Most stocks owned by Awami League leaders struggling

Share prices of most companies with directors connected to the immediate past Awami League government saw a big drop in the past month after the fall of Sheikh Hasina, though the market was in a rising trend during the period.

According to market analysts, politically powerful individuals often use their influence to benefit their companies. So, investors now fear that the regime change could lead to business losses.

This fear has prompted investors to sell shares in companies owned by politically powerful individuals, they said.

Another reason causing investors to worry is that a regime change may bring politically connected individuals under the scanner of the Anti-Corruption Commission (ACC) and legal action against these individuals could impact businesses, especially in firms with poor corporate governance, they said.

Dhaka Stock Exchange (DSE) data shows that share price of Beximco Pharmaceuticals -- whose Vice-Chairman Salman F Rahman was the former prime minister Sheikh Hasina's private industry and investment adviser -- dropped 26 percent in the past month.

Stocks of Beximco Ltd, another company owned by Rahman, are stuck at the floor price and cannot fall further due to the price-curbing mechanism.

Shinepukur Ceramics, also with Rahman as vice-chairman, saw its shares plummet 39 percent in the past month.

Similar declines were observed in Sea Pearl Beach Resort, Summit Power, Sonar Bangla Insurance, Sandhani Life Insurance, BD Thai Food and some others.

Investors consider three primary factors when investing: the company's financial situation, political aspects and people's perception of the company, according to Minhaz Mannan Emon, a former director of the DSE.

While there are other factors to consider, Emon said these are the major perspectives. Investors are aware that the owners of these companies were connected to the former government, which benefited their businesses in many ways.

With the regime change in the first week of August, some of these individuals are now fugitives, arrested, or fled the country.

He said as the politically connected entrepreneurs contributed to the businesses, investors are now understandably concerned about the future of the business ventures.

Many investors are selling shares and incurring losses, hoping to offset these losses with higher profits in other companies, Emon added.

However, he said investors should not be afraid as most of these companies have a strong corporate culture and will continue to operate even in the absence of their entrepreneurs.

In the past month, stocks of Sea Pearl, owned by former member of parliament from the Awami League Md Aminul Haque, fell 22 percent.

Stocks of BD Thai Food, with several family members of former health minister Zahid Maleque on its board, declined by 15 percent.

Summit Power's stocks dropped 14 percent. Several family members of former commerce minister Faruk Khan are on the board of this power generation company.

In the past month, Sheikh Hasina's relative Sheikh Kabir Hossain's Sonar Bangla Insurance fell 5 percent and former state minister for commerce Ahsanul Islam's Sandhani Life Insurance dropped 12 percent.

Doreen Power, with its top management involved in previous ruling Awami League politics, declined by 20 percent.

However, the banking sector showed almost an opposite trend during the period.

For example, United Commercial Bank (UCB), which was previously controlled by former land minister Saifuzzaman Chowdhury Javed before being freed from political influence in the last week of August, saw its share prices advancing.

According to industry insiders, the interim government's decision to change the board of directors of banks and other financial institutions, coupled with the financial reform efforts by the authorities, contributed to the increase in their share prices.

Similar to UCB, IFIC Bank, with Salman F Rahman acting as its board's chairman since 2015 before being recently ousted, saw its shares rise in the past month.

Shares of several other banks, with controversial conglomerate S Alam Group Chairman Mohammed Saiful Alam and his relatives on the boards, also rose in the period.

Requesting not to be named, a top asset manager said some entrepreneurs used their power to secure government contracts for their companies to make higher gains.

But a regime change could reverse this situation, impacting their financial performance and causing investors to sell shares, even though the overall market index has risen during this period.

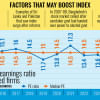

The DSEX, the benchmark index of the DSE, rose by 500 points, or 9.54 percent, in the past one month, according to DSE data.

If the companies follow proper corporate governance, investors should not be afraid, added the asset manager.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments