Worries there though Muhith assures

Finance Minister AMA Muhith denied that any of the tax hikes would affect the lives of the middle and lower middle class.

But, a simple analysis of his tax proposal should help clarify how much his assurance holds up.

From July 1 onward, anyone who wants to build a concrete home, either in rural or urban areas, will have to pay an extra flat 15 percent VAT on any purchases of rod and bricks.

Currently, one can buy a tonne of rod by paying Tk 900 as value added tax (VAT) and a VAT of Tk 0.22-Tk 0.32 per brick.

But in the coming months, individuals will have to pay nearly Tk 7,500 for each tonnne of rod as VAT at a price of Tk 50,000 per tonnne and more than Tk 1.0 as VAT for each piece of brick.

So if anyone wants to construct on 1,200 square feet (sft) now, using 23,000 bricks, 500 bags of cement and 5.5 tonnes of rod, they will have to pay an additional Tk 59,300 for brick and rod because of the imposition of the 15 percent VAT.

Additionally, one will be required to spend more than before to buy energy saving lamps and tube lights to light the house, pay more for furniture, plastics goods and even for electricity, all due to the imposition of a single and uniform 15 percent VAT, ending the present reduced and multiple rates applicable on more than 80 goods and 38 services.

So for a middle income family, the proposed VAT measures will squeeze their wallets harder although the finance minister maintains that the new VAT will not cause prices of goods to rise as there will be concessions to small and medium firms, and VAT exemptions to 1042 items, rising from 536 items under the currently effective VAT Act 1991.

However, many of the products, where VAT exemptions have been proposed, are not required in daily life.

Nine trade bodies led by the Federation of Bangladesh Chamber of Commerce and Industry (FBCI), in a joint statement yesterday, also raised concern that the new VAT proposals will affect consumers.

The government however, maintains that prices will not rise as businesses would be able to claim rebate, which is not given to products and services where multiple rates are applied now.

On the other hand, businesses said it will be tough for small and medium businesses to maintain accounts in line with the rules and claim rebates.

In a joint press statement by the Metropolitan Chamber of Commerce and Industry, Dhaka Chamber of Commerce and Industry including FBCCI, businesses expressed worry that application of a single and uniform 15 percent VAT might hurt small and medium industries.

Bangladesh Garment Manufacturers and Exporters Association, Bangladesh Knitwear Manufacturers and Exporters Association, Bangladesh Plastic Goods Manufacturers and Exporters Association, Bangladesh Chamber of Industries, Chittagong Chamber of Commerce and Industry and Chittagong Metropolitan Chamber of Commerce and Industry are the other trade bodies that raised concerns.

“This will impact consumers. Inflation will rise,” said the statement by the trade bodies demanding consideration of reduced rates of VAT.

“We urged the government for conducting an impact assessment by independent organisation on VAT. But no initiative has been taken. We again call upon the government for independent impact assessment,” said FBCCI President, Shafiul Islam, at a briefing on proposed budgetary measures for the fiscal year 2017-18 at the FBCCI office.

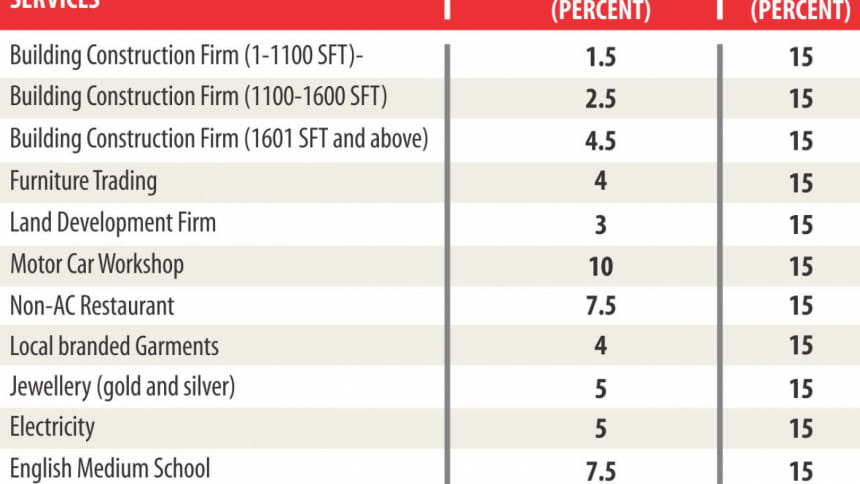

The joint statement said imposition of 15 percent VAT on jewellery, ending the reduced or truncated base value, will fuel prices of gold by Tk 700 per bhori (1 bhori= 11.64 grams). This will encourage buyers to buy gold jewellery from neighbouring countries, it added.

Currently, only 5 percent VAT is imposed on gold and silver.

In addition, people will also pay 15 percent VAT for repair and maintenance of their cars at workshop, eating at restaurants, buying apartments, paper, exercise books as well as tissue papers and above all, sending kids to English medium schools, in the coming fiscal year to help the government collect its increased revenue goal and finance an ambitious Tk 400,266 crore budget.

Low income groups will also have to pay more VAT for biscuits and bread. At yesterday's joint press meet, leading businesses warned it will not be possible to claim rebate on bread and biscuits as the raw materials of these processed foods are exempted from VAT.

So, 15 percent VAT will directly affect prices, it added.

The real estate sector, which registers sluggish businesses, will also be affected by the imposition of 15 percent VAT from the present 1.5 percent-4.5 percent, applied on flats depending on size.

Many sub-sectors are related with real estate, said the joint statement citing steel, ceramic and cement as examples. Many flats may remain unsold, it said, demanding reduced VAT rates for the sector.

SK Masadul Alam Masud, managing director of Shahriar Steel Mills Ltd, said the steel industry will be affected because of increase in prices of rod following imposition of 15 percent VAT. “Our production cost will also rise owing to increase in VAT on electricity, gas and other utility”, he added.

“The sector will be affected automatically if people cannot buy,” said Masud, also former president of Bangladesh Auto Re-Rolling and Steel Mills Association.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments