Don't reward the defaulters

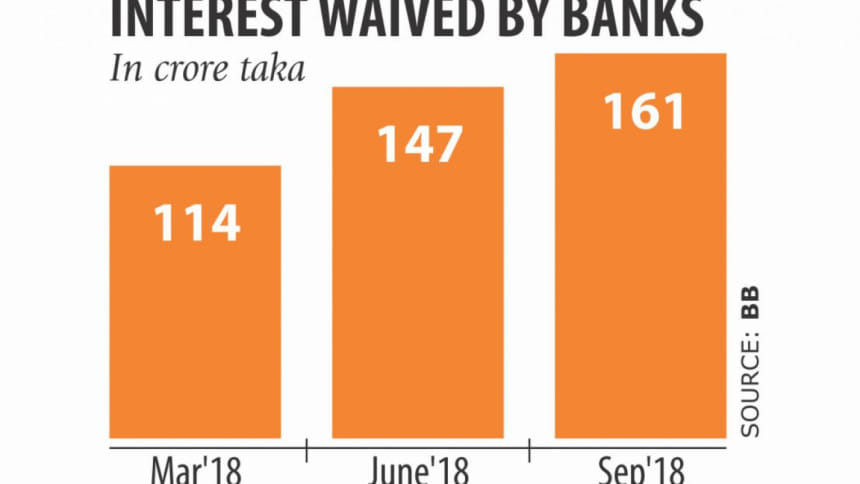

Over the first nine months of 2018, banks waived interests worth Tk 422.14 crore on nonperforming loans (NPLs). This practice has been the norm over the past few years which has had no positive impact on getting habitual defaulters to pay back their loans. Indeed, we have in place a practice that is rewarding defaulters without getting them to pay back either their principal loan amount or the interest! The magnitude of bad loans was brought to the limelight in the final quarter of the last fiscal when we learnt that NPLs had reached nearly Tk 1 lakh crore—a stupendous amount by all standards and, worse still, this amount had increased by 24 percent from a year earlier.

The current practice has created a moral hazard in the financial sector and is demoralising for good borrowers who make regular repayments on loans to banks. We cannot have double standards for loan repayment. What possessed bank managements to break established norms and cancel on interest payments without ensuring repayment on the principal loan amounts is beyond our understanding. Interest payments on loans given out are what constitute the profitability of a bank and their cancellation, while great news for loan defaulters, is a death trap for the banks. It will help create more defaulters by encouraging the culture of loan default.

Instead of taking bank directors and managements who have created the NPL mess to begin with (by sanctioning loans to unreliable parties), we are now witnessing the introduction of one more totally unethical practice that will put yet another nail in the coffin of banking institutions. The central bank, as regulator, must be given powers to check the excesses being committed in the name of loan recovery before we face a meltdown in the banking sector. Act while there is still time.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments