Mobile makers in trouble as sales plummet

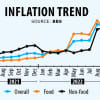

The nascent mobile phone manufacturing industry in Bangladesh has been hit hard by the higher inflation, unprecedented dollar price hike, and increased value-added tax as their sales have plummeted amid belt-tightening by consumers.

This is compelling the manufacturers to cut production as they are facing a crisis that they even didn't experience at the height of the coronavirus pandemic.

The smartphone segment is particularly finding itself at the sharp end of the current downturn. The sales of feature phones remain steady.

Smartphone manufacturers sold about 9-10 lakh units of devices per month in 2021. Monthly sales dropped to 6 lakh units in the last quarter.

Their claim is also corroborated by the data of the Bangladesh Telecommunication Regulatory Commission.

In January, around 14 lakh smartphones were churned out by the local manufacturing plants. It slumped to 6.7 lakh units in May and 9 lakh in June, data from the regulator showed.

Industry people say they sold 10 lakh phones per month on average in the first six months of 2021, but it declined to 6.5 lakh in the identical period of 2022.

"The biggest hit came in the April-June period as smartphone sales decreased by 35 per cent compared to the same period a year ago," said Mohammad Mesbah Uddin, chief marketing officer of Fair Electronics, Samsung's local assembly and manufacturing partner.

There is no sign that sales would bounce back soon as the situation is worsening day by day and the higher consumer prices and the volatility in the foreign exchange market are expected to continue in the coming months amid the raging war in Ukraine.

In Bangladesh, local handset production has made an impressive stride in recent years, aided by the government's huge tax benefits unveiled in the fiscal year of 2017-18.

Since then, 14 plants have been set up, creating jobs for around 17,000 people. Another four plants are in the pipeline.

But the recent withdrawal of a 5 per cent VAT exemption at the sales stage, along with the current global crisis, has cast a negative impact on the local industry, according to industry people.

THREE-PRONGED CRISIS

The escalated dollar price and the increased VAT have directly contributed to the hike in device prices.

The American greenback traded at Tk 86 six months ago, whereas it has rocketed to Tk 115 recently amid US dollar shortages, fueled by unprecedented import bills, which have comfortably trumped foreign currency receipts in the form of exports and remittances.

As a result, the price of a Tk 10,000 handset has gone up to Tk 12,500, eating into profit margins for the manufacturers.

However, the main blow of the dollar price hike is yet to be visible since the settlement of the letter of credit for the latest consignment in the current dollar prices hasn't started taking place on a full scale. This is because an LC settlement takes a few weeks to a few months, according to Mesbah.

Usually, manufacturers open LC, import raw materials and accessories, stock them, produce the finished products, and hand over them to distributors. The whole process takes three months.

"As we are now going to settle the LC, the price of the dollar has surged. Consequently, the costs of production have surpassed the sales price," Mesbah added.

Industry people described the increased VAT as the second-biggest blow for the handset market.

Before the current fiscal year that began on July 1, there was about 58 per cent tax on smartphone imports, whereas the tax on locally assembled and manufactured handsets was about 15 per cent.

"The VAT on sales at various stages is leaving a huge impact on the market," said Jakaria Shahid, managing director of Edison Industries Ltd.

"Since 5 per cent VAT will be collected at various stages, the VAT incidence will eventually be 10 to 15 per cent."

Md Omar Faruk, CEO of Al Amin Brothers, a feature phone manufacturer, says the basic phone segment is comparatively steady since people's financial condition is not in good shape.

"Due to the dollar price volatility, we are also facing losses and struggling to set a specified price."

Farhan Rashid, head of business at HMD Global Oy, manufacturer of Nokia-branded smartphones, says people now see smartphones as luxury goods due to higher inflation.

Inflation in Bangladesh rose to a nine-year high in June.

Mesbah of Fair Electronics thinks that the slowing smartphone sales would jeopardise the government's smart Bangladesh ambitions, prompting him to urge the authorities to bring back the VAT exemption on handset sales.

He also argues that 14 manufacturing plants were established with a combined investment of more than Tk 2,000 crore.

"If the government's policy changes abruptly, the investment will fall," said Mesbah, adding that this will also bar the country's goal to grab the global digital device export market.

Local businesses also urged the government to activate the National Equipment Identity Register, a system used to ensure devices' authenticity, since there is a surge in the grey market in Bangladesh.

The annual handset market stands at Tk 11,000 crore to Tk 12,000 crore.

The demand for mobile phone was 4.10 crore units in 2020-21 and 63 per cent of the demand were met by local manufacturing.

In the first six months of 2022, about 1.85 crore handsets were locally manufactured. Of them, 65 per cent were feature phones, according to the BTRC.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments