As trade dries up, stock exchanges turn to FDRs for survival

The country's two stock exchanges logged operating losses in the last fiscal year thanks to sluggish trading activities, according to official data, compelling the markets to resort to their fixed deposit income to avoid a net loss.

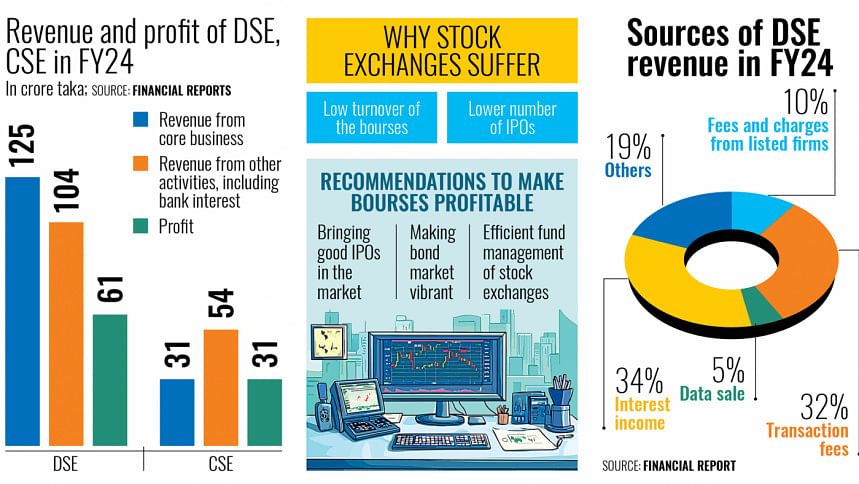

The Dhaka Stock Exchange (DSE) and the Chittagong Stock Exchange (CSE) mainly generate operating income from their core businesses, such as commissions on daily turnover, fees from new issuances and sales of stock data.

In fiscal year 2023-24, all income streams for both exchanges declined remarkably compared to previous years.

For example, the country's premier bourse DSE generated Tk 125 crore in revenue from core businesses. But, operating expenses and depreciation costs surpassed this amount, resulting in an operating loss of Tk 20 crore.

The DSE's other income, particularly interest from fixed deposit receipts (FDRs), rescued the bourse from incurring a net loss in FY24.

Apart from core businesses, the DSE earned Tk 104 crore from other sources that year, including Tk 77 crore interest from FDRs. So, DSE's net profit was Tk 61 crore in FY24.

In the past 15 years, the two stock exchanges have generated enough revenue to cover operating costs in only three to four fiscal years, according to industry sources.

AGM Sattique Ahmed Shah, acting managing director of the DSE, said turnover in the last fiscal year dropped due mainly to unfavorable macroeconomic situations, which eventually reduced the DSE's transaction fees by around Tk 20 crore.

The premier bourse earlier projected an average daily turnover of Tk 1,200 crore in FY24. But the actual turnover turned out to be Tk 622 crore.

The turnover was Tk 792 crore and Tk 1,031 crore in FY23 and FY22, respectively, DSE data showed.

The DSE acting managing director said the market had a floor price in the last fiscal year, which he said chained daily turnover.

The DSE also generates revenue when a company is listed on the market. However, the number of companies listed on the market was also low in FY24.

Moreover, only 18 initial public offerings (IPOs, including bonds and mutual funds) were approved by the DSE in the last two fiscal years, compared to 30 in the previous two fiscal years, according to official data.

On top of it, the DSE reported depreciation of its data centre from October 2023, increasing its costs in this area and eventually raising the bourse's overall expenses, Shah added.

The Chittagong bourse also represented a similar earnings pattern in FY24.

CSE's revenue from core businesses amounted to Tk 31 crore, putting the port city bourse to face an operating loss of Tk 10 crore.

But, CSE's revenue from other sources, including bank interests, was Tk 54 crore. This eventually rescued the CSE's net operating bottom line to Tk 31 crore in positive territory.

"This is a lone product-based market, which is equity. And this market growth is not favourable, so income from the core business is not high," said M Shaifur Rahman Mazumdar, managing director of the CSE.

He said both the bourses have huge assets, which show their solvency and ensure investor confidence. "Even though the market structure is weak, no stock exchange has failed to settle transactions," Mazumdar said.

But to increase revenue from core business, he recommended ensuring reasonable market growth, favourable policies, listing of good and well-performing companies and diversifying products.

The market should offer sufficient varieties of products so that all types of investors can participate, he added.

QUESTIONS OVER BOURSE INVESTMENTS

The DSE holds investments in FDRs and bonds worth Tk 832 crore, while the CSE holds FDR and bond investments worth Tk 327 crore.

Around 13 percent of DSE investments were with three banks, which were politically affiliated and recently failed to repay funds to their depositors.

The CSE also held 15 percent of its investments in the same three banks. Besides, it held Tk 34 crore in FDRs with several non-bank financial institutions (NBFIs) that are now struggling to return money to their depositors.

CSE MD Mazumdar said their FDRs with several NBFIs had become risky.

"But these funds were invested several years ago. We are now trying to recover the funds. The CSE has already blocked dividends by the NBFIs," he added.

Saiful Islam, president of the DSE Brokers' Association, also raised questions about the DSE's fund management.

"I proposed to the DSE that it transfer its funds in troubled banks to treasury bonds and bills, considering the higher rates and risk-free nature of these investments. But the Dhaka bourse had not transferred these funds till December 2024," he said.

If they had invested in T-bills and bonds, the interest income could have been at least Tk 25 crore higher, he said.

"When the stock exchange itself mismanages its funds with such carelessness, it shows the inefficiency of its decision-makers," he added.

The president of the DSE Brokers' Association said when the stock exchanges are facing operating losses, it is easily understadable how the stock brokerages are doing.

He said as many as 95 percent brokerage houses are now in operating losses due to dull trading activities.

"Only brokerage houses, who are subsidiaries of big companies, are running by taking funds from the parents. But individual houses are in real trouble," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments