Stock floor price won’t bring any good in long run

The stock market is being administered with a short-term cure, the floor price, to halt its bear run sacrificing long-term stability through the erosion of confidence among institutional and foreign investors.

Last Thursday, the Bangladesh Securities and Exchange Commission (BSEC) imposed the floor price for every stock, taking into account the average stock price of that day and previous four days.

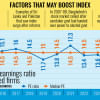

Stock market analysts are saying that the market index may rise in the short run for this decision but it can make the market illiquid as big buyers will not be interested to make purchases while the present economic condition prevails in the country while price drops are not being allowed.

So, it would have a negative impact in the long run. No foreign investor would be interested to remain in such a market where the regulator intervenes in the price mechanism of stocks.

Analysts say the index may rise in the short term for this decision but it can make the market illiquid as big buyers will not be interested to make purchases

Floor price is wholly an intervention and it goes against the basic concept of the stock market which is that the price is determined by market forces, said Faruq Ahmad Siddiqi, a former chairman of the BSEC.

Though the index skyrocketed just after the floor price was imposed, turnover was not hit by that big of an extent, he said.

The DSEX, the benchmark index of Dhaka Stock Exchange, rose 2.56 per cent, or 153 points, while turnover amounted to Tk 567 crore yesterday.

Until the market undergoes a rising trend, the problem will not be understood but if the downward trend returns, it may turn the market dry, Siddiqi said.

Foreign investors also do not like markets where regulators intervene frequently, he said.

Responding to a question, Siddiqi said the BSEC's main task was to ensure transparency in trading and curbing manipulation but it was working to control the index on a daily basis.

The stock market regulator is highly active to keep the market index high to show the government that the market is fully regulated with efficiency, said a top official of a stock brokerage firm that deals a huge amount of foreign investment.

However, the index is not the only yardstick of a good stock market.

Moreover, the regulator should keep its eyes on ensuring accountability and transparency and ensure that rules and regulations were maintained by all participants so that small investors are not affected.

The BSEC is not successful in ensuing its own task of ensuring rules and regulations in the market, so manipulation is commonplace that discourages big investors from coming over, he added.

"For the introduction of the floor price in 2020, most of the foreign investors started to sell their shares," he said.

Dhaka Stock Exchange (DSE) data shows that the value of all stocks went down by Tk 70,963 crore, or 12.5 per cent, meaning investors' collective fund faced an erosion of that amount in 2022.

To stop the freefall of the stocks, the BSEC tried its best though this was not in its to-do list.

It reduced the circuit breaker to 2 per cent from a previous 10 per cent in order to prevent any steep falls although it is harmful for the long-term development of the market.

It also requested many institutional investors through mobile phone calls to increase their investment and amended requirements for institutional investors to do so.

All endeavours were in vain, so the stocks eroded on their own accord. Now it has launched the floor price in a bid to halt the continuous fall although it is anticipated to have a boomerang effect on the market.

Earlier on March 19, 2020, the stock market regulator imposed the floor price on all stocks by calculating their average prices from the preceding five days to stop the index from falling amidst the pandemic.

The decision was criticised by most analysts and foreign investors and global association the International Organization of Securities Commissions threatened to downgrade the BSEC from its present status as an A category regulator.

This prompted the BSEC to start lifting the floor price in phases since April of 2021.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments