How dollar became global reserve currency

The Second World War changed almost everything in the world. Or in short, we can also say that after WWII, the world changed in a way it had not changed for many years.

So, WWII also reshaped the global financial system. The moment when WWII was coming to an end, the global leaders started thinking about a stable financial system for international transactions.

Because the then global gold standard of trade was affected greatly by the severe fallout of the Great Depression of 1930.

The global leaders were in trouble in finding out a good solution to the volatile global trade.

After more than one decade of the Great Depression, in 1944, more than 700 representatives from 44 countries gathered in a meeting at Bretton Woods, New Hampshire of the US to peg the US dollar as the medium of exchange for all currencies, as at that time America held the largest reserve of gold.

Government representatives who participated in the gathering at Bretton Woods promised to redeem their currencies for their value in gold upon demand.

This agreement allowed other countries to back their currencies with dollars rather than gold. This is the beginning of the journey of the US dollar to be the main convertible currency in the world and the reserve currency of the world.

The US fixed the value of the dollar to gold at $35 an ounce.

Other countries then fixed their exchange rate in tune with the dollar, making it the central mode of exchange of the system, according to NPR, an independent, nonprofit media organisation.

However, as the US started racking up huge deficits and running out of its gold reserves in the 1960s, the government found it too expensive to maintain the promise.

And so, in 1971, President Nixon arranged a divorce between the dollar and gold.

The dollar's value is now set by a mishmash of political and economic forces, ranging from central bank decisions to the frenetic buying and selling of traders around the world.

The original arrangement set at Bretton Woods is long dead, but the dollar still remains the international reserve currency.

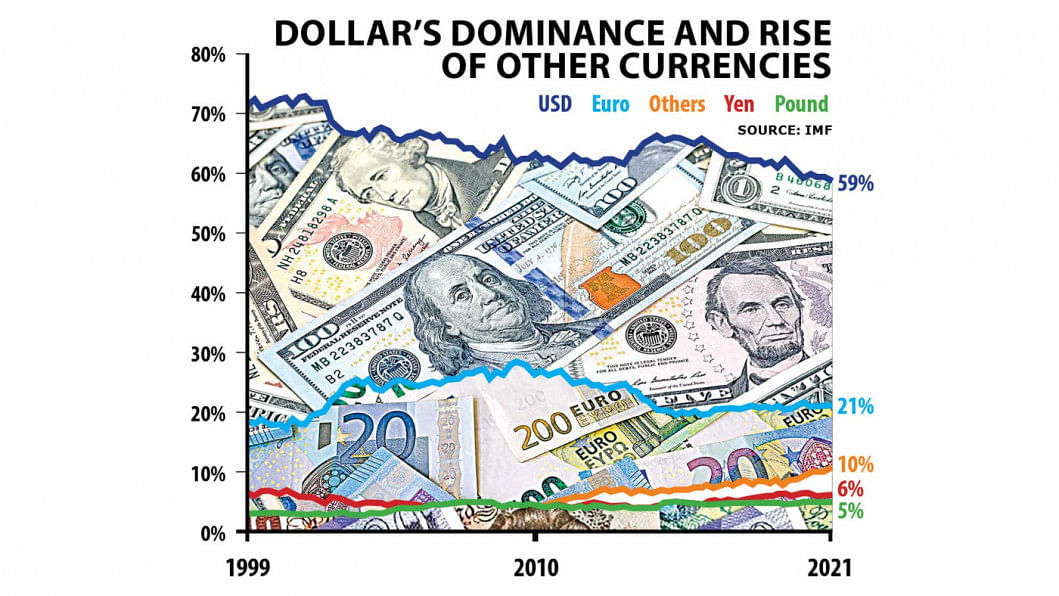

The dominance of the US dollar can be realised if some data on global finance is analysed.

Financial magazine The Economist, in 2015, said the United States accounts for 23 per cent of the global GDP and 12 per cent of merchandise trade.

Yet about 60 per cent of the world's output, and a similar share of the planet's people, lie within a de facto dollar zone, in which currencies are pegged to the dollar or move in some sympathy with it.

As of 2020, the US had $2.04 trillion in circulation. As much as half that value is estimated to be in circulation abroad, according to The Balance, an online journal.

In the foreign exchange market, the dollar rules. Around 90 per cent of forex trading involves the US dollar.

The dollar is just one of the world's 185 currencies according to International Standards Organisation List, but most of these currencies are only used inside their own countries, The Balance said.

Almost 40 per cent of the world's debt is issued in dollars. As a result, foreign banks need a lot of dollars to conduct business.

The Economist said one of the oddities of globalisation is that although America's trade footprint has shrunk, its monetary footprint has not. When the Fed changes course, trillions of dollars follow it around the world.

With the rise of some economies, Japan, Switzerland, the European Union, China, and Russia all tried several times to introduce their own currency as the reserve currency but failed.

Economists, businesses, traders, political leaders and experts said most of the people in the world still trust and have belief in the US treasury system and the US Federal Reserve for its global standard of ethics and smart management of the dollar and financial system.

As a result, many rising currencies could not be turned into reserve currency for other countries despite several attempts.

In March 2009, China and Russia called for a new global currency. China wanted its currency to be fully traded on the global foreign exchange markets.

In 1995, the Japanese yen and the Deutsche mark of Germany tried to take the place of the global reserve currency as the value of the two currencies were rising.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments