Grim year for economy

The economy has come under pressure due to the banking sector crisis, inflation and soaring imports amid inadequate export earnings and insufficient remittance inflows, the Centre for Policy Dialogue (CPD) said yesterday.

The banking sector is suffering from cronyism, the think-tank said, adding that various irregularities and embezzlement of public funds are taking place with influential people involved in it.

“We do not see any prospect of a turnaround in this sector in the next couple of months as the appetite for reforms remains low during the year ahead of elections,” CPD Executive Director Fahmida Khatun told a press briefing at the Cirdap auditorium in Dhaka.

The CPD said the stealing of public money by a handful of corrupt people and the rise in financial crimes in the country indicate that the banking sector is in dire straits.

Fahmida said economies of countries such as Indonesia and Argentina also suffered due to problems in financial sector.

“It needs to be seen if we are going in that direction,” she added.

The CPD's views come at a time when non-performing loans rose to Tk 80,307 crore between January and September last year, up from Tk 62,172 crore in December 2016, mainly due to irregularities in lending, political influence in loan sanctioning and weak corporate governance.

As a result, the financial health of some banks, namely Farmers Bank, NRB Commercial Bank and AB Bank, has recently deteriorated, creating a vulnerable situation in the entire banking sector, one of the main pillars of the economy.

Some state-run banks, including Sonali and BASIC, were also hit hard by loan scams. The government provided a total of Tk 15,705 crore to bail out the state banks from taxpayers' money between 2009 and 2017.

Currently, nine out of the 57 commercial banks in the country suffer from capital shortfall because of rising default loans, according to central bank data.

The CPD organised the event to present its review on the economic development during the first half of the fiscal 2017-18.

It said income and wealth inequality rose despite an average 6.5 percent annual economic growth between 2010 and 2016.

According to its estimate, the revenue collection in the current fiscal may fall short of target between Tk 43,000 crore and Tk 55,000 crore.

Also, the Rohingya rehabilitation expenditure, the damage from last year's flood, import of food grains by the government at higher costs and rising borrowing by the government from costly saving certificates have created a pressure on the fiscal management.

Challenges for the economy increased further in the face of inflationary pressure for higher prices of rice and other food items, rising default loans, capital shortfall in state banks, the trouble faced by some new banks and weak governance and leadership, said the CPD.

“We see various types of cracks in the macroeconomic stability,” said CPD Distinguished Fellow Debapriya Bhattacharya at the programme.

He said the year 2017 began with signs of an increase in private investment but it did not end with the same level of enthusiasm. As a result, private investment did not rise as expected despite growth of credit flow and capital machinery import.

“The macroeconomic stability has come under pressure,” he said, adding that reforms did not gain momentum either.

“The best example is the banking sector. The year 2017 will be marked as a year of scam in the sector. And at this moment, we do not see any indication that things will be any better in 2018,” said Debapriya.

He also spoke of soaring defaulted loans and shortfall in provision against defaulted loans by some banks, repicapitalisation of state banks with taxpayers' money, concentration of loans to a handful of persons, transfer of ownership through administrative measures and poor performance of new banks.

“And we now see siphoning off funds through private banks. But the government, instead of taking measures against these problems, increased family control on banks,” he said, citing the government move to extend the tenure of directors in the board and increase the number of director from a single family.

The potentials of the economy could not be exploited due to the weakness in economic management, he said.

“We have also seen weakness in the decision-making process of the finance ministry. We have seen that finance ministry could not make decisions related to economy on its own. We have seen in many cases they [finance ministry] have implemented decisions that came from top even though those were not rational from economic point of view.”

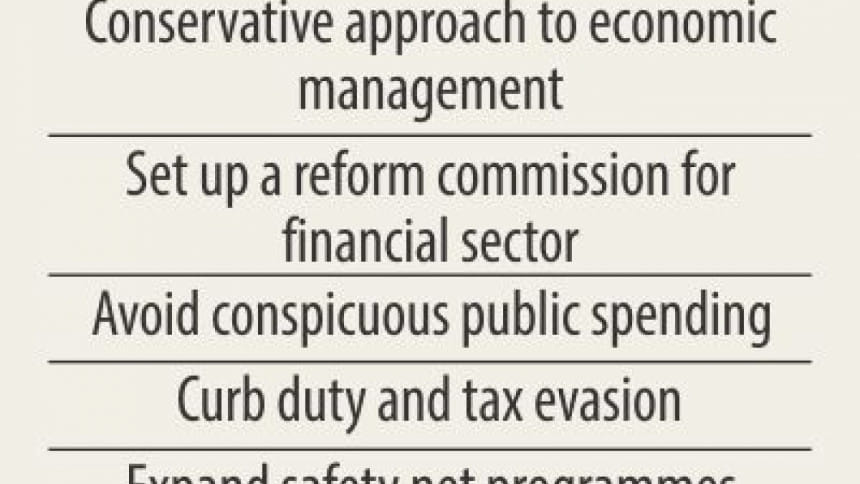

Under the circumstances, the CPD recommended a conservative approach to the economic management by curbing private sector credit flow, controlling inflation and increasing collection of income tax.

CPD Distinguished Fellow Mustafizur Rahman said foreign exchange reserve may come under pressure due to an increasing deficit in current accounts.

“We also need to analyse the quality of growth,” he said.

CPD Research Fellow Towfiqul Islam Khan, who presented the report, said the rate of job growth and poverty reduction in 2010-2016 was slower than in 2005-2010. Also, the pace of poverty reduction has not been equal throughout the country.

The income of the bottom five percent of the population dropped 60 percent in 2016 compared with 2010. By contrast, the income of the top 5 percent rose 57 percent during the same period, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments