$250m currency swap: Sri Lanka gets first tranche of $50m this week

The central bank will lend $50 million to under-pressure Sri Lanka this week as part of Bangladesh's efforts to support the Island nation suffering from a foreign exchange crisis.

The credit under the first-ever loan to any country from Bangladesh will be given under the currency swap agreement inked by the BB and the Central Bank of Sri Lanka (CBSL) on August 3.

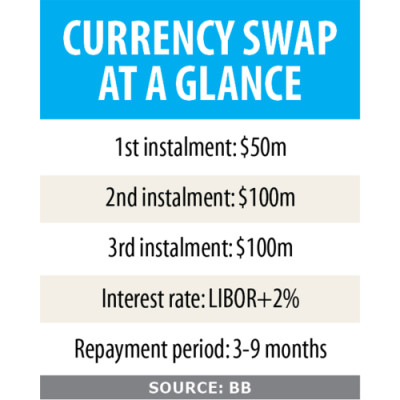

As per the deal, the BB will provide a total of $250 million to help prop up the island nation's fast-depleting foreign reserves and ease pressure on its exchange rate.

The financing will be given in three phases. The first tranche of the loan will be given this week, according to a top official of the central bank.

The remaining two tranches will involve $100 million each.

Seeking anonymity, the BB official said the central bank would give the first tranche for three months.

If the CBSL fails to repay the loan within the deadline, it will get three more months to repay. If it fails to pay back again, it will be given three more months.

The CBSL will return the amount in three months at the interest rate of the London Interbank Offered Rate (Libor) plus 2 per cent. If it can't honour the deadline, the interest rate will not change.

But if the tenure goes up to six months, the interest rate will be Libor plus 2.5 per cent.

The Libor is the global reference rate for unsecured short-term borrowing in the interbank market and acts as a benchmark for short-term interest rates.

This week, the three-month Libor is 0.14 per cent and the six-month Libor is 0.18 per cent.

If the CBSL fails to return the money, the Sri Lankan government will pay back the loan as per the state guarantee attached in the agreement, the BB official said, adding the outstanding balance limit will never exceed $200 million. He said Bangladesh was not extending the loan for any commercial purpose.

"It is being given to help a friendly Saarc member country which is in trouble. Bangladesh is, however, following the international best practices and maintaining due diligence."

The decision for the currency swap agreement was set in motion during Sri Lankan Prime Minister Mahinda Rajapaksa's visit to Bangladesh in March.

As per the deal, the CBSL will hand over an equivalent amount of its currency, which depreciated 6.8 per cent against the US dollar this year.

Yesterday, the US dollar traded at 199.52 Sri Lankan rupees.

The BB will open an account with a bank in the South Asian country to keep the sum, which will be around 49.5 billion Lankan rupees, a BB official said earlier. The amount would be used for import payments.

Bangladesh's import bill with Sri Lanka is $50-55 million a year.

The swap agreement is a good deal for the BB, which has a record $45.9 billion in its coffers as of August 3.

Under the agreement, Sri Lanka will pay more than double Bangladesh gets from all of its investments.

The injection of the American greenback from Bangladesh would be a great relief for Sri Lanka, which has $3.7 billion of foreign debt maturing this year.

It had $2.4 billion in foreign currency reserves at the end of July, down from $4 billion in April.

In 2020, Sri Lanka's economy contracted 3.6 per cent because of the financial fallout from the coronavirus pandemic.

The country's $4.5-billion tourism industry, one of its major foreign currency earners, was hit particularly hard, while its exports were down by about 17 per cent last year.

Because of the foreign exchange crisis, the Sri Lankan government imposed an indefinite import ban in March last year to save hard currency, according to the financial newspaper Nikkei Asia.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments