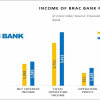

bKash incurred loss of Tk 123 crore in 2021

Losses of bKash, a subsidiary of Brac Bank, widened by 83 per cent year-on-year in 2021, even though its revenue rose by 21 per cent, for incurring higher costs on training, investment and waivers on the charge to send money.

The mobile financial service provider incurred a loss of Tk 123 crore in 2021, which was Tk 67 crore in the previous year, according to its financial statements.

This is the third consecutive year of losses for the company. In 2019, its loss amounted to Tk 63 crore.

The losses rose due to the higher burden of the cost of services that were deducted from revenue, and lower income from interest, revealed an analysis of the report.

In 2020, the company spent 72.64 per cent of its net revenue behind cost of services, which rose to 76.24 per cent in 2021.

In other words, mobile network operators' service charges and "channel commission" rose for the mobile financial service provider last year. The operators' service charge rose 47 per cent to Tk 223 crore.

Like most technology companies, the growing years are investment hungry with focus on customer acquisition and customer retention, which helps to build a sustainable base, said bKash in response to queries from The Daily Star.

bKash made significant investments to create a scalable technology platform, not only to cater to more transactions, but also to provide a wide range of services, it said.

For instance, it invested in hiring additional manpower like IT and software engineers and data scientists. In addition, bKash says it puts emphasis on regulatory and anti-money laundering and combating the financing of terrorism (CFT) compliance.

Its operating and administrative costs rose 21 per cent to Tk 585 crore in 2021, according to the financial reports.

bKash trains every agent and all personnel hired by distributors on the prevention of money laundering or terrorist financing, all of which are cost intensive.

"We hope these strategic investments made today to cater to a more digitised economy will bring commercial dividends in the coming years," it said.

As per a regulatory order, waivers had to be provided on charges for sending money from April to August of 2021 due to the pandemic, bKash said.

This also augmented the overall loss and subsequently contributed to the increase in the cost of services.

bKash's net finance income dropped 86 per cent to Tk 6.95 crore, down from the previous year's Tk 51.19 crore, the data shows.

It reduced commercial expenses by 9.88 per cent to Tk 237 crore last year.

bKash will continue to enhance financial inclusion in the country through relentless investments in innovation and home-grown talent, it added.

Brac Bank holds 51 per cent shares of bKash while the Money in Motion LLC of the US has 16.45 per cent, Alipay Singapore E-Commerce 14.87 per cent, International Finance Corporation 10.36 per cent and SVF II BEAM (DE) LLC 7.32 per cent.

In 2021, bKash's e-money circulation soared 24.53 per cent to Tk 5,853 crore, up from the previous year's Tk 4,700 crore, according to the financial statements.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments