Stocks at record low, rebound expected later this year

The Dhaka Stock Exchange (DSE) has reached a point where its shares are record cheap due to the recent macroeconomic turbulence and higher interest rates, which have diverted investments away from securities, according to leading stockbroker IDLC Securities.

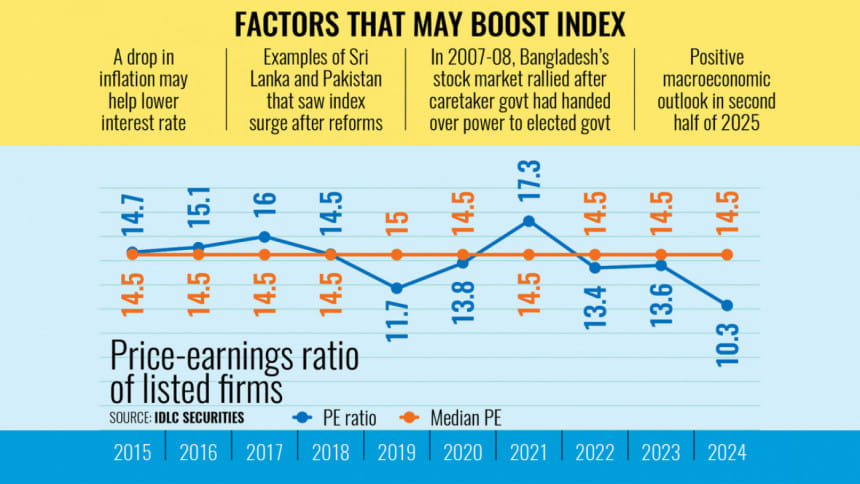

The stock market index may rise once the inflation rate declines and interest rates in the banking sector drop—a path both Sri Lanka and Pakistan Stock Exchanges took.

In its 2025 outlook titled "Are Ripples of Reform Priced In?", IDLC Securities forecast that the rebound could occur in the second half of this year.

The brokerage firm showed that the price-to-earnings (P/E) ratio of stocks on the DSE stood at 10.3 at the end of the recently concluded 2024—the lowest in at least the past 10 years.

"This is extremely low," said Tanay Kumar Roy, head of Equity Research at IDLC Securities.

The figure of 10.3 is also below the median P/E ratio of 14.5.

The price-to-earnings ratio is the proportion of a company's share price to its earnings per share.

A high ratio may indicate that a company's stock is overvalued. Conversely, a low P/E ratio suggests that stock prices are undervalued compared to their earnings.

Even though stocks in the DSE are undervalued, Roy said that high interest rates in the banking sector are prompting institutional investors to rush to the money market.

He said the current business climate is making investors hesitant to invest in the stock market. "People do not want to invest during a period of reform, so they are adopting a wait-and-see approach."

Regarding the business performance of listed companies, he said that corporate earnings dropped by around 20 percent in the July-September period of last year due to political unrest and supply chain disruptions.

Even if corporate earnings continue to decline at this rate over the next three quarters, the stocks would not be overvalued, as the P/E ratio would still be around 12, he added.

From an investor's perspective, a lower P/E may sound like a suitable investment option.

However, Saiful Islam, president of the DSE Brokers Association, said a lower P/E ratio alone would not attract investors.

"Building investor confidence, alongside improved macroeconomic conditions, is important for the market," he added.

To improve investor confidence, Islam said visible progress in governance, surveillance, monitoring, and enforcement is important to bring it up to at least a regional standard.

He suggested that doubling the number of investable stocks is necessary for meaningful growth in the stock market.

On a positive note, Islam mentioned that financial discipline has begun to return, and the erosion of asset quality has stopped.

IDLC Securities projected that macroeconomic indicators will start to improve in the coming months.

It said that Bangladesh's exports have recently recorded double-digit growth, despite labour unrest in the RMG sector, political changeover, and economic hurdles in major markets such as the US, China, the UK, and the EU.

"Exports are expected to benefit from tailwinds as inflation and interest rates ease in export destinations. The European Central Bank (ECB) has cut rates from 4 percent to 3 percent, while the US has reduced short-term rates to a range of 4.25 percent to 4.50 percent from the previous 5.25 percent to 5.5 percent."

Besides, double-digit growth in remittances has continued, said the brokerage firm.

IDLC Securities believes the political changeover has likely curbed the creation of black money and wealth transfer, leading to increased remittance inflows through formal channels.

With austerity measures on imports, rising exports, and steady remittance inflows, the current account deficit declined in early FY25 and is expected to remain low throughout FY25, the report said.

Although foreign debt repayment is expected to increase in the second half of fiscal year 2024-25, Bangladesh has foreign fund commitments amounting to $4.9 billion, which it is expected to receive within the next one and a half years.

The recent depreciation of the local currency, coupled with the declining current account deficit, suggests that another significant currency depreciation is unlikely under the current economic circumstances.

Going forward, depreciation is expected to align with the long-term average rate of 3.4 percent observed over the past 20 years.

"The declining trend in global inflation and interest rates, along with the increasing yield differential between Bangladesh and US Treasury instruments—currently at 7.46 percent—further supports such expectations."

Depending on crop seasons, the report suggested that inflation might ease in the second half of this year.

However, rice prices rose as the Aman crop was adversely affected by recent flooding. With the Boro harvest scheduled for April to June, rice prices are expected to decline after the harvest.

Lower freight and commodity prices in the international market are also likely to help curb inflation.

IDLC Securities said that once inflation is brought under control, interest rates in the banking sector would also decline. The recent rise in interest rates was driven by multiple increases in the central bank's policy rate.

On Saturday, DSE Chairman Mominul Islam said at a press conference that the market would hopefully show improvement by June this year with different reform initiatives bearing fruit.

IDLC Securities also said that if reforms take place, the stock market index will get a boost, as was seen in Pakistan and Sri Lanka in recent years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments