Hopeless revenue target: No major tax hike planned

Wishy-washy -- is what best describes the government's stance on scaling up its narrow revenue base, which is posing to become the Achilles' heel to Bangladesh's growth aspirations.

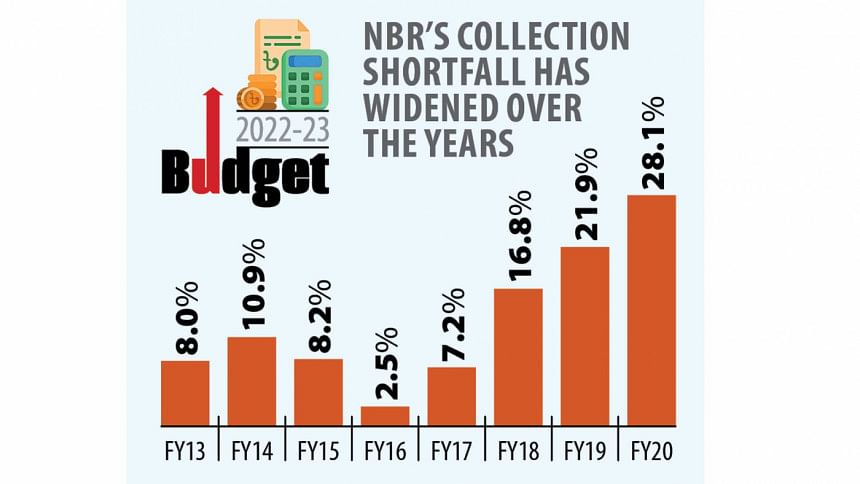

While it is acutely aware of the longstanding shortcoming, it has not shown any willingness to take any bold, decisive actions to address the issue, relying instead on putting big collection targets in front of taxmen and crossing its fingers.

Take the case of the forthcoming fiscal year's collection target of Tk 370,000 crore for the National Board of Revenue, which, unsurprisingly, is the biggest yet.

The highest the NBR has managed is Tk 263,872 crore, which was in fiscal 2020-21.

And in the first nine months of this fiscal year, the revenue authority has received about Tk 204,008 crore, meaning the target of Tk 330,000 crore will be missed by a wide margin.

Given the elevated inflation level and the recuperating economy, the government will maintain the status quo, resisting going for tax hikes, by and large, said a finance ministry official on the condition of anonymity as they are not allowed to speak with the media ahead of the budget.

"I would have gone for a tax hike on tobacco, soft drinks, alcoholic beverages and luxury cars," said Nasiruddin Ahmed, a former NBR chairman.

Given the current economic conditions, it is not possible to increase tax rates anywhere else.

"The scope is very limited. Sri Lanka slashed the VAT rates from 15 percent to 7 percent -- look, what is happening there," he added.

So, without any radical reform, getting within a touching distance of next fiscal year's target seems overly optimistic.

This raises the question of what Finance Minister AHM Mustafa Kamal has up his sleeves.

"Strengthening VAT administration and expanding the VAT base holds substantial potential to address the tax gap," Kamal said in his letter to the World Bank in March when seeking budget support of $250 million.

This action plan has been peddled for long -- with little progress.

"We have been hearing about widening the tax net, automation and setting up tax offices in rural areas for a long time now," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

Reforms are too tough on the administrative side.

"When it takes them a year just to recruit officers, how can the entire tax administration be reformed in that time?"

Expecting collections will shoot up in a year because of administrative reforms is being overly optimistic.

"It is an unrealistic target," he said, adding that the forthcoming year's targets are most definitely set without considering the present state of collection.

Instead, overhauling the tax policy by simplifying rates would have brought immediate results.

There are numerous tax rates, which leads to manipulation, leakages and corruption, according to Hussain.

For instance, there is one rate for the import of capital machinery and a higher rate for its spare parts.

"Both are capital machinery, so what is the need for two different rates?"

This leaves the door open for businessmen to negotiate with customs officials to lump both under the same category.

"If we don't design the rate structure in a way that it closes the loop for tax avoidance, the problem of revenue collection will not be solved," he said, adding that the VAT law, which was meant to have a uniform rate, has too many slabs and exceptions.

The government could also withdraw the tax holidays and tax breaks, which, according to the NBR's own calculations, cause revenue losses equivalent to 7-8 percent of GDP.

"This also creates scope for leakages. All policy decisions are taken on an ad hoc basis," he added.

Tax compliance is too weak in Bangladesh because of problems in both policy and administration, according to Ahmed.

"The corporate tax rate is too high. The VAT rates are not right -- too many exemptions were made. The tax administration is not well-equipped. It is not digitalised, which gives scope for conflict of interest among tax officials."

He went on to call for accelerating the automation of the tax system.

"Let alone other reforms, just full automation would lead to collections that far exceed the target," he added.

Whatever the government does, it must act now and decisively as the existing revenue base, which is just shy of 10 percent of GDP, is insufficient to meet the country's development needs, according to the WB.

"Bangladesh's aspiration of becoming an upper-middle-income country by 2031 crucially hinges on the improvement of its revenue mobilisation."

The issue of domestic revenue mobilisation has been highlighted in several policy documents, including in the Five-Year Plans and the yearly budgets.

"But revenue generation continues to disappoint," it said.

Selim Raihan, a professor at the University of Dhaka's economics department, says it is because of a lack of strong will on the government's part.

"The government has failed to carry out longstanding reforms. Reforms cannot happen for vested pressure groups. Take the case of VAT law, which was implemented by accommodating everyone's demands -- it has failed to make a difference," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments