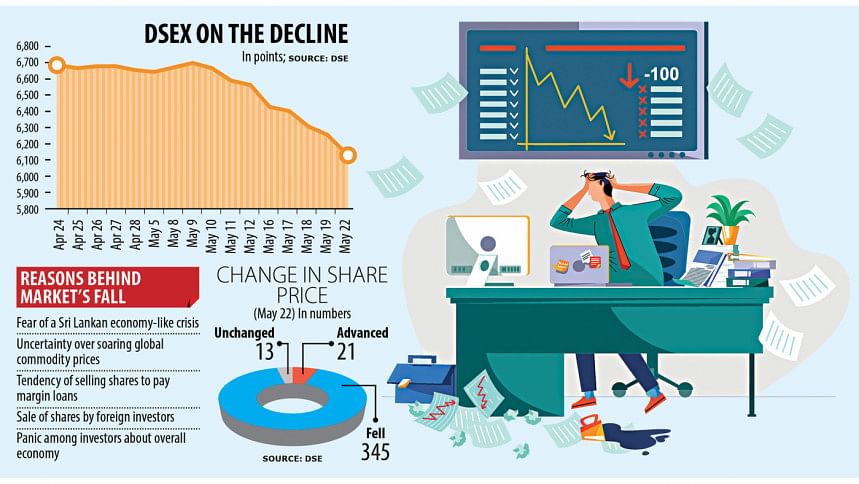

Stocks keep bleeding as panic grips investors

No matter how hard the government tries to give a message that Bangladesh would not face a Sri Lanka like crisis, edgy stock market investors don't seem to be in the mood to listen.

As a result, the broad index of the Dhaka Stock Exchange (DSE) has been falling sharply since investors fear that the country may be heading to a similar economic crisis being faced by the Island nation because of the deterioration in some macroeconomic indicators.

Yesterday, the DSEX gave up 115 points, or 1.84 per cent, to close at 6,142, the lowest in 11 months. This means the index plummeted 556 points, or 8.30 per cent, in the span of eight days.

"The market is falling for the widespread irrational panic among investors," said Shahidul Islam, managing director of VIPB Asset Management.

"The market can't decline continuously in such a fashion for economic reasons. What is more, our economy is not in that bad shape. And whatever economic pressures we are in now, they have not been created overnight."

He says an irrational fear prevails among investors that the economy may face the same kind of problems the Sri Lankan economy has been going through

"But the situation in Bangladesh is not like that," said Islam.

Bangladesh has foreign currency reserves of more than $42 billion and export earnings are also growing at a healthy clip. The country has also no sovereign loan obligation and has never defaulted on its international loans.

On the other hand, Sri Lanka has almost run out of foreign currency reserves, forcing the government to enforce a curfew, the prime minister to quit and the nation to default on a multi-million-dollar foreign debt payment.

However, there are volatility in the global commodities market, which fuelled a surge in import payments in import-dependent countries like Bangladesh, bringing the reserves and the local currency under pressure.

If the policy-makers allow the local currency to witness the natural course of depreciation against the American greenback, foreign investors will also invest in the market, according to Islam.

"But when they fear that the local currency may see further devaluation, they halt their investment decision. But once the depreciation takes place, they come back again."

Mohammed Rahmat Pasha, managing director of UCB Stock Brokerage, says there are rumours that have made people panic.

"There are uncertainties as well, so buying pressure has ebbed."

Uncertainties persist since the Russia-Ukraine war shows no signs of abating and commodity prices globally have remained at a higher level.

On the domestic front, the taka is under huge depreciation pressure and nobody can predict how much it would lose despite the recent bouts of devaluation.

Investors are worried about how the uncertainty will affect the profits of the listed companies, said Pasha.

He says investors are not pulling their funds out of the market to open FDRs (fixed deposit receipts) with banks. Rather, they are waiting to buy shares at a lower price, he said.

"The market will rebound when investors get back their confidence."

Budgetary steps can be a tool to boost the confidence of investors, according to Pasha.

The Bangladesh Securities and Exchange Commission (BSEC) has raised the margin ratio. As a result, the margin-led sale pressure will drop, he added.

The regulator issued a directive yesterday allowing stockbrokers to extend the maximum limit of credit facilities to their approved clients.

Earlier, the stockbrokers were allowed to lend up to 80 per cent of a client's deposit. Now, it can be 100 per cent.

The market has been falling due to the spread of panic, said Md Sayadur Rahman, president of the Bangladesh Merchant Bankers Association.

Rumours are doing the rounds on the social media about the Sri Lanka crisis and the Russia-Ukraine war, he said.

The day traders are more nervous than the real investors and the key index has suffered more compared to the actual stress in the economy.

Rahman says there is a rumour that institutional investment in the DSE is falling, but the reality is the investment of stock dealers has risen in recent months.

However, foreign investment in the premier bourse in the country has been on the decline since the pandemic hit the world and it intensified following the imposition of the floor price in March 2020.

Global stock markets are also feeling the pinch of the war and the pandemic.

The Dow Jones Industrial Average of the US dropped 8.27 per cent in the last month while India's BSE Sensex shed 6.06 per cent, Japan's Nikkei 225 was down 1.41 per cent, and Hong Kong's Hang Seng Index plummeted 14.84 per cent.

"The stock market witnessed another massive fall as the jittery investors went on a heavy sell-off to exit from the market," said International Leasing Securities in its daily market review.

Both the DS30, the blue-chip index, and the DSES, the Shariah-based index, lost 39.52 points and 21.31 points, respectively.

A stockbroker says as the level of trust in government data is low, investors' fear is high.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments