Changing of the guard at Islami Bank

Several little-known local companies have bought the bulk of the local shares in the Islami Bank Limited over the last one and a half years, leading to the latest reshuffle at its top level, say officials of the bank.

Changes have been made to the posts of the bank's chairman, managing director, heads of various committees and chief of the Islami Bank Foundation in line with a decision at the bank's board meeting on Thursday.

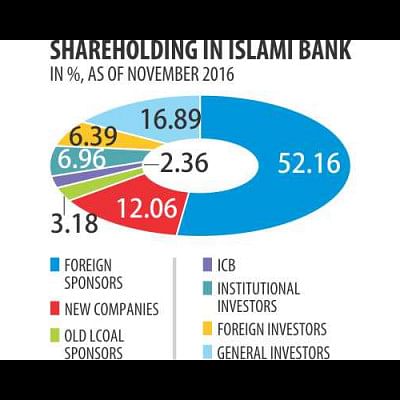

Until November last year, six companies, set up a couple of years back, had 12.06 percent local stakes in the bank, while only 3.18 percent shares were held by local sponsors, many of whom were known to be linked with the Jamaat-e-Islami, according to the officials.

Among the local sponsors, the Ibn Sina Trust, which is believed to have connections with the Jamaat, owned 2.24 percent stakes.

State-run Investment Corporation of Bangladesh had 2.36 percent shares.

Foreign sponsors had majority of the shares with 52.16 percent stakes in the bank, according to bank data.

The remaining 30 percent shares were held by general investors -- both local and foreign.

Bank officials said the stakes of the new companies would cross 14 percent once the shareholding position is updated.

The companies include Platinum Endeavours Limited, Paradise International Limited, BLU International Limited, ABC Ventures Limited, Grand Business Limited, and Excel Dyeing and Printing Limited. They held 12.06 percent local stakes in the bank till November last year.

Another new company, Armada Spinning Mills Limited, which bought more than 2 percent shares at the bank, had its representative Arastoo Khan appointed as a director of the bank in December last year.

Arastoo, a former bureaucrat, was elected chairman of the bank at Thursday's board meeting.

These new companies started buying shares in Islami Bank in 2012 and secured a strong position in it last year.

Bank officials said the companies allegedly have links with Chittagong-based business giant S Alam Group.

However, S Alam Group Chairman Saiful Alam refuted the claims.

“I have nothing to do with the changes happening at the Islami Bank,” he told The Daily Star yesterday.

The bank board on Thursday decided to appoint Md Abdul Hamid Miah, former managing director of the Union Bank, as its managing director. The appointment is subject to approval from the central bank.

Union Bank Chairman Shahidul Alam is a director of S Alam Group and brother of Saiful Alam.

The board also decided that Zahidul Quddus Mohammad Habibullah, company secretary of First Security Islami Bank, would be appointed company secretary of the Islami Bank.

Saiful Alam is the chairman of First Security Islami Bank.

Abu Reza Mohammad Yeahia, existing company secretary of the bank, has been promoted to the post of deputy managing director. Besides, three others were promoted to deputy managing directors and six to executive vice presidents.

Islami Bank officials said most of its foreign sponsors are from Saudi Arabia and Kuwait. Islamic Development Bank held 7.5 percent shares in the bank till November last year.

Though the foreign sponsors have two or three representatives in the board, they don't engage in day-to-day banking operations. They only participate in board meetings. It is the local shareholders who control the bank, said the officials.

Abunaser Md Abdus Zaher, who was selected as Islami Bank chairman in May 2013 for three years, was a representative of a local sponsor and was also a member of the Jamaat's Central Executive Council. He left the country when the government initiated the process of trying the 1971 war criminals.

Later, Mustafa Anwar, who was representing the Ibn Sina Trust, had been selected as the bank's chairman. He has been replaced by Arastoo Khan.

The bank's new board is comprised of 16 members. Seven of them come from the new companies, seven are independent directors and one each is from Saudi Arabia and the Islamic Development Bank.

Following the latest changes, the local sponsors now don't have any representative in the bank board.

Changes have also been made in the Islami Bank Foundation.

Syed Monjurul Islam, a former secretary, has been elected chairman of the Foundation, while Shamim Mohammad Afzal, director general of Islamic Foundation Bangladesh and director of Islami Bank, has been elected its vice chairman.

On different occasions, the government said the Islami Bank should rid itself of Jamaat's control.

In 2015, the finance minister requested the foreign ministry to take initiatives to free the bank from Jamaat's control. He also suggested that the ministry take help of the Bangladesh ambassador to Saudi Arabia.

Later, the foreign minister wrote to the finance minister, mentioning that the ambassador had talked to foreign sponsors who gave assurance of providing help on the matter.

“The Saudi investors in IBBL appeared positive about the above-mentioned subject, which could be considered as the expression of their solidarity and trust towards the government's policy on Jamaat. As the subject is very sensitive, it has to be dealt with proper care, so it does not create any negative attitude among related parties, particularly the foreign investors, about our initiative,” the letter read.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments