No cheers in tax measures

Every year when the budget is placed in the parliament, Taufiq Hasan, a 35-year-old private sector employee, gets all worked up about which products and services he would have to pay more the following fiscal year.

He never had to worry about income tax as he earned less than the tax-free threshold since the day he started working for a printing firm.

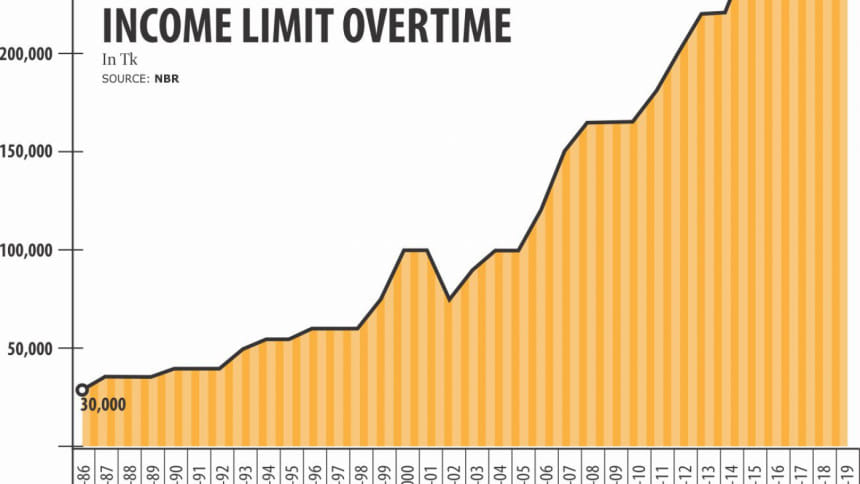

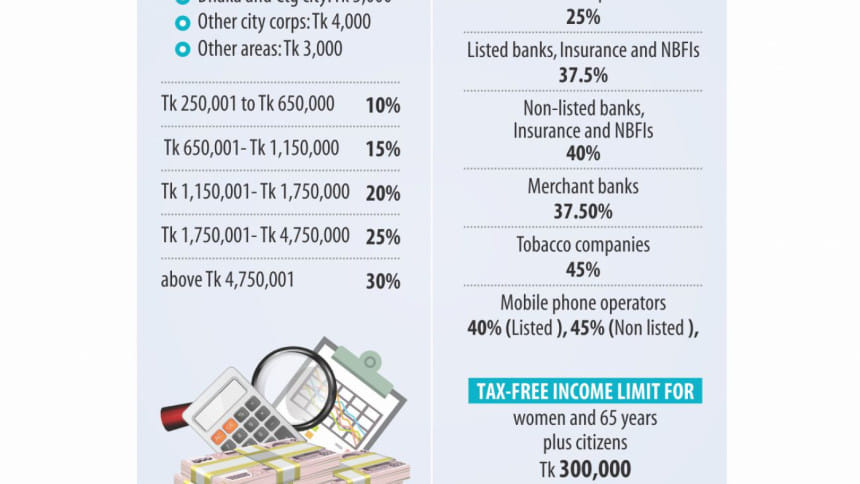

Now, he will have to bother as his annual income would be more than Tk 2.50 lakh, and the government did not raise the ceiling for tax-free income in fiscal 2018-19.

Not only that, from the incoming fiscal year the government will crackdown on employees evading income tax return submission.

His employer will have to submit statements on return submission by its employees.

If the firm fails to comply with the new measure, its entire tax returns will be audited by taxmen, a scenario that no firm would like to face as it invariably leads to higher taxes.

Apart from the changes in the law to tax the income of tech giants such as Facebook and Google, this is one of the major changes the tax authority is seeking to bring for next fiscal year with the viewing to widening the tax base.

Save for a 2.5 percentage reduction in the corporate tax rate for banks and financial institutions and withdrawal of a provision taxing dividend income multiple times, there is little to cheer for individual taxpayers and companies.

The National Board of Revenue is seeking to keep most of the tax measures unchanged in a bid to attain the 31 percent higher income tax collection target of Tk 102,201 crore for fiscal 2018-19.

Hasan feels hard done by the budgetary measures: not only was he dragged into the tax net for a Tk 4,000 month raise in salary, he also has to pay more for goods and services from the incoming fiscal year. "How will I make my ends meet?"

"The budget mainly focused on expanding the tax base and higher compliance," said Sushmita Basu, a partner of PricewaterhouseCoopers Bangladesh.

The exemption of multi-tier dividend taxation would benefit many existing companies and encourage investment in the economy, said Basu, also the lead of Pricewaterhosue Coopers's Bangladesh Tax and Regulatory Services.

"Virtual businesses too would come under the tax net after ambiguities were cleared," she added.

Taxmen said the NBR would collect withholding tax if anyone purchases any product such as apps and games or service while in Bangladesh. Some 3 percent withholding tax will be deducted during payment to virtual business platforms, officials said.

It has also brought in changes to the tax rules to ensure that car owners who are offering taxi service by way of Uber and Pathao will have to submit returns.

"We have tried to ensure increased compliance through the proposed measures," said Md Shabbir Ahmed, NBR first secretary of income tax policy.

By ensuring compliance of withholding tax collection, which accounted for 62 percent of total income tax collection in fiscal 2016-17, the tax authority would be able to log in Tk 3,000-4000 crore more next fiscal year, especially from increased collection of payroll tax.

Officials said the tax rate cut for banks and financial institutions will cause a loss of about Tk 2,000 crore from the sector, which generate about Tk 10,000 crore in tax.

To offset the losses and increase tax collection, the NBR is also seeking to slap on wealth tax surcharge on those who own more than two cars or have property of 8,000 square feet in any city corporation.

It has also imposed Tk 3,000 as minimum surcharge if the net wealth of individuals is up to Tk 10 crore and Tk 5,000 for net wealth of above Tk 10 crore.

The tax authority also brought multi-purpose vessels under the tax net and proposed to increase the corporate tax for the garment sector, the main export earner, to 15 percent from 12 percent this fiscal year.

The tax collector also increased tax for garment firms establishing green building. Day care home and educational institutes for challenged persons have been offered exemption.

To curb tax evasion, the NBR also brought in changes in the rule under which other agencies can share financial information of taxpayers automatically with taxmen.

It also aims to use email as legal instrument to issue notice, according to tax measures.

However, less attention has been given to reforms, which analysts have seen suggesting for boosting revenue collection.

In his budget speech, Finance Minister AMA Muhith expected that the new income tax law would be placed in the parliament next fiscal year.

He also proposed to introduce electronic tax deduction system and establishment of a tax information unit.

The government has set the target to increase the number of registered taxpayers to 1 crore and the number of return filers to 80 lakh within the next 5 years to fiscal year 2022-23, Muhith said.

However, Sadiq Ahmed, vice chairman of Policy Research Institute of Bangladesh, said the government believes that the drive to increase the number of income tax payers is working and continuing this drive is the primary focus of tax implementation for fiscal 2018-19.

"The target assumes that the government will adopt measures to improve tax administration, but these are not clearly identified in the budget," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments