Banks not in trouble, claim top bankers

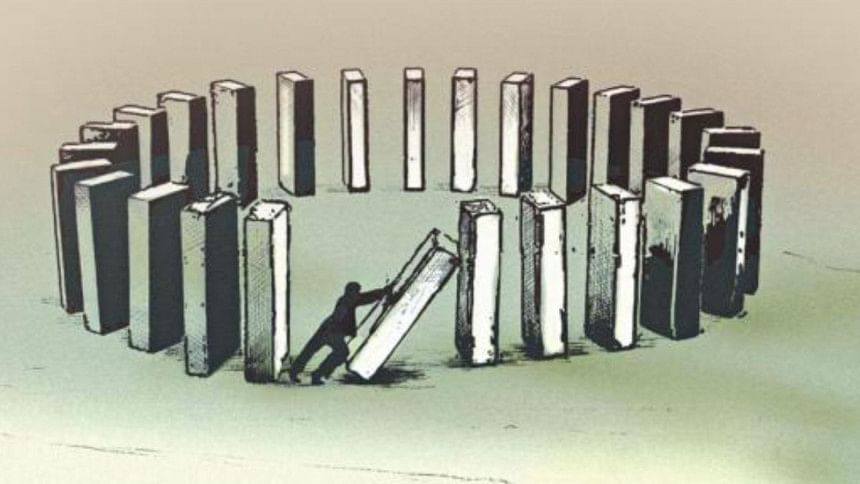

Top bankers yesterday claimed that the anomalies that surfaced in the banking sector were nothing big and serious in comparison to the industry's loan volume of more than Tk 8 lakh crore and healthy economic growth.

They also claimed that nonperforming loans, which jumped to nearly 11.50 percent of the outstanding loans at the end of September, were not a concern for banks. But continued negative reports, which they said are excessively done, may affect the industry and the economy.

Managing directors of over two dozen banks, both private and public, came up with the claims at a sudden press conference at the newly opened InterContinental Hotel in the capital.

Association of Bankers, Bangladesh (ABB), a platform of banks' managing directors, organised the briefing, just three days after the Centre for Policy Dialogue (CPD), an independent think-tank, launched a report on the country's banking sector at a discussion.

Quoting newspaper reports, the CPD, in that report, said some major loan scams, involving BASIC Bank, Hall-Mark, Anontex and others, cost 14 banks Tk 22,502 crore in the last 10 years.

There are 59 scheduled banks in Bangladesh. Of them, six are state-owned and they are plagued with around 30 percent NPL (non-performing loans). In the last 10 years, the overall NPL has increased by four times to nearly Tk 100,000 crore, according to Bangladesh Bank data.

Of the loan scams, the major ones involved the state-owned banks. Those include Tk 4,500 crore BASIC Bank scams, Tk 3,000 crore Hall-Mark scandal and nearly Tk 10,000 crore Anontex and Crescent loan scams involving Janata Bank. But none of the board of directors of those banks was held responsible for gross irregularities in their banks.

On Sunday, Planning Minister AHM Mustafa Kamal admitted that the problems in the financial sector were results of weaknesses in government supervision.

The banking sector would need major reforms, he said.

The comments came a day after the country's top economists and bankers at the CPD discussion observed that the banking sector was passing through “the worst time ever”.

They also gave six recommendations to bail out banks. Those include reformation of the judicial process for speedy recovery of defaulted loans, prevention of board of directors' appointment on political grounds, protection of the independence of the central bank and establishment of an independent commission for banks.

At yesterday's press conference, presided over by ABB Chairman Syed Mahbubur Rahman, managing director of Dhaka Bank, the speakers said the country has been achieving over 7 percent GDP growth for the last three fiscal years and, on an average, 6.5 percent for a decade.

Md Obayed Ullah Al Masud, managing director of state-owned Sonali Bank, said, “Considering the volume of loans, defaulted loans are not a matter of concern for the banking sector.”

Lehman Brothers, one of the ancient banks in the US, collapsed 10 years ago, but it did not raise any hue and cry, said Mohammad Shams-Ul Islam, managing director of another state lender Agrani Bank.

“We do not have such a vulnerable situation in our banking sector. Rather, the sector has created a lot of success stories,” he said.

Shah A Sarwar, managing director of IFIC Bank, said the CPD's report had not given any clear picture of the calculation method of the funds relating to the scams.

Banks give loans after stringent scrutiny, but repayments depend on the respective banks' risk management system, said Sarwar.

The banking sector is strong enough to tackle small-scale shock, but 25 percent of banks will be in trouble if there is any medium shock, said Ali Reza Iftekhar, managing director of Eastern Bank.

“The bankers are not responsible for the NPL [non-performing loan] as banks disburse loans after scrutinising documents of borrowers,” he said.

Adil Islam, managing director of Meghna Bank, said it was a true that some scams hit the banking industry but all defaulted loans did not stem from irregularities.

“Many businesses have become defaulter because of unavailability of electricity and gas in time,” he said.

ABB Chairman Rahman said all people involved in the “ecosystem of the banking sector were not angels”, and that some wrongdoings might have happened in the banking activities.

But media reports about the financial scams have left an adverse impact on the sector, he said.

Asked whether the ABB arranged the press conference to counter the CPD report, Rahman claimed it had nothing to do with that.

Managing directors of Mutual Trust Bank Anis A Khan, City Bank's Sohail RK Hussain, Dutch Bangla Bank's Abul Kashem Md Shirin, Bank Asia's Md Arfan Ali and Islami Bank's Mahbub ul Alam, also addressed the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments