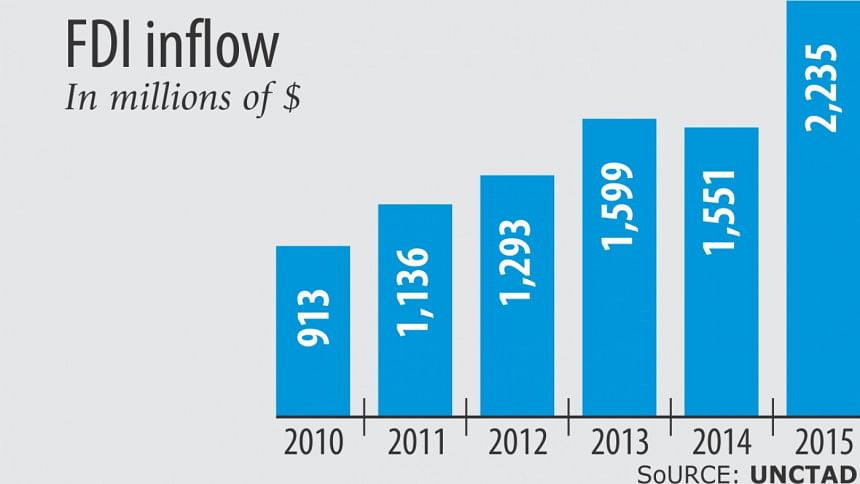

Record $2.2b FDI came last year

Bangladesh received its highest ever foreign direct investment of $2.2 billion last year with the manufacturing sector getting the bulk of the investment, according to the United Nations.

The FDI receipt was 44.1 percent higher compared to that of 2014, said the World Investment Report 2016 of the United Nations Conference on Trade and Development (UNCTAD). The report was published on its website yesterday.

In South Asia, Bangladesh is ahead of Pakistan, Sri Lanka and Nepal but trails behind India, which was the 10th largest FDI recipient country in the world in 2015. India received $44 billion.

Inflows to Pakistan and Sri Lanka declined to $865 million and $681 million respectively. In Nepal, FDI inflows rose by 74 percent to $51 million last year.

The report said FDI in the textile and garments industries remains strong in Bangladesh, so does FDI in power generation. Reinvested earnings in the country continued to rise, exceeding the value of the equity component.

Bangladesh, in fact, became the largest FDI host in the subgroup of exporters reinvesting their earnings, as flows into Cambodia fell slightly.

Adani Enterprises Ltd's investment plan involving $1,500 million and Reliance Power's $1,500 million -- both in the energy sector -- were among the 10 largest fresh projects announced in 2015.

Despite the increased flow, FDI receipt to Bangladesh remains below 1 percent of the gross domestic product.

On Saturday, Khandker Golam Moazzem, additional research director of the Centre for Policy Dialogue, said that in case of foreign investment, the share of reinvestment was going up which might ignite hope in many that the foreign investors are investing their profits in Bangladesh rather than sending them out.

“It is a good sign. But at the same time, the share of potential new investors is decreasing.”

In April this year, Zahid Hussain, lead economist of the World Bank's Dhaka office, said new investment in the form of equity was not coming.

“This is because there has not been any significant change in Bangladesh's investment scenario. The fundamental barriers that have been holding back new investment have not seen new visible improvements apart from the power sector.”

The problems with roads and highways, ports and land have remained the same, he said.

FDI outflows from Bangladesh rose slightly to $46 million last year from $44 million year ago.

This year, the UNCTAD's report looks into global financial flows against the background of stalling global growth, falling commodity prices and geopolitical tensions.

The report, titled “Investor Nationality: Policy Challenges”, said globally, the recovery in FDI was strong in 2015, with foreign direct investment flows jumping.

A surge in cross-border mergers and acquisitions (M&As) was the principal factor behind the global rebound. However, part of the growth in FDI was due to very large corporate reconfigurations by multinational enterprises, including shifting their headquarters, for strategic reasons, it said.

Regulations on the ownership and control of companies are essential in the investment regime of most countries. The report provides insights into the ownership structures of multinational enterprises, analyses national and international investment policy practices worldwide, and proposes a new framework for handling ownership issues.

Global FDI flows jumped by 38 percent to $1.76 trillion in 2015, the highest level since the global economic and financial crisis began in 2008.

“However, this growth did not translate into an equivalent expansion in productive capacity in all countries,” said Ban Ki-moon, secretary-general of the UN, in the foreword of the report.

“This is a troubling development in light of the investment needs associated with the newly adopted Sustainable Development Goals and the ambitious action envisaged in the landmark Paris Agreement on climate change.”

The United States topped the list of the countries receiving the highest amount of FDI, followed by Hong Kong, China, Ireland, the Netherlands, Switzerland, Singapore, Brazil, Canada and India.

In South Asia, thanks to rising FDI in India, total inflows to South Asia increased by about 22 percent to $50 billion, surpassing FDI into West Asia.

The report said global FDI flows are expected to decline by 10-15 percent in 2016. Over the medium term, flows are projected to resume growth in 2017 and to surpass $1.8 trillion in 2018.

Hindered by the current global and regional economic slowdown, FDI inflows to Asia are expected to decline in 2016 by about 15 percent, reverting to their 2014 level, it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments