a move which is likely to disappoint related industrial sectors. Prices of these items may increase.

Besides, VAT exemption benefits have been withdrawn on some items such as generator, hardboard, cake and bread worth above Tk 100, biscuits, clothes made by power looms, and plastic and rubber sandals.

“Such withdrawal will increase the prices of necessary commodities,” PricewaterhouseCoopers or PwC, a tax and consulting service provider, said in a budget analysis yesterday.

However, ambulance service, among others, has been exempted from VAT to facilitate low-cost transport of patients. Cooking oil is also going to enjoy waiver along with local textile, rubber and locally assembled refrigerator and air conditioner for the next fiscal year.

Further, services provided by a private university, private medical college and private engineering college have also been exempted from VAT, which the PwC termed a boost to education.

Despite the relief here, people may have to pay more for many other products and services. For example, operators of garages and workshops, which enjoyed truncated value-based VAT, will have to pay 10 percent VAT. Immigration advisory services will get costlier as 15 percent VAT has been imposed on the service providers.

VAT on rents of office space and installation services will also go up to 15 percent from 9 percent now.

Discretionary power of VAT authority related to input-tax credit is likely to decrease.

There is no good news for dishonest traders. Businesses seeking to appeal against the assessed amount of VAT will have to pay half of the evaded amount or penalty money slapped on them.

Muhith seeks to introduce some sections of the new VAT law in the upcoming fiscal year, such as the abolition of the present value approval system by the VAT authority.

At present, businesses have to get approval of the price of any good from the VAT office as per current VAT law.

The new law does not contain any such provision, and the finance minister wants to run with it from fiscal 2016-17.

“It would reduce the hassles of dealers, as well as litigation on valuation of goods,” said PwC.

But if taxpayers do not make a proper declaration of the price of their goods, the VAT commissioners will have the authority to look into the matter and take necessary corrective measures, if any irregularities are detected, according to the proposed measures.

Also, single registration for different business units situated on different adjoining plots under single ownership is expected to start from next fiscal in line with the new VAT law.

Online registration and online return submission will begin soon, said the finance minister.

“Unfortunately, the necessary preparation for achieving the above objective is far from satisfactory. Under the above circumstances, the government has decided not to fully implement the new act from the next financial year,” he said.

This would be the second year the government backtracked from its stance to enforce the law that will replace the VAT 1991.

The new law was enacted after a lot of deliberations, he said.

Revenue officials engaged in the automation of VAT administration said the new VAT law will require businesses to maintain books of accounts properly.

If they do this, they will be required to pay a less amount of tax than before, he said.

The new law, once implemented under an automated platform, will do away with fixed VAT or package, VAT determined on truncated base and VAT fixed at administered or tariff value.

However, the new law will boost the state's revenue collection by as much as 20 percent from Tk 32,276 crore in fiscal 2014-15, finance ministry officials said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments