Price cut not on govt's mind

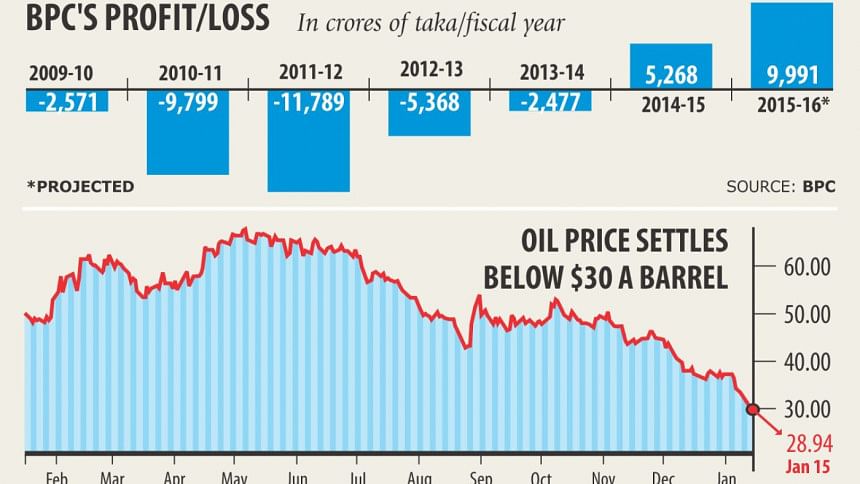

Bangladesh Petroleum Corporation this year is expected to log in twice the profit it counted in fiscal 2014-15 on the back of the low oil price on the international market.

The benefits of this low price, however, are yet to trickle down to the consumers.

The state-run agency, which had been incurring losses since FY1999-2000, is expected to register about Tk 10,000 crore in profit in fiscal 2015-16.

Oil prices stood below $30 per barrel for the first time in 12 years on Friday, but the government is still resolute about not adjusting the domestic prices so that the BPC “can make up for its past losses”.

An official of the energy ministry said fuel prices fell in recent times on the global market, which means the BPC profit would soar.

From the start of 2014, the price of petroleum products started sliding in the international market. But the government has not adjusted the prices despite various quarters' call for price cuts.

According to a BPC report, in FY2013-14 the average import price of crude oil was $109.6 per barrel and that of finished oil was $125.27 per barrel. The prices were $75.23 and $90.16 respectively in FY2015-16.

In the current fiscal year, the price of crude oil slumped to $30 a barrel. So the BPC's profit will increase further.

Behind this price fall on the global market is economics of supply and demand.

Over the last several years, US domestic production has almost doubled. Saudi, Nigerian and Algerian oil that once was sold in the US market is suddenly competing for Asian markets. As a result, producers are compelled to cut prices. Canadian and Iraqi oil production and exports are also rising. Even the Russians, despite economic problems, keep pumping.

On the other hand, the economies of Europe and developing nations are weak and vehicles are becoming more energy-efficient. So demand for fuel is declining a little, contributing to the price fall.

But the BPC is not in favour of price cuts now as it incurred huge losses in the past, said the energy ministry official, asking not to be named.

Since 1977, when the BPC started operation, its accumulated losses stand at Tk 45,945 crore, according to the Corporation.

Considering this, the government gave it Tk 42,709 crore in “subsidy” between FY2006-07 and FY2013-14. Even in the last fiscal year, it was given Tk 600 crore despite making profits.

The money was given in loan, but the BPC never paid back.

A top official said the government gave the BPC almost the same amount of the loss it incurred. So there is no logic behind not adjusting local prices with the global prices.

On the other hand, the BPC had been making profits for the last two years. But it did not pay back the loan it had taken from state-owned banks through bonds.

According to state bank statistics, the BPC took Tk 10,974 crore in loan from Sonali, Janata and Agrani banks through bonds. Of this, Tk 5,416 crore was taken from Sonali Bank alone.

Against the bonds, the BPC gives the banks only five percent interest which is lower than the banks' cost of fund. The banks have taken a joint move to write a letter to the finance ministry so that either the money is returned or the interest rate is increased.

Sonali Bank Managing Director Pradip Dutta told The Daily Star that against the bonds they invested a huge amount of money at a low interest.

He said the three banks decided to take the matter to the finance ministry.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments