Develop stock, bond markets to meet infrastructure financing needs

Bangladesh must develop its capital and bond markets to meet the long-term financing needs of infrastructure projects as bank loans are not viable for mega initiatives worth billions of dollars, said a top official of a state-run non-bank financial institution.

“Funds will have to come from the stock market or the financial sector. So, if we can’t develop the stock and bond markets, we will not have access to funds,” said SM Formanul Islam, executive director and CEO of Bangladesh Infrastructure Finance Fund.

He said a country could not implement infrastructure projects relying on bank borrowing.

Even if all banks in Bangladesh become one single entity, they will still not be able to bankroll a project like that of the Padma bridge or Dhaka-Chattogram expressway, said Islam.

“Investment is taking place in various sectors but we need more,” he said.

He said Bangladesh’s credit rating was not of investment grade, for which local businesses had to pay more if they wanted to borrow from international sources because the lenders take into account all factors, including risks, while fixing margins.

“If we could mobilise funds domestically, then the margins will be less and infrastructure projects would be more viable,” said Islam.

Islam is heading an organisation set up just a couple of years ago in 2011 to address the importance of infrastructure development and insufficient investment in the sector and to promote an attractive environment for sustainable private investment.

It is the biggest NBFI in the country with authorised capital and paid-up capital of Tk 10,000 crore and Tk 2,010 crore respectively.

Of the paid-up capital, the government has provided Tk 1,600 crore and the rest came in the form of profits from its investment in various projects.

It has invested in the elevated expressway project, three special economic zones, the Cox’s Bazar-Chittagong railway and Rooppur nuclear power plant.

It also has investment in liquefied petroleum gas projects, hospitals, hotels, energy efficiency projects, flyovers, textile mills and an electronics products maker.

The company is supporting projects aimed at producing green construction materials as part of efforts to protect the environment.

“Our pipeline is also very robust. There are 70 projects under our consideration,” Islam said.

The NBFI has disbursed Tk 3,400 crore as of May 2019 but it will require at least Tk 5,000 crore in the next few years to meet the minimum financing need of prospective borrowers, prompting it to explore various avenues to source funds.

Its board has approved a proposal to raise Tk 500 crore through issuing a bond. Since the rate is very high, the company is going slow, Islam said.

The board has also approved another plan to raise Tk 1,000 crore from the stock market.

Bangladesh Infrastructure Finance Fund has received funds from World Bank, Asian Development Bank, Japan International Cooperation Agency (Jica) and Bangladesh Bank.

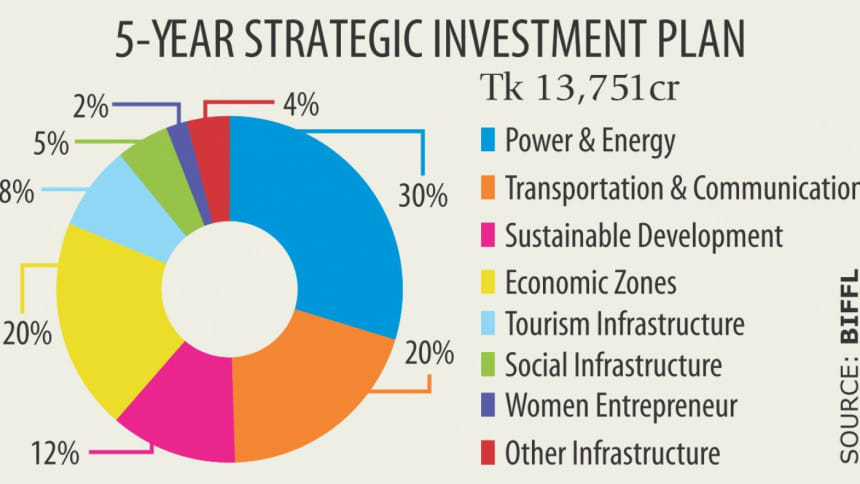

It has a target to disburse Tk 13,751 crore under its five-year plan that spans from 2017 through 2021.

“Our investment plan is a drop in the ocean since Bangladesh requires at least $10 billion a year to meet its infrastructure financing need,” Islam said.

Islam, who attained a master of public management degree from the National University of Singapore, a master of laws from Bond University in Australia, and an LLB from the University of Calcutta, has been working in his current post since June 2015.

Previously, he worked as deputy CEO of Infrastructure Development Company, another NBFI owned by the government. He had also worked with PricewaterhouseCoopers Securities LLC.

According to Islam, Bangladesh’s lack of deep integration with the international markets was depriving the country from availing funds available there.

“The positive side of it is that Bangladesh remains unaffected when there is a collapse in the global market. But the downside is we are failing to put the opportunities available in the international financial markets to good use,” he said.

Islam said there were only a handful foreign banks operating in Bangladesh but those operated like local banks and could not raise huge funds overnight from their international operations.

There is no Chinese bank in Bangladesh although China is its biggest trading partner and is engaged in billions of dollars of two-way trade. Also, there is no Japanese bank, he said.

“As a result, when a letter of credit is opened, the involved party has to incur additional costs at every stage, raising the cost of doing business,” he added.

Islam talked about improving legal infrastructure to draw in foreign direct investment (FDI).

He said if an investor invests in Bangladesh, there should be legal remedy for anything that might go wrong. It takes many years to get the remedy in Bangladesh, he said.

“We, the local people, don’t feel it that way because we are used to it. But foreign investors will not want to drag an issue for even two years. They want instant results. Getting immediate results is also not impossible,” he said.

He gave the example of the National Board of Revenue’s assertion that thousands of crores of taka were stuck because of court cases.

According to Islam, the legal infrastructure would have to be investment-worthy.

“Our legal infrastructure is not that investor-friendly. It takes two to three years to get a court decision and then appeal is made against the verdict. Can you continue with that?” he said.

He said investors preferred to put a provision in agreements to settle disputes in courts in Singapore or the UK. There has to be a lot of scopes for alternative dispute resolution.

“We should look into this side given the level of development we are aspiring.”

According to Islam, international investors were increasingly getting interested in Bangladesh.

In the past, foreign investors were not much interested in Bangladesh for long-term investment because of political instability and a lack of investment-grade credit rating, but now they have a change of heart and are coming to Bangladesh, he said.

“Countries that had never thought of investing in Bangladesh are now looking at the country as an investment destination because of a steady economic growth and the huge local market.”

He said if Bangladesh could successfully implement five to 10 special economic zones, those would draw in FDI, export and create a huge number of jobs.

Despite being a new company, Bangladesh Infrastructure Finance Fund posted a Tk 83 crore profit last year. There is also no non-performing loan, a problem that is affecting all lenders in the country.

“This is largely because it carries out due diligence properly. Besides, as all of the board directors are senior government officials and they don’t have business motive, the loan decisions are merit-based,” Islam said.

Bangladesh Infrastructure Finance Fund has put in place a dedicated team comprising experienced professionals, such as environmentalists, legal experts, investment people, chartered accountants, and engineers.

“You will not find this type of professional team in many banks,” said Islam.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments