Regulator steps up efforts to stop freefall of stocks

The stock market regulator in Bangladesh has stepped up its efforts to forestall the freefall of shares despite criticism from institutional investors and analysts as uncertainty is deepening owing to the raging Ukraine war, persistently higher inflation and fresh coronavirus flareups.

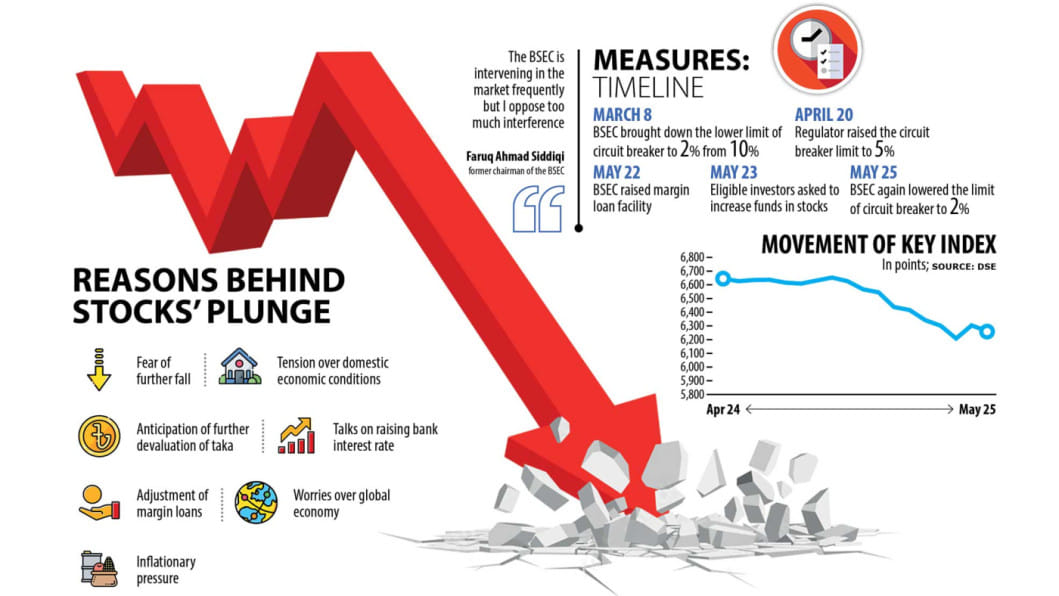

The Bangladesh Securities and Exchange Commission (BSEC) is using tools under its disposal as the key index of the Dhaka Stock Exchange has lost 10 times in the last 11 trading days.

The regulator's latest move, which came yesterday, will not allow an individual stock to slip more than 2 per cent on a single day, down from 5 per cent previously, as it reset the lower limit of the circuit-breaker.

Just three days ago, the BSEC raised the margin loan facility to 100 per cent, from 80 per cent earlier.

But market watchers are opposed to frequent intervention from the regulator since it is not the job of the commission to protect the market from falling and the interference rather disrupts the natural course of the market.

"The BSEC is intervening in the market frequently but I oppose too much interference," said Faruq Ahmad Siddiqi, a former chairman of the BSEC.

For example, reducing the lower limit of the circuit-breaker may stop the index from sliding in the short run, but it will slow the movement of the market in the long run.

Because of the limit, investors may not be keen in buying shares assuming that further fall might be on the way.

"Frequent regulatory intervention can't bring any good outcome for the market. Rather, it erodes the confidence of people," said Siddiqi.

Siddiqi thinks raising the credit facility limit has not been a good idea.

"If the market falls further, both investors and lenders will fall into trouble."

On May 23, the BSEC also raised the investment requirement for the eligible investors that want to qualify for the quota benefit during initial public offerings, in a bid to increase the liquidity in the market.

Turnover on the Dhaka Stock Exchange fell to Tk 513 crore yesterday, the lowest in a month.

Siddiqi also argues that if the regulator allows the demand and supply-based market movement and the index to move naturally, a group of investors will surely enter the market, sending the key index to higher levels.

A top official of a merchant bank, preferring anonymity, says the BSEC has brought down the circuit breaker limit to stop the spread of the growing panic.

"Panic has been the main reason for the fall in the market in recent weeks. But such a step is not a global standard."

In the last 11 days, the DSEX, the benchmark index, plunged 511 points due to the worry among investors about the worsening economic indicators.

Yesterday was not the first time the regulator had lowered the ceiling a stock is allowed to go down in a single day.

On March 8, the BSEC fixed the maximum limit a stock would be allowed to give up in a single day at 2 per cent from the previous 10 per cent. It raised the limit to 5 per cent on April 20.

On March 19, 2020, the regulator imposed the floor price on all stocks by calculating their average prices from the preceding five days to stop the index from plummeting after the coronavirus pandemic hit the country.

This irked institutional and foreign investors as the liquidity dried up. It even kept the market closed for two months in the middle of 2020, one of a few countries in the world that had done so.

The BSEC removed the floor price in June last year.

Because of the regulatory moves, the number of buyers became thinner since the prices did not reflect the real demand and supply scenarios, said the merchant banker.

"The slashing of the lower limit of the circuit-breaker will save the market from massive declines, but it will impact it in the long run. Foreign investors may pull out their investments and institutional investors may also feel shaky."

"The frequent use of the tool makes investors hesitant," he said, adding that retail investors, however, might feel happy to see a slower decline in the index.

About the recent fall, Mohammad Emran Hasan, chief executive officer of Shanta Asset Management, says it was mostly driven by the panic sales by the retail investors.

In Bangladesh, retail investors dominate the market, controlling 80 per cent of capitalisation. This has deepened the volatility of the market since many individuals lack adequate knowledge about the market, behave like day traders, and are reactive to local and global developments and panic-driven.

According to Hasan, investors are edgy since the economy is now in a discomfort situation.

Bangladesh's economy has come under immense pressure owing to surging import bills, which have caused the foreign exchange reserves to slip to $42 billion since exports and remittance inflows have not kept pace with the escalating foreign purchases.

This has hurt the local currency and forced the central bank to devalue the taka six times just this year.

Another worry for investors is the elevated level of inflation, led by global commodity prices and supply disruptions.

And Bangladesh might not get relief from the higher cost of living immediately.

This is because worsening supply-demand imbalances, including from the war in Ukraine, and further commodity-price gains could keep the pace of inflation persistently high for a longer period, according to researchers at the International Monetary Fund.

The market might suffer another setback if the lending rate, which has been capped at 9 per cent since April 2020, is hiked since it would tighten the money supply. A number of economists have already called for the withdrawal of the ceiling.

"The deepening of uncertainty has dented the confidence of retail investors," said Hasan.

The Sri Lankan economic crisis, which was largely caused by the plummeting foreign currency reserves and piling up of foreign debts, also made local investors in Bangladesh worried about the economy's future.

"But Sri Lanka's economic condition is much different than ours," Hasan said.

Experts say instead of attempting to protect the index, the regulator should focus on helping the exchanges get rid of perennial challenges.

They urge the regulator to improve corporate governance, ensure discipline, take stern actions against speculators and manipulators, and enhance investment climate.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments