Long on promises, short on specifics

All eyes were on fever-stricken Finance Minister AHM Mustafa Kamal as he stepped into parliament to unveil his maiden national budget yesterday.

He had to retire mid-way and Prime Minister Sheikh Hasina took over from him, lending an additional element to the budget speech that was not short of suspense, given it comes at a time when the Bangladesh economy is taxiing for take-off.

The finance minister has prepared a fiscal plan, long on promises but short on specifics, to make Bangladesh a higher middle-income country by 2030.

It speaks of bold, essential reforms like overhaul of the tax machinery, cleaning up the banking sector and upgrading the education system to tap the country's potential, but without any concrete action plan or timeline.

What would have been a watershed moment for the economy ultimately ended up being mostly empty rhetoric.

Even with the best of intents, a government with limited resources cannot do much; it needs to boost its means to execute its plan or else it remains just an idea.

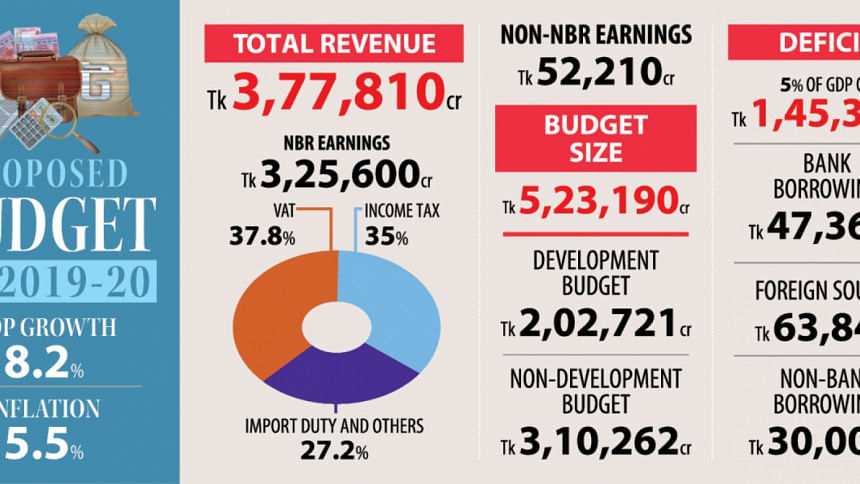

The National Board of Revenue, the main breadwinner for the government, has been tasked with bringing home Tk 325,600 crore in fiscal 2019-20, up 16.29 percent from this year's revised budget.

This is a lofty target, given the NBR managed to collect Tk 153,477 crore in the first nine months of FY 2018-19, meaning more than Tk 126,522 crore has to be collected in the last three months. This is not possible, if past records are any indication.

This begs the crucial question: How would the government pull off an even bigger amount next fiscal year? Kamal's game plan is therefore wishy-washy at best.

He speaks of establishing revenue offices in every upazila and growth centres in the country, bringing in more people under the tax net, simplifying the laws and processes for income tax, value-added tax and customs, and checking corruption.

But there are no details about how he would do that.

For instance, there is a plan to automate the VAT system, with the National Board of Revenue working to set up electronic fiscal device in every business organisation to make VAT collection more transparent. But would it be done in fiscal 2019-20? He doesn't say.

The long-awaited VAT law will finally take effect in the new fiscal year.

Prescribed by the International Monetary Fund, with a single VAT rate of 15 percent at the turn of the decade, it has gone through populist changes since.

The overwhelming opinion of economists and tax experts is that its implementation would be rather tricky.

Kamal had the chance to dismiss those fears by coming up with a definitive plan but he held back. All he said was that all logistical support would be provided.

One area where he sounded more assured is income tax, as the government is desperately looking for ways to bring in revenue.

Work on formulating a new income tax act in line with the international best practices is underway, and is likely to be placed before parliament next year.

Effective initiatives have already been taken to expand the income tax department. The number of tax zones will be increased to 63 from the existing 31.

Also, fixing the banking system is the need of the hour. The problem has built up over the years and the Awami League government has so far not taken a corrective action plan.

Kamal's predecessor AMA Muhith spoke of forming a banking commission in the run-up to the budget for 2018-19, but in his budget speech the issue went missing.

Kamal at least mentioned it, along with the much-needed amendment to the Bank Company Act to facilitate absorption of weak banks by stronger ones, stern action for wilful defaulters and an effective insolvency and bankruptcy law. Again, he stopped short of giving a timeline.

But rejuvenating the cash-strapped banking system is imperative given the government's plan to raise its borrowing from this source by 53 percent to Tk 47,364 crore.

The need for enhancing the quality of human resources did get some attention in the budget.

"Much of our future depends on how we manage our education system. Our government will take necessary measures from this year," Kamal said.

He allocated Tk 100 crore for training and employment of the youth. Youth unemployment for a lack of necessary job skills is a growing headache for the government.

A three-year programme has been taken up to create more jobs in the industrial sector.

The government will facilitate qualitative employment for the growing population within the next two years, Kamal said.

In the new budget, Tk 100 crore has been allocated to provide seed money for budding entrepreneurs.

One of the common broadsides directed at the government when it claims tremendous economic growth in the last one decade is that a large portion of the population is yet to see any of its benefit trickle down.

Kamal tried to address the issue to some extent by expanding the social safety net a little: 15.45 lakh people would be added in the incoming fiscal year to take the tally to 1.13 crore.

Some Tk 74,367 crore has been allocated for this, up 15.47 percent year-on-year. The amount is 2.58 percent of the GDP, which is too paltry a share.

The agriculture sector, which is still the backbone of the economy, has been neglected in comparison with other sectors, particularly the issue of ensuring fair prices of their produce.

But the biggest hole in Kamal's budget was the absence of any special plans for the mega infrastructural projects, which are non-negotiable if Bangladesh wants to become a higher middle-income country and then go beyond.

Fifteen mega projects got Tk 52,758 crore, which is one-fourth the development budget, but the minister did not articulate whether special attention would be given to ensure their completion as early as possible.

Every year, they are given huge allocations only to witness little work taking place.

What is most important at the end of the day is effective implementation of the budget -- shorn of corruption, leakage and evasion. Unless that is ensured, even an unlimited amount of resources would not be of any help.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments