Stocks sink to lowest level in 3 years as investors sell and go away

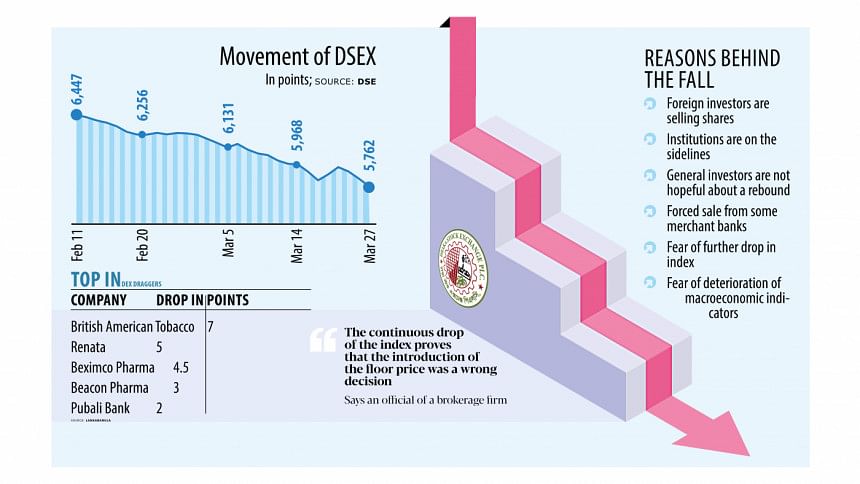

Bangladesh's stock market has been going through a bear run for the last two months despite petering out of election-linked uncertainty, signaling that the worries about the macroeconomic challenges are far from over.

The falling trend comes after the regulator lifted the floor price, handing investors the long-awaited freedom to sell shares at their will, a liberty they could not enjoy for the 18 months to January this year owing to the artificial measure.

The selling spree among foreign investors who fear that the local currency might fall further following a 25 percent depreciation in the past two years and the concern among local investors that the key indexes would slide more are hurting the overall sentiment.

Thus, the DSEX, the benchmark index of the Dhaka Stock Exchange, gave up 680 points, or 10 percent, in the last two months. Yesterday, it plunged 71.71 points, or 1.22 percent, to close the day at 5,762, the lowest level in three years.

Turnover, however, rose to Tk 538 crore from Tk 445 crore.

After recovering from the lows caused by the coronavirus pandemic, the economy came under renewed pressure in the middle of 2022 after the Russia-Ukraine war broke out. The conflict crippled global supply chains, hurting import-dependent economies like Bangladesh since reserves began drying up.

The deepening crisis prompted the Bangladesh Securities and Exchange Commission (BSEC) to reintroduce the floor price to prevent the market from a sharp fall.

The initiative paid well when it came to obviating the freefall of shares, but it ultimately turned the market illiquid since investors could not transact scrips at will because shares were not allowed to be changed hands below the floor price. So, when the BSEC began to lift the restrictions, both local and foreign investors breathed a sigh of relief.

An asset manager, however, said foreign investors started to sell their stake gradually in 2019 when they realised that the local currency was overvalued against the US dollar.

However, they could not continue to sell owing to the floor price mechanism, which was first rolled out at the height of the pandemic in 2020. Sales hunger were unaddressed for most of the four years between 2020 and 2023.

"Now those sales are taking place," the asset manager said.

"Foreign investors are selling shares but institutional investors are not extending enough backing to the market because the latter are also worried about the direction of the market. If institutional investors choose to be inactive who else can support the market?"

The combined shareholding of institutional investors, foreign investors, sponsors and directors stands at about 80 percent of the securities traded at the DSE. The rest is owned by general investors, DSE data showed.

The asset manager, however, acknowledged that many institutional investors don't have enough room to inject fresh funds into the market.

A senior official of a brokerage firm said the continued drop of the index proves that the introduction of the floor price was a wrong decision. In fact, such an artificial price cap never works in the long term.

Many investors still think that the prices of the listed companies are overvalued when compared with their performances in an economy facing an elevated level of consumer prices for a longer period. Moreover, economic indicators are not showing significant improvement, meaning the sales and profits may take more beating in future like they did in the previous years.

"There is a thin presence of buyers which ultimately hit the broader index," the broker said.

After a two-day losing streak, the market opened on a positive note yesterday but the momentum did not last at the end of the day amid panic-driven sell-offs.

The DSES, which represents Shariah-compliant firms, slipped 14.81 points, or 1.17 percent, to 1,252. Similarly, the DS30, which comprises blue-chip stocks, lost 12.85 points, or 0.63 percent, to settle the day at 2,012.

Another broker said investors have little confidence in the market. Besides, merchant banks are executing forced sales as many blue-chip stocks are declining.

When marginable shares dip more, merchant bankers and brokers sometimes need to sell stocks if investors are unable to bring their investment up to the minimum requirements.

Of the issues that traded on the premier bourse of Bangladesh, 321 gained, 38 declined, and 50 remained unchanged.

In its market update, Shanta Securities said the market movement was driven by negative changes in the market cap of travel and leisure, paper and printing, and bank scrips.

Of the sectors, cement closed in positive territory, while tannery, ceramics, and paper and printing ended in the red.

The pharmaceutical sector dominated the turnover chart, accounting for 19.42 percent of the turnover.

Central Pharmaceuticals posted the sharpest gain, rising 6.14 percent, followed by BD Thai Aluminium and Takaful Insurance.

Crystal Insurance shed the most, losing 9.95 percent. IPDC Finance declined 9.27 percent.

The Caspi, the all-share price index of the Chittagong Stock Exchange, shed 124.28 points, or 0.74 percent, to close the day at 16,579.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments